New research by Discovery Insure shows that cellphone distractions top the list of risky driving behaviours in South Africa.

Thanks to its Vitality Drive programme, the short-term insurer has access to more than 19 billion kilometres of driving data from 500 000 daily trips, allowing it to gain an in-depth understanding of vehicle-accident risk factors.

The data shows that although environmental factors, such as road conditions, and vehicle-related factors contribute to road fatalities, driver behaviour plays the biggest role. Notably, the data indicates that cellphone distractions are the biggest contributor to road accidents in South Africa.

According to the research, more than 60% of motor vehicle fatalities are influenced by five behaviours: drinking and driving, using a cellphone while driving, excessive speeding, aggressive driving, and lack of vehicle care.

“Discovery Insure’s investment in telematics has been critical in unlocking key insights that enable us to create a nation of safe drivers,” said Discovery Insure’s chief executive, Robert Attwell.

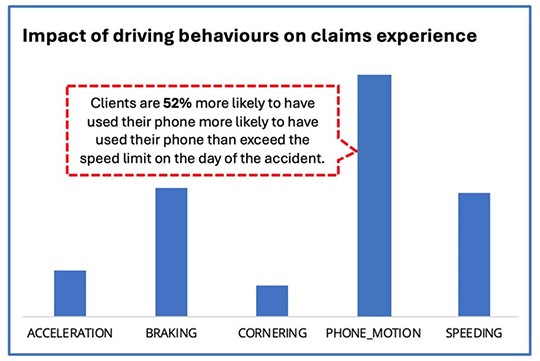

Cellphone usage has a bigger impact than speeding

The data showed that cellphone use has the biggest impact on the likelihood of a claim, even higher than speeding. A mere 20 seconds on the phone in each trip increases accident risk by more than 60%.

Discovery Insure’s clients who submitted accident claims were 52% more likely to have used their phone than to have exceeded the speed limit on the day of the accident.

The data also showed that driving at night significantly increases the risk that an accident will be fatal. Accidents that occur between 10pm and 4am are nine times more severe than daytime accidents.

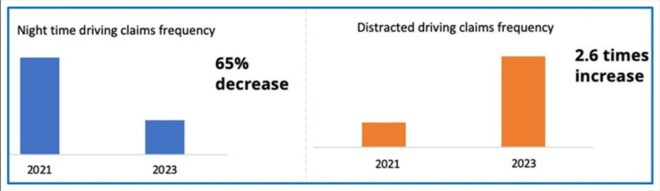

In addition, there has been a shift in driving behaviour, with an increase in accidents relating to cellphone usage, while night-time accidents have reduced.

“We’ve seen a positive development as far as night-time accidents are concerned, which was partly attributed to increased usage of our Uber benefit. But now the increase in distracted driving accidents overshadows that,” said Attwell.

The state of South African roads

South Africa’s deteriorating road infrastructure also contributes to the risk of road fatalities. The Road Traffic Management Corporation reported that poor road conditions accounted for 22.2% of motor vehicle fatalities in 2022. It estimated they caused a 3.29% or R200 billion loss to GDP that year.

“Combining these insights with our driving data, we can see that driving behaviour has a bigger impact on road fatalities than road conditions. The data shows that parts of the country with the best roads may have high motor vehicle fatalities because of bad driving behaviour,” added Attwell.

Limpopo has one of the best road infrastructures, but drivers in that province have the highest number of driving events that cause accidents. They exceed the speed limit significantly. Limpopo’s road fatality rate per registered vehicle is the highest in the country. On the other hand, the Western Cape has good road infrastructure and good driver behaviour. This has led to lower road fatalities.

“This shows that road safety is a complex problem in South Africa, and it requires a multifaceted approach that largely drives a change in driver behaviour,” said Attwell.

Also emerging from Discovery Insure’s research is that accidents usually occur on the same roads or intersections, with 1% of locations accounting for 27% of accidents.

Vitality Drive changes behaviour

Data shows that drivers on Vitality Drive reduce their accident risk by 15% within the first month of joining the programme, and they have a 34% lower fatality rate than the South African average.

According to Discovery, the programme’s telematics technology helps drivers to understand the good driving behaviours that will increase their rewards. The more they engage with the programme, reaching the highest Vitality Drive status, their frequency of accidents reduces by 70% and accident severity drops by 35%.