Monday briefing: a round-up of recent financial services news

Two-thirds of CEOs expect unrest | Funds with exposure to Transaction Capital

Two-thirds of CEOs expect unrest | Funds with exposure to Transaction Capital

Old Mutual Insure and Elite Risk policyholders in six provinces given a deadline to instal a tracker.

Among other things, the new rules provide for 80 days to submit an objection and more independence for an alternative dispute resolution facilitator.

Policyholders and beneficiaries receive claims and benefits payments worth R578 billion in 2022, the second-highest paid in a year.

More than 62% of survey respondents say they are ‘seriously reconsidering’ how they will vote in 2024.

OM concerned about lapses | OM 2022 results | Santam buys MTN’s device book | RAF seeks to appeal claims ruling.

These risks will significantly affect those who don’t have the right cover in place or no cover at all, says Old Mutual Insure.

Comparison of fees shows that PayShap is not necessarily the cheapest way to transfer money.

Advice on identifying possible problem units and using a lithium-ion battery safely to prevent it from degrading rapidly.

An outbound money transfer may now take much longer than a week or two.

But new business volumes from life insurance operations fall 10%.

Applies to contributions received from 1 January.

Lack of regulation and insufficient knowledge are the main barriers.

This is one of three changes the Authority is proposing to make to Board Notice 90.

Our Further Education and Training Certificates provide a pathway to further qualifications.

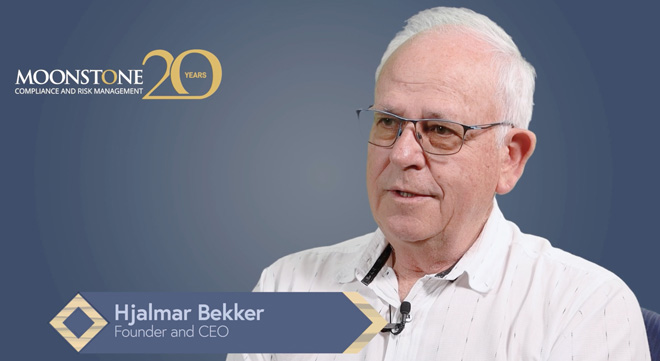

Watch our special anniversary video that tells the Moonstone Compliance story.

Insurer must pay R1.82m to a Ferrari owner whose claim was rejected on the grounds of reckless driving.