A cyber event is the top global business risk for 2024, but here in South Africa, critical infrastructure blackouts or failure ranks as the number-one concern among corporates, according to the latest Allianz Risk Barometer.

Released last month, the 13th Allianz Risk Barometer incorporates the views of 3 069 respondents from 92 countries and territories. The annual corporate risk survey was conducted among Allianz customers (businesses around the globe), brokers, and industry trade organisations. It also surveyed risk consultants, underwriters, senior managers, and claims experts, as well as other risk management professionals in the corporate insurance segment of Allianz Commercial and other Allianz entities.

According to the report’s authors, this year’s survey highlights the key challenges facing businesses, including digitalisation, climate change, and geopolitical uncertainties. With actual impacts, such as extreme weather, ransomware attacks, and regional conflicts, already testing supply chain and business model resilience, the report says “a shift up in gear for many companies when it comes to risk management” is likely to be necessary.

What the numbers say

Cybersecurity and business interruption remain top concerns globally, while traditional threats such as natural catastrophes, and fire and explosion are regaining importance. Some recent issues, such as the energy crisis and pandemic-related concerns, are less prominent as certain Covid-19 challenges subside, “though uncertainties persist”, the report says.

Globally, data breaches, attacks on critical infrastructure or physical assets, and increased ransomware attacks drove cyber concerns (36%).

Business interruption was named the second top risk (31%), while natural catastrophes came in third (26%).

Changes in legislation and regulation ranked fourth at 19%, macroeconomic developments came in fifth at 19%, and fire and explosion incidents secured the sixth position, also at 19%. Climate change followed closely at 18%, with political risks and violence at 14%, market developments at 13%, and a shortage of skilled workforce at 12%, completing the top 10 risks in that order.

The survey looked at 24 industry sectors. The top five risks in finance include:

- Cyber incidents (43%) – for example, cybercrime, IT network and service disruptions, malware/ransomware, data breaches, fines, and penalties.

- Macroeconomic developments (26%) – for example, inflation, deflation, monetary policies, and austerity programmes.

- Changes in legislation and regulation (26%) – for example, tariffs, economic sanctions, protectionism, and euro-zone disintegration.

- Business interruption (22%), including supply chain disruption.

- Natural catastrophes (22%) – for example, storm, flood, earthquake, wildfire, and extreme weather events.

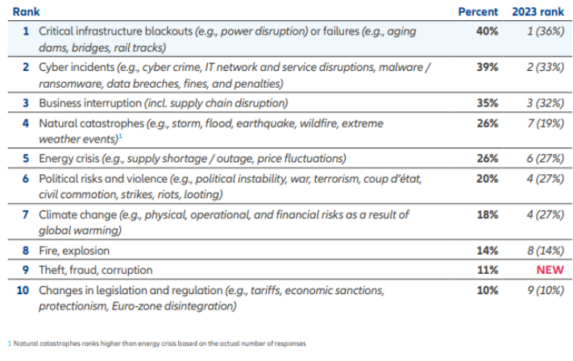

In South Africa, the risk landscape looked slightly different, with critical infrastructure failure at the top followed by cyber incidents; business interruption; natural catastrophes; energy crisis; political risks and violence; climate change; fire and explosion; theft, fraud and corruption; and changes in legislation and regulation, in that order.

Examples of critical infrastructure blackouts or failures are power disruption, and aging dams, bridges, and railway lines.

Cyber fears

Cyber incidents are the top global business risk – for the first time by a clear margin (five percentage points ahead).

The survey finds that businesses worry the most about cyber-related issues causing interruptions. Cyber security resilience is their biggest concern in areas such as environmental, social, and governance (ESG) risks. This worry is consistent across various industries such as consumer goods, financial services, government, public services, healthcare, leisure and tourism, media, professional services, technology, and telecommunications, the survey finds.

Data breach is the cyber exposure of most concern, followed by cyber-attacks on critical infrastructure and physical assets and an increase in ransomware attacks.

The report warns that hackers are beginning to use artificial intelligence-powered language models to increase the speed and scope of ransomware attacks, as well as create new malware and produce highly convincing phishing emails and deep fakes. Such attacks, the report says, are likely to proliferate during 2024.

Michael Bruch, global head of Risk Advisory Services at Allianz Commercial, says it’s no surprise that cyber is the top concern for businesses globally.

“Businesses and the wider economy are now reliant on digital services and infrastructure for both critical and everyday activities. Almost everything is now linked to technology. But once you are connected, it opens the door to hackers to steal data or threaten disruption for extortion,” says Bruch.

Interconnectivity drives business interruption concerns

Despite an easing of post-pandemic supply chain disruption in 2023, and risk management actions taken by companies, business interruption (31%) retains its position as the second biggest threat in the 2024 survey.

The survey results show that the most common actions businesses are taking to de-risk their supply chains are:

- developing alternative suppliers;

- improving business continuity management; and

- identifying and remediating supply chain bottlenecks.

Business interruption is closely connected to many of the top risks this year, such as cyber threats, natural disasters, and fires, the survey finds.

Ranked sixth overall, fires and explosions (19%) have become a major concern for companies and global supply chains. This, the report says, is particularly true in areas where vital components are concentrated geographically and with only a few suppliers.

What makes fire disruptions so severe is that it often takes longer to recover from than other risks. According to the report, the impact on suppliers can be significant, particularly in industries such as pharmaceuticals and chemicals, where facilities dealing with highly flammable materials may take years to rebuild after damage.

It also finds that, with the rise of electrification and the increased use of lithium-ion batteries, fire risk has heightened. Poor handling and transportation of these batteries have led to several major fire incidents at sea and on land in recent years.

An analysis by Allianz Commercial of more than 1 000 business interruption insurance claims in the past five years, totalling more than $1.3 billion, highlights fire as the most common cause of these claims and the second-highest in terms of loss value.

The growing climate insurance protection gap

One of the biggest movers in this year’s survey is natural catastrophes (26%). In a sign that companies are feeling the impact of extreme weather and climate events, it ranks third, up three positions on last year.

The report states that last year was the hottest year since records began, according to the World Meteorological Organisation, while insured losses in 2023 exceeded $100bn for the fourth consecutive year.

Losses from severe thunderstorms reached a new all-time high of $60bn. The shattering of climate records in 2023 included sea surface temperatures, sea level rise, and low Antarctic Sea ice.

Climate change (18%) may be a non-mover year-on-year in the Allianz Risk Barometer at number seven, but the report says, this risk’s importance is also reflected in natural catastrophes’ rise in the rankings.

Physical damage and business interruption are the two direct impacts of climate change businesses fear most.

When it comes to mitigation actions, the major company implementations are transitioning to low-carbon business models, and improving planning and response to climate events, including adopting measures to improve the ability of sites to cope with extreme weather.

Businesses are also seeking protection and financing mechanisms to address the growing climate insurance protection gap, while boosting supply chain resilience is expected to be a key area of focus in 2024, the survey results show.

Economic and energy crisis concerns ease

The energy crisis (12%) is the biggest faller from the fourth to eleventh spot. Although the immediate threat appears to have receded, the risk has far from gone away, the report reads.

Daniel Muller, emerging risks and trends manager at Allianz Commercial, says the energy crisis is now seen as less of a looming threat with steps taken over the past 12 months to reduce reliance on Russian gas and reduce energy consumption.

“However, longer term, energy security is strongly linked to geopolitical risks, climate change and critical infrastructure failure. The transition from fossil fuels to green energy will be difficult for carbon-intensive industries and a major challenge for the mobility sector and associated infrastructure,” says Muller.