Bestmed Medical Scheme and Medihelp Medical Aid – the fourth and fifth largest contenders in South Africa’s “Big Five” open medical schemes – have announced their 2024 contribution increases, hot on the heels of Discovery Health Medical Scheme (DHMS), Bonitas, and Momentum Health.

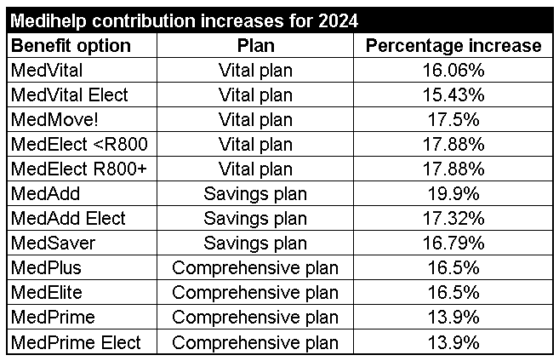

Bestmed announced a 9.6% average weighted contribution increase across all its benefit plans, while Medihelp’s weighted average adjustment is 15.96%, effective on 1 January 2024.

Although Medihelp is the smallest of the five (at last count), the scheme has announced the biggest average weighted contribution increase for 2024.

Last week, the country’s largest open medical scheme, DHMS, announced a weighted average contribution increase of 7.5%. Bonitas’s weighted increase for next year is 6.9%, and Momentum Health’s will be 9.6%.

Growth in membership

Membership growth among open schemes is low, but Bestmed this year reported a 10.6% growth in principal membership, marking its fourth consecutive year of consistent growth. The scheme has more than 240 000 beneficiaries.

Along with its contribution increase announcement, the scheme shared it has been able to attract a younger membership, resulting in a steady decline in the average beneficiary age. It reported that non-healthcare expenses remained significantly lower than those of the other large open schemes.

“This year, Bestmed’s key focus was ensuring minimal changes to our benefit options, to maintain benefit richness, while providing enhanced preventative care and wellness benefits across our Rhythm, Beat, and Pace product ranges,” said Leo Dlamini, Besmed’s chief executive and principal officer.

‘Responsible decision’

Medihelp said its membership growth has put pressure on the scheme’s reserves, necessitating the 15.96% hike. According to figures shared in February of this year, Medihelp had 197 621 beneficiaries.

The scheme made headlines three years ago when it absorbed contribution increases and introduced an overall weighted average premium reduction of 0.45% for 2022. This was followed by a hike of 7.5% in 2023.

Johan Viljoen, the acting principal officer at Medihelp, said the increase was not an easy decision. Although Medihelp is aware of the impact it will have on members, it is the responsible decision.

Medihelp also decided not to cut benefits, change products, or limit members’ benefits. This means that savings accounts and day-to-day benefits, among others, have not been reduced.

“Medihelp decided at the end of 2021 to support the allocation of accumulated reserves to alleviate economic pressure on members. This led to last year’s overall 0.45% contribution reduction. At a weighted average of 7.5%, Medihelp’s 2023 increase was also lower than the industry average, providing a very low base for any future adjustments,” Viljoen says.

Medihelp stated that most of its options are priced the lowest in the market, “which provides a very low base for adjustment and ensures that the product range remains well positioned despite the increase”.

Contribution increases up for approval

In a circular distributed in August, the Council for Medical Schemes (CMS) advised schemes to limit their contribution increases for 2024 to 5% – in line with headline inflation as measured by the Consumer Price Index (CPI) – plus “reasonable” utilisation estimates.

The CMS projected these estimates at 3.2% to 3.8% based on its analysis of cost increase assumptions for 2023. In other words, a recommended increase of just over 8%, give or take a percentage point or two.

However, the council acknowledged that “industry-specific cost-push factors” may necessitate medical schemes to implement contribution increases that exceed the CMS’s recommended increments linked to the CPI.

In such cases, the circular said, boards of trustees must provide the registrar with a comprehensive business plan justifying the proposed above-inflation contribution increases.

Last week, DHMS said its valuation report for 2024 had been submitted to the CMS, but it had not yet been approved by the CMS.

“This is not unprecedented, since most medical schemes announce their annual contribution increases after submitting their valuation report to the CMS, but prior to CMS approval,” said Deon Kotze, the chief product officer at Discovery Health.