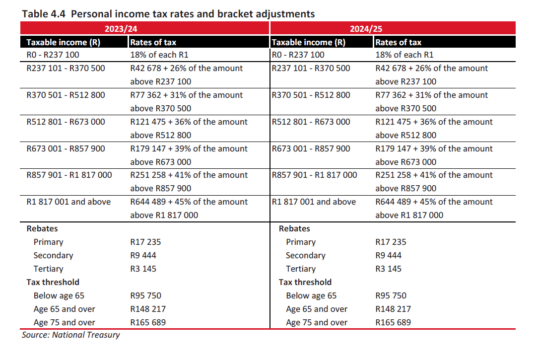

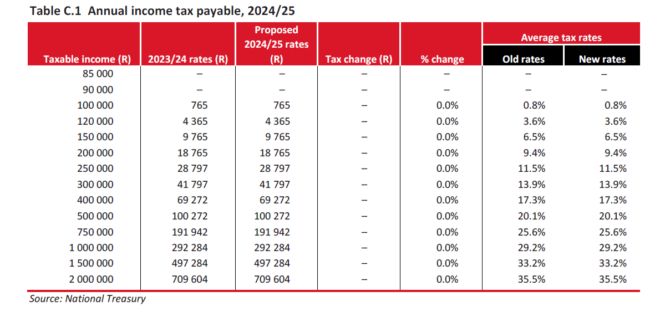

There will be no relief for personal income-taxpayers in the 2024/25 tax year, as the Minister of Finance is proposing not to adjust the PIT table or the tax rebates to account for inflation.

The non-adjustment of the rates means taxpayers who receive salary increases will be liable to bracket creep: a higher taxable income will bump them into a tax bracket with a higher rate of tax.

The medical tax credits will also not be adjusted to account for inflation: they will remain at R364 a month for the first two members and R246 a month for additional members.

The upside for medical scheme members is that nothing was said about phasing out the medical tax credits, to shift the money to National Health Insurance (NHI). And there was no mention in the Budget about new tax taxes to pay for NHI.

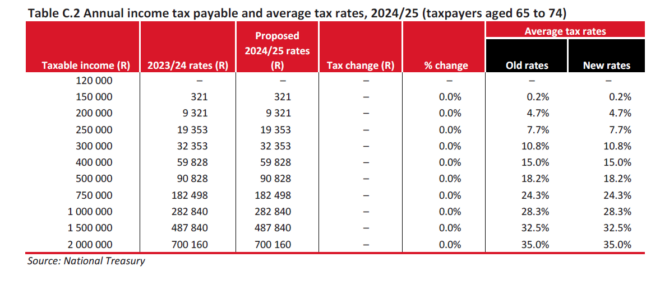

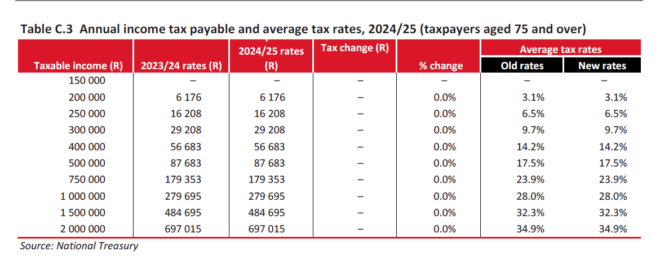

(The annual income tax tables by age band are at the end of this article.)

But contrary to the predictions of some tax experts, no increases in the rates of PIT or value-added tax were announced.

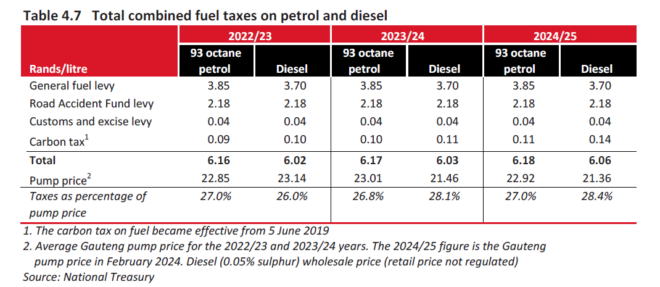

The good news is that the three fuel levies will not be increased. These levies are the general fuel levy, the Road Accident Fund levy, and the customs and excise levy.

