Fraudsters impersonate FSCA commissioner in latest scam

The FSCA also reiterates its warning against Donafin, which continues to charge fees for unauthorised financial services.

The FSCA also reiterates its warning against Donafin, which continues to charge fees for unauthorised financial services.

In investing, one key factor is often overlooked: the payback period. Understanding duration can reshape your portfolio strategy and help you manage risk more effectively.

Key proposed amendments include imposing fines for non-compliance, enhancing the Information Regulator’s authority to issue directives, and introducing search-and-seizure powers.

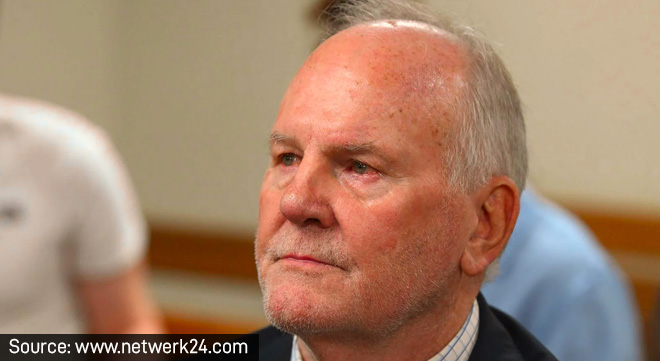

Stephanus Grobler, who is facing multiple charges including racketeering and fraud, is due to appear in court in February next year.

Financial stress frequently appears in the workplace as anxiety, which can develop into depression, increased absenteeism, and substance abuse.

Associate Professor Tasleem Ras’s analysis of a patient’s case highlights critical pitfalls in cancer care.

FSCA warns about Miway Express Credit Solutions, as well as entities and individuals who are impersonating legitimate FSPs.

The group reported a 15.9% increase in assets under management to R435bn.

Medical inflation outpaces CPI because of unique pressures such as the rising costs of technology, chronic diseases, and private healthcare pricing.

The Allianz Commercial Cyber Security Resilience report shows that the costs associated with certain data privacy breach claims can match or surpass those of ransomware incidents.

Court finds that Pieter Bothma accepted bribes to facilitate unauthorised investments, laundering millions for Fidentia’s directors.

Launched in 2019, the inquiry sought to investigate allegations of racial profiling by medical schemes. As 2024 draws to a close, the CMS is still battling objections and technical reviews to finalise the report.

Contribution increases in 2025 are exceeding CPI, with some medical schemes aiming to rebuild reserves and ensure long-term sustainability.

The stronger rand has shifted the focus back to domestic equities and property. Managers leaning into local value and shedding expensive offshore assets are reaping the rewards of this pivot.

In September, Sanlam received more than 83 000 withdrawal claims, with most coming from members aged 35 to 44, many of whom had a replacement ratio below 50%.

SARS has processed more than 1.2 million tax directives for savings component withdrawals, paying out R21.4 billion to fund members.

SMMEs serving critical infrastructure and global corporations, as well as those in regulated industries such as insurance, healthcare, banking, and credit monitoring, are particularly vulnerable.