Ninety One retained its position as the largest asset manager in South Africa in 2023, according to Alexforbes’ latest survey of retirement fund investment managers.

The December 2023 Manager Watch analyses key statistics and findings from the survey by Alexforbes. The edition includes 28 surveys: 13 balanced, 14 specialist, and one multi-manager.

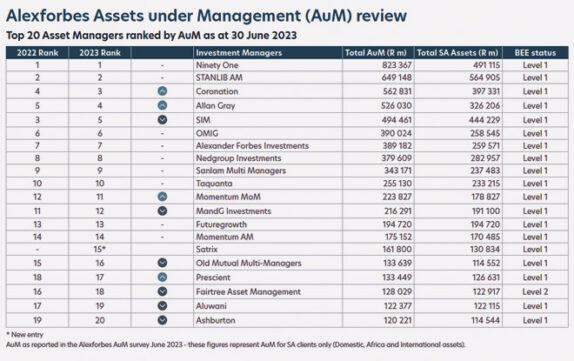

According to the June 2023 Alexforbes assets under management (AUM) survey, which focuses on assets owned by South African clients only, Ninety One consolidated its leading position from 2021 and 2022, with a 6% increase in assets.

Stanlib remained in second place, also with a 6% increase in assets, while Coronation moved from fourth to third spot, with an asset increase of 8%.

Allan Gray leapfrogged Sanlam Investment Management and Old Mutual Investment Group to secure the fourth spot, with an 11% rise in assets since June 2022.

The Public Investment Corporation, which has about R2.9 trillion in AUM, is not included in the survey because it is a state entity.

Alexander Forbes Investments remains the leading multi-manager in South Africa, ranking seventh overall.

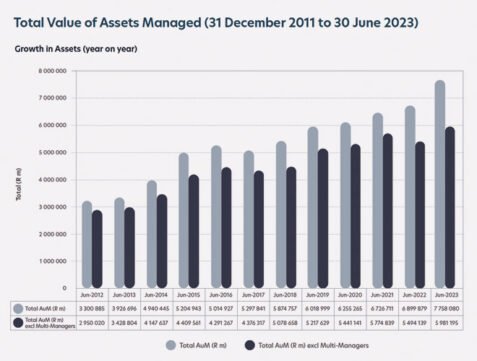

“The assets managed by South African multi-managers have seen steady growth compared to those managed by their single-manager counterparts. In 2016, the ratio of AUM was 86% for single managers and 14% for multi-managers. By 2022, this ratio changed and to 80%:20% and in 2023, it further shifted to 77% for single managers and 23% for multi-managers. This trend indicates a growing confidence in multi-managers, as more investors are diversifying their portfolios across various asset classes and management styles,” the Manager Watch survey says.

The total assets of participants in the survey increased by 12% from June 2022, with the concentration remaining among the top 10 asset managers. The AUM held by this group constituted 62% of the assets for the total universe of 79 managers participating in the survey.

The June 2023 survey universe grew by two compared to the 77 investment managers in the June 2022 survey. Three investment managers entered the survey, while one left.

Offshore shift

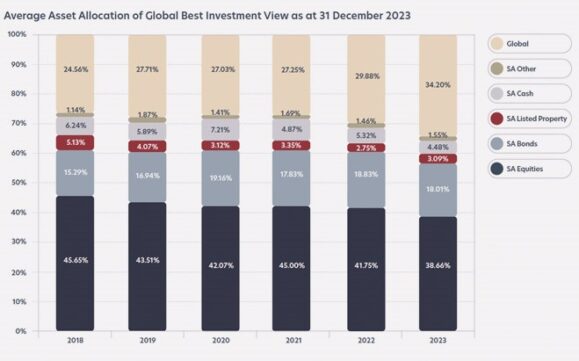

This year’s survey shows the extent to which asset managers are increasingly investing offshore.

In the Global Best Investment View category, of the 45 surveyed managers, 34 exceeded a 30% allocation to international assets, with 11 surpassing 40%. The average exposure to international assets rose to 34.2% in December 2023 from 29.9% in December 2022. Only four managers had international asset exposure below 30% by more than 5%.

Performance for the year surpassed domestic mandates by 4.5%, with median returns of 12.6% and 8.1% respectively, driven by strong global equities.

Other key trends

There was a notable increase in the number of asset managers rated as Level 1 BEE contributors: 51 out of 79 achieved Level 1 status, an increase from 49 out of 70 last year. All top 10 asset managers, as well as 19 of the top 20, were rated as Level 1 in 2023.

The asset management landscape in South Africa is witnessing a profound shift to the integration of artificial intelligence (AI) and machine learning (ML). A survey of 24 asset managers sheds light on this transformation, revealing insights into adoption rates, benefits, challenges, and industry prospects.

“Currently, only 32% of asset managers have embraced these technologies, indicating early-stage adoption. However, this cautious approach underscores significant growth potential. As the industry evolves, strategic investments, skill development, ethical considerations and fostering collaboration, will be vital for maximising the potential of AI and ML,” Alexforbes says.

The uptake of responsible investing principles saw a further increase last year. Sixty-nine asset managers who participated in the surveys endorsed the Code for Responsible Investing in South Africa, compared to 62 in 2022. Additionally, 59 asset managers signed up for the United Nations’ Principles for Responsible Investment, compared to 48 in 2022.

“This growth underscores a continuing trend towards the integration of ESG factors into investment and business decisions, highlighting an enhanced commitment to sustainability within the investment industry,” Alexforbes said.