The assets managed by South Africa’s collective investment schemes (CIS) again exceeded R3 trillion by the end of 2022 despite the strong headwinds faced by the industry.

The industry recorded net inflows of R108 billion in 2022, ending the year with R3.14 trillion in assets under management (AUM), according to statistics released this week by the Association for Savings and Investment South Africa (Asisa), which represents the asset management and life insurance industries.

Asisa calculates net inflows/outflows by deducting the rand value of repurchases (units sold by investors) from the total value of units bought by investors. The net inflow figures in this article consist of new money invested and dividends reinvested.

The number of rand-denominated portfolios increased from 1 710 at the end of 2021 to 1 769 at the end of 2022. Worldwide, there were 136 643 CIS portfolios, with total AUM of $56 trillion (R1.031 trillion) at the end of September 2022.

The South African CIS industry first reached the R3-trillion milestone in the last quarter of 2021, finishing the year with R3.14 trillion in AUM.

In 2022, financial markets were buffeted by headwinds, including higher levels of load shedding, accelerating inflation, and heightened risk aversion because of the impact of Russia’s invasion of Ukraine on energy prices and supply chains.

AUM dropped to R2.98 trillion in the second quarter, but the CIS industry clawed back the losses, finishing the year with AUM at the same level as the previous year.

Sunette Mulder, senior policy adviser at Asisa, said the movement in the industry’s AUM mirrored the FTSE/JSE All Share Index, which also ended 2022 almost exactly where it finished in December 2021. It closed at 73 709 on 30 December 2021 and 73 048 on 30 December 2022.

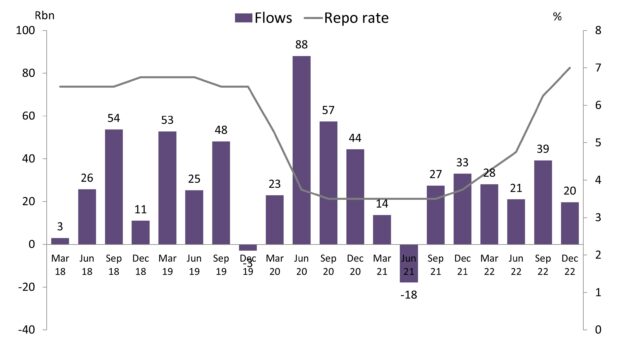

The graph below shows how changes in the repo rate have affected CIS quarterly rand-denominated flows since 2018. When interest rates decline, investors turn to unit trust funds.

Impact of grey-listing

It was too early to predict how grey-listing would impact the CIS industry, Mulder said.

“It will be interesting to see how the grey-listing will come through in the market. Whether it is going to have an impact on investment flows again, it’s difficult to say. I think many companies have already priced it into how they do business,” she said.

“A lot of the people have already put alternative agreements in place. The grey-listing didn’t come as a surprise. I think everybody was fully aware the possibility was there. I think most people have already built into their business processes,” she said.

Mulder said the CIS industry has weathered many turbulent times before. “In the past, we’ve seen various shocks in our system, and we’ve seen the CIS industry behave very resiliently. So, I’m hoping we will continue to see that with these current shocks.”

Asisa chief executive Busisa Jiya said although grey-listing was expected, it came at a time when the country could ill afford the reputational damage.

Grey-listing was expected to result in more due diligence on cross-border transactions and higher compliance costs. However, retail investors should not expect delays in executing their transactions.

Sector performance

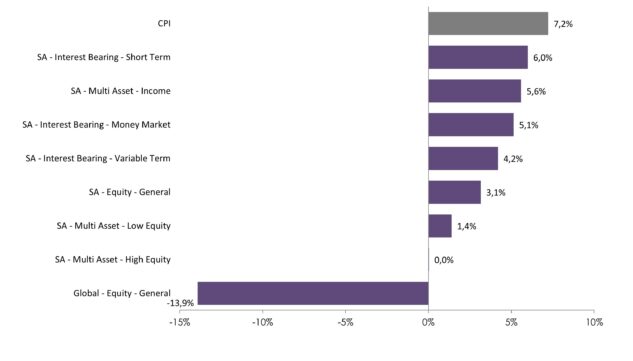

All rand-denominated CIS categories under-performed inflation in 2022, while global equity funds produced negative returns of -13.9%. But long term (five years or more) investors have benefited from inflation-beating returns, irrespective of where their money was allocated.

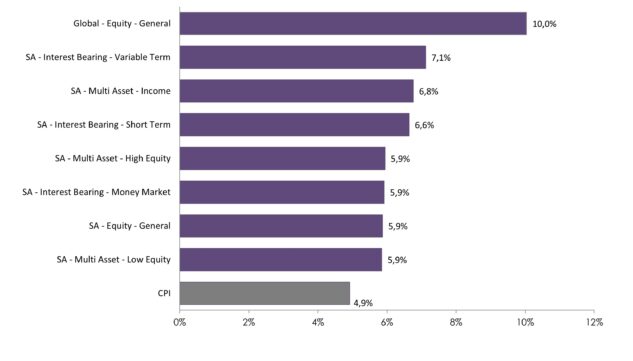

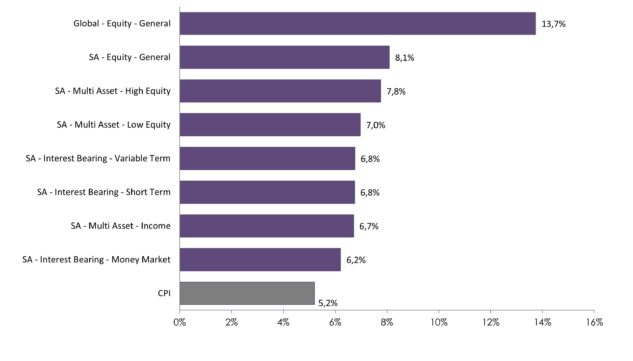

The global equity general category has been the top performer over five and 10 years, while domestic equity produced the best returns over 20 years.

Sector performances over one year to 31 December 2022

Sector performances over five years to 31 December 2022

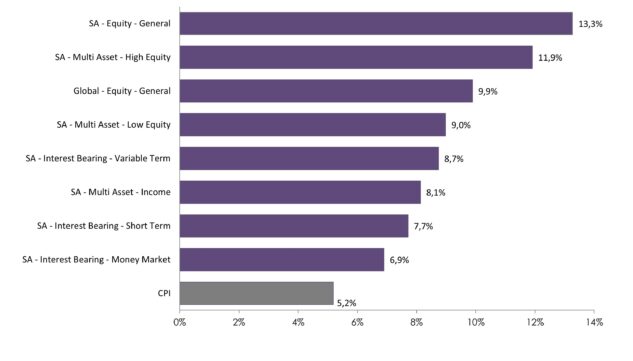

Sector performances over 10 years to 31 December 2022

Sector performances over 20 years to 31 December 2022