Members who are contemplating withdrawing money from their savings component should be aware of the tax consequences, which can be significant, says Alexforbes.

The two-pot retirement system, which took effect on 1 September, enables members of occupational retirement funds to take cash withdrawals (if they have more than R2 000 in their savings component) before retirement without having to resign. Members of retirement annuity funds can also access their savings component before the age of 55.

Vickie Lange, the head of Best Practice at Alexforbes, says members should be aware that a fund can, in certain circumstances, restrict members’ access to their savings component if they owe amounts to third parties that are secured or payable by the fund. These circumstances may include housing loans, court orders in favour of an employer, and divorce and maintenance orders. Funds are obliged to restrict access to the savings component if a withdrawal could leave insufficient funds to pay amounts owed to third parties.

The deductions that can apply

Members who withdrawal money from their savings component should be aware of the deductions that will apply.

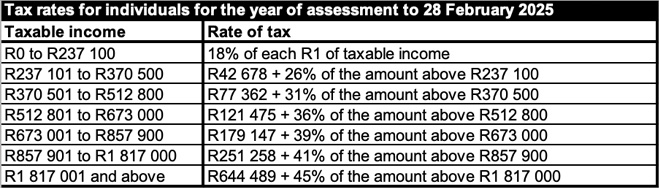

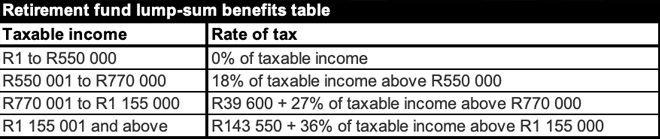

First, the fund or administrator must apply the member’s marginal tax to the amount withdrawn.

On the other hand, if members wait until retirement to withdraw from the savings component, not only are the tax rates lower, but the first R550 000 withdrawn is not subject to any tax.

Note that a member’s ability to take full advantage of the R550 000 tax-free withdrawal may be affected by:

- Pre-retirement withdrawals from the savings component.

- Lump sums taken from savings accumulated before the two-pot system was implemented (savings that will go into the vested component).

Members who owe tax to the South African Revenue Service (SARS) should know that SARS may not only deduct tax at the marginal rate but also the outstanding tax.

In addition to tax, it is likely that most fund administrators will charge a fee to process withdrawals from the savings component. These fees will differ from administrator to administrator.

Illustrating the impact

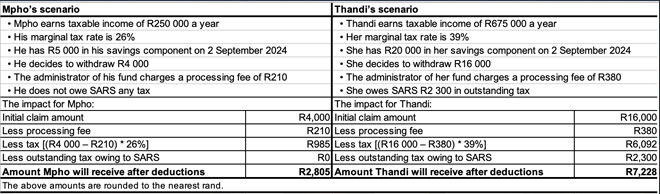

Lange provides the following examples to illustrate how these deductions will impact a pre-retirement withdrawal from the savings component.

As can be seen from the above scenarios, tax can significantly erode the amount paid to members. Therefore, it is advisable for members to avoid relying on their savings component to provide cash for financial emergencies or unplanned expenses.

Alexforbes advises members to set up a separate emergency fund and access their savings component only as a last resort.

Another reason members should avoid dipping into their savings component is that they are likely to need cash lump sums at retirement to meet their financial needs, such as moving to a new house, paying off debt, or putting money aside for medical costs during retirement.

The risk of not having any cash in available at retirement is particularly acute for people who join the retirement system for the first time on 1 September – they will not have a vested component from which they might be able to make a cash withdrawal at retirement.

Members of pension funds and RA funds can take up to one-third of the benefit as a cash lump sum at retirement. Members of provident funds can withdraw as a cash lump sum whatever they have saved in a provident fund up to 1 March 2021, plus one-third of any savings in the vested component between 1 March 2021 and 31 August 2024.

Ultimately, members should understand that all their retirement savings – in the savings, retirement, and vested components – are intended for a specific purpose: funding their income in retirement. Depleting their savings component annually will result in their having one-third less on which to retire.

Izak Odendaal, Old Mutual Wealth’s chief investment strategist, says early withdrawals from retirement funds should be avoided unless absolutely necessary.

“The biggest friend any investor has is time, because time facilitates compound growth. Early withdrawals from a retirement fund robs that money of the time to grow,” he says.

Even at a relatively modest growth rate of 4% a year, R30 000 will more than double to R65 733 over 20 years. At a 6% annual growth rate, it will more than triple to R96 214, and at 10%, will grow to R201 825.

Therefore, taking R30 000 out of your retirement savings today does not mean that your future self will be R30 000 poorer. It means in future you will be poorer by R65 000, or R96 000, or R200 000 two decades from now. It gets worse, because early withdrawals will be taxed at your marginal rate, whereas growth inside a retirement fund is tax-free, Odendaal says.

Tips for establishing an emergency fund

Tebogo Marite, a communications specialist at Allan Gray, echoes Lange’s advice about the importance of establishing an emergency fund, to preserve long-term investments for their intended purpose.

Marite says members should aim to accumulate at least three times their monthly salary in an emergency fund.

“Accumulating a healthy emergency fund may take some effort, including lifestyle adjustments, such as paying off expensive credit card debt and sticking to a monthly budget. Commit to ‘paying yourself first’, and then set up a debit order so you don’t have to battle old habits each month.

“For example, if you earn R25 000 per month after tax and other deductions and want to build up three months of reserves, you will need to set aside R4 167 per month for 18 months to accumulate R75 000. By the time your emergency fund is established, you will be used to the monthly sacrifice,” she says.

Once you have built up three months of reserves, instead of reverting to your previous spending habits, you should redirect your monthly payments into a longer-term investment (and increase their contributions in line with your salary increases to account for lifestyle inflation).

“This way, you continue with the new habit, which builds your investment resilience. If you do have an emergency and need to spend some of the emergency fund, you can then easily redirect your debit order until you have replenished the spend,” Marite says.

Members should aim for their emergency fund to be sufficiently large to buy enough time to manage and recover from a crisis without the need to dip into long-term investments.

“It is not prudent to rely on long-term investments – including the soon-to-be accessible savings component of your retirement funds – as they are specifically intended to meet long-term goals and are typically invested accordingly, with relatively high equity exposure.”

Although equities are the best way to ensure your portfolio beats inflation over the long term, market ups and downs are to be expected. Equities are not well suited for short-term savings or emergency funds, because if you need cash during a market downturn, you may be forced to sell at a low, locking in losses. An appropriately invested emergency fund can help to avoid this scenario, Marite says.

“Deciding how to allocate your money to various goals can be complex and requires trade-offs between current and future lifestyle wants and needs. Typically, an investment plan includes different investment products to meet a range of objectives. Using the products as intended and appreciating the time frames required for success are important aspects of long-term wealth creation. A good, independent financial adviser can help you with these decisions,” she says.