The Office of the FAIS Ombud says it has made significant strides in streamlining its complaint-handling processes, which have not only sped up resolution times but also boosted settlements in favour of consumers.

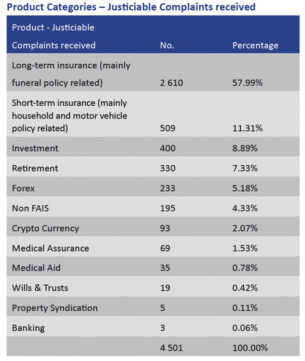

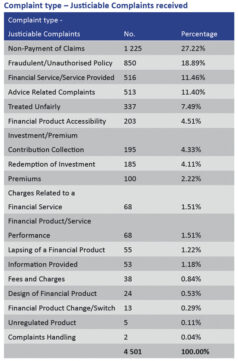

The Office received 10 574 new complaints in 2023/24, a 3.6% decrease from the 10 970 complaints received during the 2022/23 financial year. Of these, 4 501, or 43%, fell within the Office’s mandate – they are classified as justiciable complaints.

The 4 501 complaints that were referred for investigation was 30.5% lower than the 6 483 complaints in the previous year, the Office’s annual report released this week shows.

“More efficient and accurate processes made the initial identification of non-FAIS-related complaints easier and quicker. This resulted in fewer cases of non-FAIS complaints being erroneously identified and referred as justiciable complaints,” the annual report stated.

Similarly, the Office said the early identification of non-FAIS complaints resulted in fewer cases having to be dismissed or referred at the formal investigation phase. This, it said, was the reason for the 23.7% reduction in the number of justiciable complaints resolved during 2023/24 to 5 046 (including cases carried over from the previous year and premature complaints) from 6 614.

The Office issued two determinations in 2023/24, both of which Moonstone has reported on.

Read: Insurance brokers ordered to pay R300 000 after failing to disclose crucial policy requirement

Read: Policyholder waiting for funeral policy payout after three years

“The Office introduced numerous workflow and case management processes that have significantly improved the historical challenge of identifying and prioritising cases. The Office subsequently identified hundreds of active cases on our system which were up to 10 years old and had never been successfully resolved. All these matters were subsequently resolved and closed. The Office sincerely regrets the delay in assessing these matters and apologises to each of the consumers affected,” the Ombud, Advocate John Simpson (pictured), said.

The percentage of justiciable complaints settled in favour of the consumer or where an award was made was 35%, compared to 29% in the previous year.

The introduction of the premature complaints process (see below) and the closure of old complaints contributed to the increase, the Office said.

The total amount settled or awarded to consumers was R39 525 923, an increase from R39 133 121 in 2022/23.

The justiciable cases were closed within an average of 63 working days.

Premature complaints process

Simpson said the implementation of the premature complaints process contributed to improved complaint-handling.

Previously, the Office processed all justiciable complaints by referring them directly to the case management department’s adjudicators to be assessed and investigated. Due to high case-loads, the complaint could only be assessed over a longer period.

The Ombud introduced the premature complaints process under Rule 4(iv), which provides that the respondent must have failed to address the complaint satisfactorily within six weeks of its receipt for the complaint to be submitted to the Office.

“Before formally accepting a complaint, the FSP is now granted an opportunity to resolve the dispute directly with the complainant. This process has resulted in a significant increase in matters settled directly by the FSP and obviated the need for further investigation by the Office. Valid and clear claims are now settled quickly, which benefits consumers,” Simpson said.

Where a justiciable complaint is received, and there is no indication that it was submitted to the respondent before receipt by the Office, it is designated as a premature complaint and sent to the respondent, who is provided with six weeks to resolve the complaint or respond.

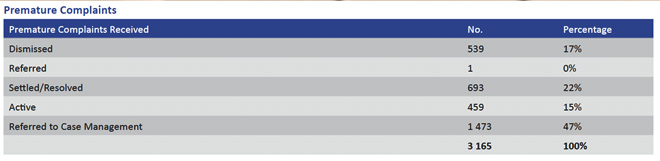

During 2023/24, the Office processing 3 165 premature complaints. A total of 1 473 premature complaints, where the matter remained unresolved after six weeks, were moved to the formal investigation phase.

About 1 233 premature complaints were closed (dismissed, referred, or settled) without requiring a formal investigation. Of those, 693, or 56.20%, were resolved directly by the respondent in favour of the complainant with a settlement value of R11 110 701.23.

The Ombud’s Office also introduced a vulnerable consumer policy to assist vulnerable consumers with their complaints quickly and efficiently, following a recommendation by the Ombud Council.

The policy means that a complainant who is blind or struggles with literacy, for example, will be assisted verbally and telephonically and not be required to complete forms. The Office prioritises complaints by elderly consumers.

Simpson said now that the Office has the volume of complaints under control, it will focus on improving the quality of its decisions.

Another ongoing focus area is preparing the Office for its eventual amalgamation with the National Financial Ombud (NFO) Scheme. The Office is working with the NFO and the Ombud Council to align its processes and timelines with those of the NFO, so that integration would be seamless, Simpson said.

Complaints by category

Complaints about funeral policies remained the largest category of complaints received.

The cryptocurrency complaints related mainly to allegations of fraud. Consumers made payments based on cryptocurrency investment advertisements on social media and received nothing in return. The Office was unable to assist unless a registered Financial Services Provider is involved in the transaction.

Reconsideration applications

Any party to a complaint who is aggrieved by the final decision may apply to the Financial Services Tribunal for a reconsideration of the decision.

During 2023/24, 76 applications for reconsideration were made to the Tribunal, compared to 104 in the previous year. The Office said the reduction in applications can be ascribed to its introducing new quality control measures and processes to ensure its decisions are well reasoned and the parties are granted an additional opportunity to make final submissions before the complaint is finally closed.

Of the 76 applications filed with the Tribunal as of 31 March 2024, 71 (94.67%) applications for leave were dismissed, and four complaints were referred back to the Office for further investigation.