National Treasury has published a discussion document setting out a different excise tax framework for alcohol, with the main aim to reduce consumption and address alcohol abuse.

It proposes a minimum unit price mechanism – as part of a package of interventions – that will set the price floor below which no unit of alcohol should be sold.

However, industry players are concerned that higher taxes on alcohol will lead to an increase in the illicit market for alcohol products. The illicit alcohol market is estimated at 22% of the total market in South Africa.

The South African Liquor Brand Owners Association (SALBA) says it cannot comment in detail on the discussion document because it must still engage with its members to confirm their position on the paper.

“What I can confirm is that we are of the view that excise tax for spirits is very high, and this has the unintended consequence of fuelling illicit trade, which Treasury acknowledges in the position paper as a very serious problem in South Africa,” says SALBA’s chief executive, Kurt Moore.

According to a 2021 Euromonitor-commissioned study, the value of the illicit market was R20.5 billion, and the fiscus was losing more than R11bn due to illicit traders not contributing to the tax net at the time of the study.

Harmful use

The World Health Organization (WHO) reports that world-wide the harmful use of alcohol results in more than 3.3 million deaths (5.3% of all deaths) annually.

About 59% of South African alcohol consumers over 15 years of age have engaged in “heavy episodic drinking”. Treasury quotes the WHO recommending excise tax increases to reduce the affordability of alcoholic beverages, thereby reducing consumption.

Christo Conradie, stakeholder engagement, market access and policy manager at South Africa Wine, says it will be irresponsible to tailor WHO recommendations and guidelines to the domestic alcohol market without proper consultation.

Treasury has given industry players until 13 December to submit detailed written comments and proposals to develop an appropriate excise policy framework to reduce the harmful use of alcohol.

Both South Africa Wine and SALBA want more time to consult and gather scientific-based evidence to back their inputs to Treasury. Moore says 30 days are simply not enough time to enable the association to consult properly with its members.

Conradie believes mid-February next year and even the end of February would be a more reasonable timeframe. “We note Treasury’s intention to make some announcement in the 2025 Budget, but that would simply be premature and unreasonable.”

The current framework

South Africa applies an excise tax framework that provides a guideline for the tax incidence as a percentage of the weighted average retail selling price of alcoholic beverages.

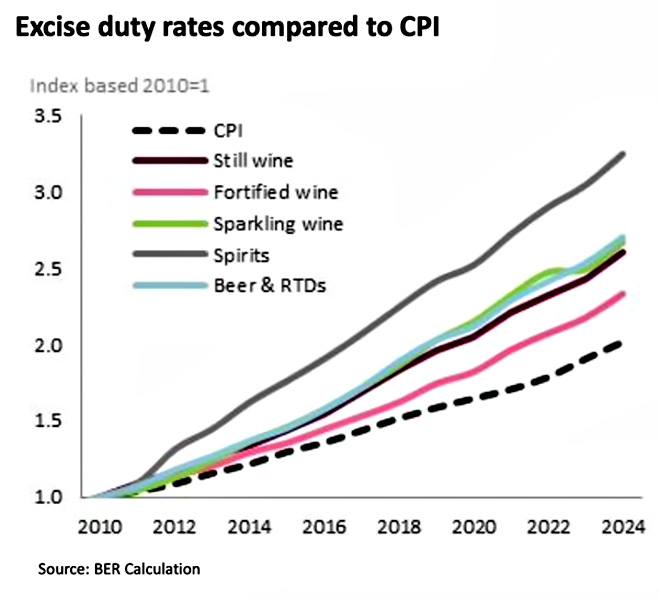

The current guideline for the tax incidence (the rate of the excise duty as part of the price) for wine, beer, and spirits is 11%, 23%, and 36%, respectively. The annual excise duty rate adjustments have been higher than inflation, resulting in the excise incidence being above the policy guidelines for each alcohol category.

Although this raised concerns from the alcohol industry and other stakeholders, there have also been calls for the government to do more to reduce excessive consumption of alcohol.

The current market

According to South African Wine Industry Information & Systems, beer, based on alcohol content, represented 55.5% of the market, ready-to-drink 9.7%, wine 15.8%, and spirits 18.9%

The beer industry’s contribution to the gross domestic product amounted to R70bn, and it supports 249 000 jobs in the country. Tax payments generated by the beer sector totalled R43bn – of which R26bn is estimated to come from value-added tax and excise duties on beer.

Charlene Louw, the chief executive of the Beer Association of South Africa (BASA), says the excise policy framework has been a major source of frustration and controversy for the beer industry.

She says the BASA will collaborate with the government to ensure that the excise policy framework fosters “growth, innovation, and sustainability” in the industry.

The wine industry contributes R56bn to the fiscus, and it employs more than 270 000 people or 1.8% of national employment. Conradie does not want to speculate on the potential impact on the industry. “We want the opportunity to test different scenarios to offer constructive and substantive comment.”

The future sustainability of the industry, the retention of jobs, wine tourism, the establishment of new vineyards, and the contribution to tax revenue can be adversely affected if decisions are made in haste and based on emotions, he adds.

South Africa Wine also believes that the proposals are not necessarily aligned with international best practices in other wine-producing countries such as France, Spain, and Italy as well as the United States and Argentina.

A 2022 study by the Newcastle University in Scotland showed that a minimum unit price (Treasury’s preferred option) was not associated with reduced consumption in younger men living in more deprived areas, or the heaviest-drinking men. In fact, consumption increased among the 5% of heaviest drinkers following its introduction in 2018.

Amanda Visser is a freelance journalist who specialises in tax and has written about trade law, competition law, and regulatory issues.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies. The information in this article does not constitute financial planning, legal, or tax advice that is appropriate to every individual’s needs and circumstances.