Bestmed Medical Scheme, South Africa’s fourth-largest open medical scheme, has announced a 12.75% average contribution increase across all its options for 2025.

This marks a 3.15% rise from its 2024 increase of 9.6%. It also makes it the highest contribution hike for next year among the country’s top five open medical schemes. In comparison, Discovery Health Medical Scheme (DHMS) announced a weighted average increase of 9.3%, Momentum 9.4%, Bonitas 10.2%, and Medihelp 10.8%.

Read: As medical schemes announce hikes, members brace for tough choices amid rising costs

Read: Discovery announces 2025 contribution increases: average hike of 9.3%

Leo Dlamini, the chief executive and principal officer, said although Bestmed recognises that the proposed contribution increase is higher than in previous years, the scheme is confident it is the right thing to do given the increased demand for healthcare services by members and the increasing cost of healthcare, “which is largely beyond our control”.

He said the 2025 contribution increase must be considered in the context of Bestmed’s average increase of 7% over the past five years, which was marginally less than the market average for the same period.

“Also, whilst the annual percentage increase is an important lens through which one compares what different medical schemes are changing, the rand amount (absolute number) is what the member will experience. Rand for rand, Bestmed’s benefit options will remain competitive in 2025 and beyond,” Dlamini said.

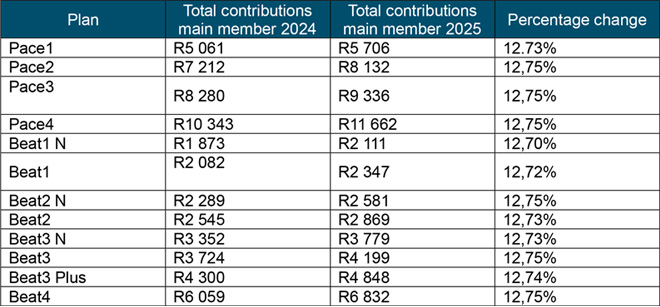

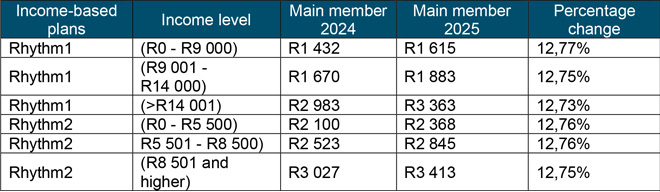

Bestmed’s gross contribution increases for 2025 across its benefit plans are:

Members will see an average benefit limit increase of 4.6% in 2025.

Factors driving medical contribution increases

Dlamini said the cost of healthcare had risen substantially in recent years.

Medical inflation has, for a number of years, exceeded the Consumer Price Index (CPI) and, therefore, annual medical scheme increases are higher than CPI.

“However, in 2021 and 2022, many medical schemes opted to increase their contributions by less than CPI because they had accumulated reserves during the Covid pandemic. With claims returning to pre-Covid levels, schemes must safeguard their sustainability by managing reserves and ensuring that contribution increases are at levels that commensurate with claims and expenditure.”

Healthcare claims have risen more rapidly since the end of the pandemic. Dlamini said the reasons for this included increased claims for treating long-term health complications related to the Covid pandemic, an increase in oncology prevalence, and an increase in the prevalence of fraud, waste and abuse.

“We’ve also seen growing demand for mental health services exacerbated by the pandemic (and post-pandemic realities), alongside an increased prevalence of chronic conditions such as diabetes and hypertension, resulting in rising claims.”

What’s new

Key product changes that members should take note of include:

- The enhancement of Bestmed’s internal prosthesis offerings with endovascular and catheter-based procedures.

- Drug-eluting stents will now be funded on all options, subject to the limits for vascular prosthesis on each option.

- Both single pacemakers and dual-chamber pacemakers will be funded on all options.

- The preventative care benefits on the Rhythm1 option for mammograms and pap smears have been adjusted to be covered on this option from 2025. These two preventative benefits are now covered on all 14 of Bestmed’s options.

- The structure of the specialised diagnostic imaging benefit has been changed, where MRI scans, CT scans and nuclear/isotope studies will now have a combined family limit per year for in-hospital and out-of-hospital on all options, except Rhythm1, where it is covered only for the Prescribed Minimum Benefits.

- Dependants up to the age of 24 years are still regarded as child dependants, whereas previously dependants who were registered students up to the age of 26 years were covered at child dependant rates.

The benefit whereby members pay for three children and the rest are covered for free remains in place.