Although the fuel levies remained untouched, the carbon tax on petrol and diesel will be increased. The carbon fuel levy will increase from 10 cents to 11 cents a litre for petrol and from 11 cents to 14 cents a litre for diesel effective from 3 April 2024, as required under the Carbon Tax Act.

National Treasury wants to raise R15 billion in 2024/25 “to alleviate immediate fiscal pressure and support faster debt stabilisation”, the Budget Review says.

Treasury will raise R16.3bn by not adjusting the PIT rates and rebates and R1.9bn by not adjusting the medical tax credits. It will forfeit R4bn in revenue by not increasing the fuel levies.

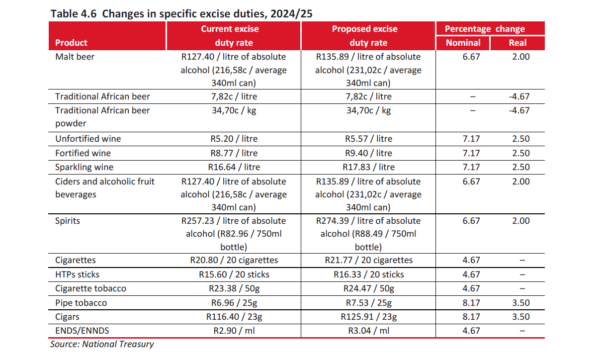

It will raise R800 million by above-inflation increases in excise duties on alcohol and certain categories of tobacco products.

Drinkers, smokers, and vapers will pay more

The government proposes to increase excise duties on alcoholic beverages by between 6.7% and 7.2%. The duties on cigarettes and cigarette tobacco will increase by 4.7%, and the duties on pipe tobacco and cigars will rise by 8.2%.

The duty on vaping products (electronic nicotine and non-nicotine delivery systems) will increase from R2.90 per millilitre to R3.04 per millilitre.

Motor vehicle emissions tax

Th government proposes to increase the motor vehicle emissions tax rate for passenger vehicles from R132 to R146 per gram of CO2 emissions per kilometre and the tax rate for double cabs from R176 to R195 per gram of CO2 emissions per kilometre from 1 April 2024.

Plastic bag levy and incandescent globe taxes

The government proposes to increase the plastic bag levy from 28c a bag to 32c a bag from 1 April 2024. To encourage the uptake of more efficient lighting such as light-emitting diode bulbs and reduce electricity demand, it proposes to raise the incandescent light bulb levy from R15 to R20 a light bulb from 1 April 2024.

Taxes that will not be changed

The Budget does not contain proposals to increase on investment income. Therefore, the rates for capital gains tax, dividends tax, and securities transfer tax remain unchanged.

The exemptions on interest income from a South African source remain at R23 800 a year for people under 65 or an estate of a deceased person and R34 500 for those aged 65 or older.

The rates for property transfer duty, estate duty, and donations tax also remain unchanged.

Sun sets on solar tax breaks

The government has not extended the tax incentives for individuals and businesses to generate renewable energy.

In last year’s Budget, the Minister of Finance announced tax measures to encourage businesses and individuals to invest in renewable energy, increase electricity generation, and reduce their reliance on Eskom.

Businesses were enabled to reduce their taxable income by 125% of the cost of an investment in renewables, with no thresholds on the size of the projects.

Individual households were enabled to claim a rebate of 25% of the cost of solar panels, to a maximum of R15 000.

Individuals who pay personal income tax could use the incentive to decrease their tax liability in the 2023/24 tax year.

The rebate for individuals will end on 29 February 2024.

The rebate for businesses will run another year, with the deadline scheduled for 28 February 2025.

PIT rates by age band

How the changes to the rates of PIT will affect how much tax you pay in the 2024/25 tax year.

The SARS 2024 tax pocket guide provides a summary of the most important information relating to taxes, duties, and levies for 2024/25. Click here to download it.