While we await the publication of the proposed new Fit and Proper requirements, it is time to assess our own approach to change.

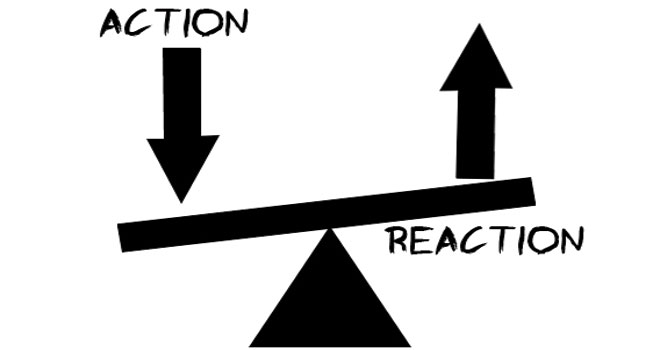

Die Burger’s editorial comment, on 19 October 2016, raised the issue of unintended consequences in so far as changes to the Liquor Act are concerned.

It discusses two sides of the coin.

Job creation and the industry’s contribution to the gross domestic product versus alcohol abuse with its social and financial consequences.

Amidst concerns over the practical feasibility of the proposed legislative changes, the article states that it is heartening to know that it is still early in the process, with considerable opportunity for public input.

This is also, however, where the process can derail.

It cites the example of proposed amendments to visa regulations, where the Minister involved refused to listen to warnings from informed persons and simply pushed ahead with what he thought was right.

When it exploded in his face, he shrugged his shoulders and blamed it on unintended consequences. It then required a ministerial task team to rectify his “brouwerk” (bungling).

Consultation

A lack of consultation is one thing we cannot fault the financial services regulators of.

Most of what is happening at the moment started with the publication of a report titled A safer financial sector to serve South Africa better in 2011 which outlined four major areas of reform:

- Strengthening financial stability

- Market conduct

- Financial inclusion and

- Combating financial crime and enhancing financial integrity.

There have been numerous publications since, on a variety of topics. In fact, the consultation process, as has been utilised in recent years, is prescribed in future regulations.

Divergent Interests

To a certain extent, the industry faces challenges very alike to what Rugby South Africa does at the moment.

While there is consensus about the need for change, various role players follow their own agendas without due regard for the bigger picture, and what is best for the industry and clients. Smoke screens are used, in the same way as those who blame transformation or quotas in rugby for the demise of Springbok rugby, to retain the status quo.

Radical change cannot come without a certain degree of pain for all concerned. If, like in rugby, our concern is more about the retention of our own positions and constituents than what the industry requires in the long term, we will remain part of the problem.

“Try first to understand, then to be understood”, said Stephen Covey.

This applies equally to regulators, employers, product providers and industry bodies. The intermediary is possibly the most important cog in the machinery, without whom a malfunction is inevitable.

Establishment challenges

It is probable that a lot of people will have left the industry by the time the new regulations are implemented and functioning. High staff turnover has always been testimony to just how difficult it is to maintain personnel numbers, never mind grow a business. Whatever changes are envisaged should consider barriers to entry as a very important aspect.

Independent advisers, in particular, are under threat in view of the increased cost of remaining compliant, and the cost to them of dumbing down of service by product providers.

One IFP said recently he felt like succumbing to the old saying: “If you can’t beat them, join them.”

The editorial comment in Die Burger concludes:

Wat die land nodig het, is ministers wat besef dat dit jou werk is om “onbedoelde gevolge” te sien kom en te verreken voordat ’n verreikende besluit geneem word. Mag ’n besluit dan hier geneem word op grond van die beste beskikbare inligting, eerder as op grond van bravado en ’n groot ego.

Roughly translated, this reads:

What the country needs are ministers who realise that it is their job to pre-empt unintended consequences before taking far reaching decisions. May decisions be made, based on the best information available, rather than on bravado and huge egos.