Luxury goods stocks are under severe pressure after a spectacular performance during the last quarter of last year through the first quarter of this year. Most of the gains have been wiped out since then.

The fortunes of the luxury goods companies are closely linked to the evolvement of the Chinese luxury goods market.

The Chinese luxury goods market is dominated by four listed companies (“the Big Four”), which collectively own 11 of the top 16 brands listed by Vogue Business: Richemont (Cartier, Van Cleef & Arpels), LVMH aka Moët Hennessy Louis Vuitton (Dior, Louis Vuitton, Tiffany, Loro Piana), Kering (Gucci, Saint Laurent, Balenciaga, Bottega Veneta), and Hermès (Hermès).

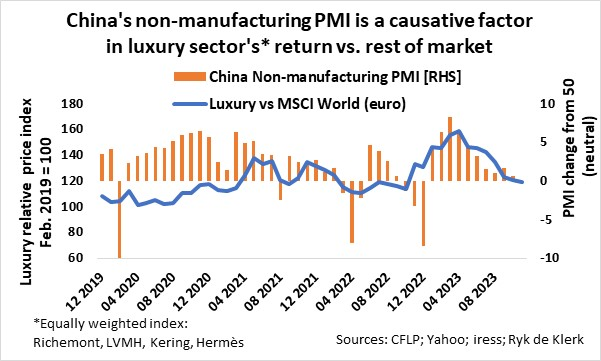

An equally weighted luxury index comprising the share prices of Richemont, LVMH, Kering, and Hermès in euro terms relative to the MSCI World Index (developed markets) indicates a strong relationship with the CFLP non-manufacturing purchasing managers’ index over the past few years. According to investing.com, the “China Non-manufacturing Purchasing Managers’ Index (PMI) provides an early indication each month of economic activities in the Chinese non-manufacturing sector”. A reading above 50 indicates expansion, whereas one below 50 indicates a contraction of economic activities.

The trend of the said PMI is very important, though. A rising trend in the PMI tends to coincide with the luxury index outperforming the MSCI World Index, while a downtrend in the PMI tends to coincide with the luxury index underperforming the MSCI World Index.

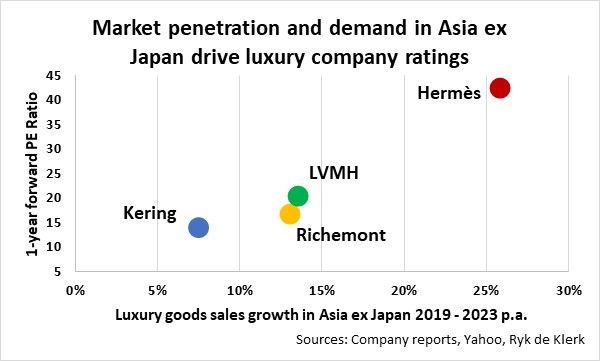

Due to a dearth of information, I concentrated on the Asian market excluding Japan as a proxy for China when I analysed the Big Four.

The performance of the individual stocks comprising the Big Four relative to each other is dependent on their growth in especially the Asia excluding Japan market, and, in my opinion, secondary the rest of the world.

Furthermore, the luxury goods market spans jewellery, dress shoes, casual shoes, handbags, watches, coats, outerwear, small leather goods, and wine and spirits. The portfolio offerings of the Big Four differ materially from each other and so do their growth and margins, which are all individually dependent on customers’ needs and preferences.

Richemont is the highest geared to sales during the Chinese lunar holidays.

Over the past three years, the contribution of sales revenue in Asia excluding Japan to Richemont’s total revenue on average increased by 11% during the holidays, while the average contribution to Hermès, Kering, and LVMH increased by 10%, 5%, and 7%, respectively.

Sales revenue in Asia excluding Japan outpaces the rest of the world by a wide margin.

The compounded growth rate of the Big Four in the combined sales revenue in Asia excluding Japan for the first three quarters of 2023 compared with the same period in 2019 amounted to 13.8% a year. Hermès experienced the highest growth, with 25.8%, followed by LVMH and Richemont, with 13.5% and 13% respectively, while Kering recorded 7.5% a year.

The Big Four’s growth rate in their collective sales in the rest of the world over the same period amounted to 10.7% a year, with Hermès and LVMH leading the way, with 14.1% and 13.7% respectively, followed by Kering and Richemont, with 6.9% and 6% a year.

Hermès gains market share

Hermès’ market share of the collective Big Four’s Asia excluding Japan revenue pie increased to 13% in the first three quarters of 2023 from 9% in the same period in 2019 at the expense of Kering’s drop to 14% from 18%. LVMH is still the single largest player and maintained its share of 54%, while Richemont is holding on to 18% of the pie.

It is therefore not surprising that since China’s Non-manufacturing PMI peaked in April this year, Kering fell the most, by about 32%, Richemont by 29%, and LVMH by 24%, while the drawdown of Hermès was a mere 8%.

The immediate outlook for retailers and wholesalers of luxury goods is not good at all. Weak demand and declining sales are among the top trending phrases used by executives, while business and consumer confidence worldwide are waning the longer the Middle East war drags on.

Also, the much-awaited Chinese Golden Week that began on October 1 was supposed to be the perfect opportunity for a surge in consumer spending. It proved to be a damp squib, with spending increasing by only 1.5% more than 2019 as Chinese people remain cautious amid rising youth unemployment and income stability concerns.

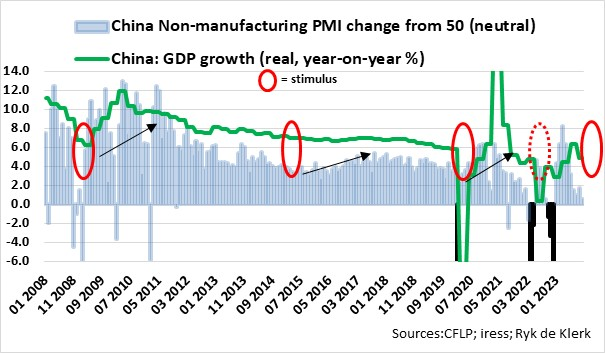

But all is not lost for China, the world’s second-largest economy. Plans are afoot to stimulate the Chinese economy through infrastructure spending, and while the feeling is that the People’s Bank of China has not done enough yet, most analysts and economists project China’s economic growth at 5% by the end of this year.

In the past, stimulations were very soon followed by improved business and consumer confidence, leading to higher CFLP Non-manufacturing PMI readings. I would hesitate to say this time is different.

Therefore, all is not lost for Chinese and Asian demand for luxury goods. Nor is it lost for luxury goods stocks, as the higher PMI readings are likely to lead to re-ratings of the stocks. I am not too optimistic about Chinese stocks and rather prefer exposure to China by holding Richemont and LVMH.

Ryk de Klerk is an independent investment analyst.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies. The information in this article does not constitute investment or financial planning advice that is appropriate for every individual’s needs and circumstances.

Hou baie van jou analiese !! Stem saam !!