The Ombudsman for Long-term Insurance (OLTI) released its annual report for 2023 last week. Here are 10 take-aways from the report:

-

Decline in requests for assistance

The OLTI received 13 750 written requests for assistance in 2023, a decrease of 16.7% from the 16 476 in 2022. The OLTI received a record of 17 379 requests in 2021, which was not surprising because many Covid-19-related claims were filed in that year.

The OLTI received 14 198 requests for assistance in 2020, and the report commented that the 13 750 requests received last year indicated a return to pre-Covid levels.

-

Chargeable complaints decrease

Of the 13 750 requests for assistance, 6 714 became chargeable complaints (the complaint fell within the OLTI’s jurisdiction), a decrease of 5.8% from 2022.

Chargeable complaints are categorised as:

Mini Cases

These are simple complaints within the OLTI’s jurisdiction, but which insurers can handle without the office’s involvement. There were 145 (2022: 231; 2021: 284) mini cases last year.

Transfers

These are complaints referred to insurers to try to resolve them directly with the complainant. If the complaint is not resolved and if the complainant requests the OLTI to do so, they are taken up as Reviews and handled in the same manner as Full Cases.

Transfers decreased to 5 465 (2022: 5 506; 2021: 6 038). Insurers settled 1 580 (29%) of these Transfers, compared to 1 666 in 2022 and 1 775 in 2021. Reviews increased to 1 616 last year after decreasing from 1 677 in 2021 to 1 207 in 2022.

Full Cases

These are complaints that have already been seen by insurers, and they are handled by the office from inception to finalisation. There was a 20.5% decrease in Full Cases, from 1 389 in 2022 to 1 104 last year, following the 25% decrease in 2021.

The number of complaints to the OLTI should be seen in context of the number of in-force policies.

According to statistics provided by the Association for Savings and Investment South Africa in March this year, there were 43.8 million in-force policies at the end of 2023. Therefore, the 6 714 chargeable complaints dealt with by the OLTI constituted only 0.015% of the total number of in-force policies.

-

Fewer cases resolved in favour of consumers

There was a further decrease, to 26%, in the percentage of cases resolved wholly or partially in favour of complainants last year. (If Transfers settled in favour of complainants are included, the percentage increased to 38%.) The percentage of cases settled in favour of complaints decreased to 29% in 2022 from 34% in 2021.

-

Declined claims the biggest reason for complaints

Insurers’ declining claims because the policy terms or conditions were not recognised or met remained the biggest reason for complaints last year, accounting for 50% of the total number of complaints received and 46.76% (2022: 44.99%) of finalised complaints.

Among finalised complaints, poor communication or service remained the second-biggest reason for complaints, followed by policy lapses.

Summary of Full Cases finalised

-

Fewer complaints about funeral benefits

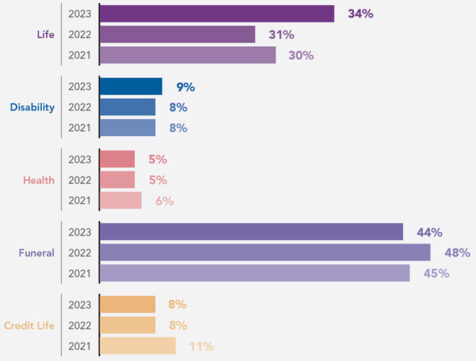

Funeral benefits remained the highest percentage of benefits complained about, although these complaints declined from 48% in 2022 to 44%.

The percentages of complaints about credit life and health benefits have remained consistent for the past two years, while the percentage of complaints about life policies has increased the most.

-

More money recovered for complainants

Despite the decline in complaints, there was a 28% increase in the amount recovered for complainants in the form of lump sums, from R200 836 922 to R283 084 553. The OLTI said this figure does not reflect the value of all benefits awarded in favour of complainants, such as recurring income or instalment benefits, annuities, and the reinstatement of policies.

-

Decrease in poor-service compensation

The amount of compensation awarded to complainants because of poor service by an insurer was R727 838 in 169 complaints in 2023 compared to R857 544 in 203 complaints in 2022.

-

The OLTI finalised 10% fewer cases

Finalised cases include Full Cases and Reviews. These resolved cases came to 3 137 in 2023, a decrease of 10% compared to 3 510 cases in 2022. Of the cases finalised, 2 768 were finalised without requiring a final determination, while a final ruling was issued in 369 cases. In total, including Transfers closed, 6 342 complaints were finalised in 2023 (2022: 7 034).

Although the number of finalised cases decreased, the number of cases categorised as “complicated” and “complicated plus” increased from 452 to 493 and from 52 to 58, respectively.

The OLTI classifies cases as “complicated” or “complicated plus” if they involve complex legal, medical, or financial issues, or if complainants persist with trying to obtain an outcome in their favour.

-

Three insurers had to be prodded to respond

The OLTI publishes the names of insurers that were sent more than five second reminders in the year to respond to the office. As was the case in 2022 and 2021, 3Sixty Life and Emerald Life were named in the 2023 report.

Emerald Life was sent 13 second reminders (2022: 12), 3Sixty Life was sent nine (33), and Liberty Life was sent seven.

-

Further decrease in Incompetent Cases

The office charges double or triple the Standard Case fee for what it calls Incompetent Cases. These are cases in which the insurer’s response was late or inadequate. Encouragingly, there was a further decline in the number of Incompetent Cases last year, to 58, from 129 in 2022 and 185 in 2021.

The OLTI again increased its Standard Case fee last year, by 8.8% to R5 135. The Standard Case fee was increased by 7% in 2022 to R4 720.