Social media analytics company DataEQ has released its latest report measuring consumer sentiment towards 15 of South Africa’s major insurers.

The report aims to present the sentiments of consumers in relation to their experiences with claims-handling and insurance staff.

This year’s Insurance Sentiment Index tracked 901 000 public mentions across X, Hellopeter, and other online sources from 1 April 2023 to 31 March 2024, to determine South Africa’s best and worst insurers according to their customers.

The insurers included in the report are 1Life Insurance, 1st for Women, Auto & General, Budget, Dialdirect, Discovery, Hollard, King Price, Liberty, MiWay, Momentum, Old Mutual, OUTsurance, Sanlam, and Santam.

DataEQ analyses public sentiment towards the banking, insurance, retail, and telecommunications sectors.

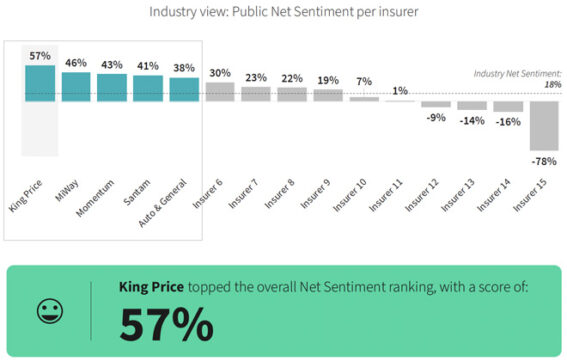

The insurance sector experienced its fourth consecutive year of improved net sentiment, rising from 16.1% in 2023 to 18% this year. However, unlike last year, banking, with a score of 24%, overtook insurance as the sector with highest positive net sentiment.

Positive reviews on Hellopeter, coupled with positive engagement from campaigns and competitions, were largely responsible for the improvement in sentiment towards the insurance sector, DataEQ said.

Among the insurance companies included in the report, King Price achieved the highest overall net sentiment score of 57%.

“This success was largely driven by positive reviews on Hellopeter, where customers commended the insurer’s staff for their efficiency and general helpfulness during sign-ups and policy adjustments. Customers also engaged favourably with the brand regarding pricing and affordability. This was evident when customers expressed positive sentiment towards a decrease in monthly car premiums relative to the depreciating values of their insured vehicle,” the report said.

Nine of the 15 insurers performed above the aggregate net sentiment of 18%.

MiWay, Momentum, Santam, and Auto & General emerged as the other top insurance brands. The report publishes only the names of top five brands and their scores.

MiWay, which recorded the highest net sentiment among individual providers in 2023 and 2022, fell into second place.

The top four topics of conversation around net sentiment were customer service, product offerings, the claims process, and pricing.

Overall customer service sentiment was net positive at 40%. However, when removing Hellopeter data from customer service conversations, the overall net sentiment plummeted to minus 50%.

The biggest source of dissatisfaction was the claims process, where the overall score was negative 45%.

“Negative claims experiences often led to frustration and distrust of the insurer. In some instances, customers threatened legal action and taking the insurer to the ombudsman,” the report said.

What frustrates customers the most

Delving deeper into customer service issues, DataEQ said prolonged turnaround times generated the most complaints (64%), with customers often citing problems around the claims process and policy updates.

“This generally occurred alongside mentions of staff, with customers frequently questioning the competency of staff members, and mentioning a lack of knowledge and professionalism to handle their queries and claims effectively. The lack of response from insurers added to customer frustrations.”

DataEQ said consumers were frustrated by poor communication around the status of their vehicle and other short-term insurance claims, with customers experiencing the most delays in these areas.

Insurers’ call centres were the most cited channel in conversations and recorded the lowest Net Sentiment score.

Websites recorded the highest net sentiment, with customers praising the ease of submitting claims, managing policies, and activating new policies online.

Customers often complained about the challenges in reaching a call centre agent, citing issues such as non-operational phone numbers, extended waiting times because of high call volumes, dropped calls, and poor line quality. When customers finally managed to speak with an agent, negative interactions often marred their experiences.

“Unsolicited sales calls, which persisted despite requests to stop, frustrated customers and led to concerns about unlawful tactics,” the report said.

Conversely, customers requesting call-backs via insurers’ websites reported never receiving a call, signalling missed sales opportunities.

Products and pricing

Most online conversations were about short-term insurance products, with only 17% about life products.

King Price, Santam, and Discovery were the most-mentioned short-term insurers, while Old Mutual, Discovery, and Liberty dominated in the long-term space.

“Innovative product offerings such as bundled cover, pothole cover, and extended warranties resonated with customers. Bundled insurance products, in particular, were praised for their convenience, cost savings, and the fact that they provided comprehensive coverage under a single policy. Additionally, perks such as courtesy cars or driver services, combined with the convenience of digital platforms, helped drive positivity,” DataEQ said.

Despite this, the overall conversation was a net negative -7%, with dissatisfaction around service performance, particularly in the areas of claims and policy management.

Conversations about long-term insurance products were characterised by overwhelmingly negative sentiment of -70%.

Complaints often mirrored those about short-term insurance, where customers expressed frustration with delays in claims processing and payouts. A lack of transparency around policy details and premiums, as well as a perceived neglect of their needs by insurers, further added to customers’ frustration, DataEQ said.