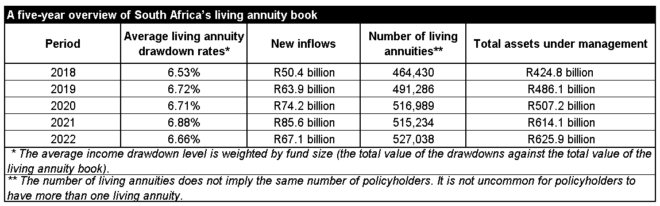

The average drawdown rate among living annuitants dropped from 6.88% in 2021 to 6.66% in 2022 – the lowest average drawdown rate since 2018, according to statistics from the Association for Savings and Investment South Africa (Asisa).

Asisa this week released a five-year update on the living annuity book held by member companies based on consolidated statistics gathered in line with the Asisa Standard on Living Annuities. The Standard, which came into effect in 2010, also makes it possible for Asisa to monitor the level of income drawn by policyholders from their retirement capital.

Asisa said it paused the publication of the drawdown statistics after 2017 to avoid misinterpretation.

“The statistics are aggregated at industry level and do not contain enough granular data to assess whether individual living annuity policyholders are applying prudent drawdown levels or are at risk of eroding their purchasing power. Drawing these conclusions would require insights into the personal circumstances of the annuitants, which is impossible.

“Asisa reconsidered its position on publishing the living annuity statistics because there is value in providing stakeholders with insight into the health of the overall system and as a benchmark to evaluate outcomes and consumer choices at a more granular level,” the organisation said in a media release.

In 2011, the average drawdown rate was 6.99%, the highest rate on record. The drawdown rate has not moved back to that level, despite challenging market conditions, said Jaco van Tonder, the deputy chairman of Asisa’s Marketing and Distribution Board Committee.

In the five years since Asisa published the 2017 living annuity statistics, the drawdown rate has consistently stayed below 7%.

In 2018, the average drawdown rate was 6.53%. It increased slightly to 6.72% in 2019 and adjusted to 6.71% in 2020.

Van Tonder drew attention to the fact that in 2020, the first year of the pandemic and the period in which National Treasury introduced temporary Covid-19 relief measures for living annuity policyholders, only 6 314 out of 518 389 living annuity policies moved beyond a drawdown rate of 17.5% to a maximum of 20%. At the same time, 10 780 living annuities moved into a temporary lower drawdown band of between 0.5% and 2.5%.

In 2021, the year in which South Africans suffered the biggest economic aftershocks of the Covid-19 lockdowns, the average drawdown rate moved up to 6.88%.

Living annuity policyholders must draw a regular income of between 2.5% and 17.5% of the value of their living annuity assets if the policy was bought on or after 21 February 2007. This can be reviewed once a year on the anniversary date of the policy.

When the percentage of income drawn exceeds the real returns of the investment portfolio supporting the living annuity, the capital base will be eroded over time.

Van Tonder said annual drawdown rates of 4% to 5% in the first decade of retirement and below 8% in the later retirement years are generally considered prudent, providing annuitants with a high probability of preserving their purchasing power for their lifetime. It was therefore encouraging that in 2022, the 2.5% to 5% rate made up the biggest income band by number of policies (159 147), followed by 5% to 7.5% (98 942 policies).

He said the statistics confirm the robustness of the living annuity model – the average drawdown rate has remained stable over four the past four years.

South African retirees had R625.9 billion of their retirement savings invested in living annuities at the end of 2022, an increase of 47.3% from the R424.8bn invested in living annuities at the end of 2018.

The number of living annuity policies grew by 13.5% over the same period to 527 038 at the end of 2022.

Click here to download Asisa’s spreadsheet providing detailed statistics of drawdown levels according to the number of policies and the value of assets across the different age bands since 2017.