2024’s lessons for business resilience: 5 strategies for thriving amid uncertainty

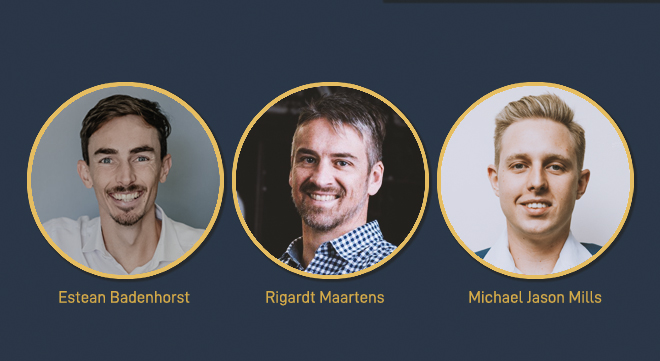

Businesses faced a whirlwind year of challenges and opportunities in 2024. Business Partners has five critical strategies owner-managers can adopt to build resilient, future-proof businesses in this unpredictable environment.