Most retirement fund members who are withdrawing from their savings components have a fund credit of R100 000 to R250 000, according to the FSCA.

The Authority last week briefed the media on its assessment of the implementation of the two-pot retirement system. The information it released is based on data from the retirement funds supervised by the FSCA. According to the Authority’s 2022/23 Integrated Report, it supervises 4 868 funds, but only 887 of these funds are active – they are operational and receive contributions and pay benefits.

The 887 active funds cover about 155 000 participating employers and 9.6 million members. Members may be double-counted because an individual can belong to more than one fund.

The FSCA does not supervise funds that are not subject to the Pension Funds Act. These funds include the Government Employees Pension Fund, the biggest fund in South Africa, with 1.267 million contributing members.

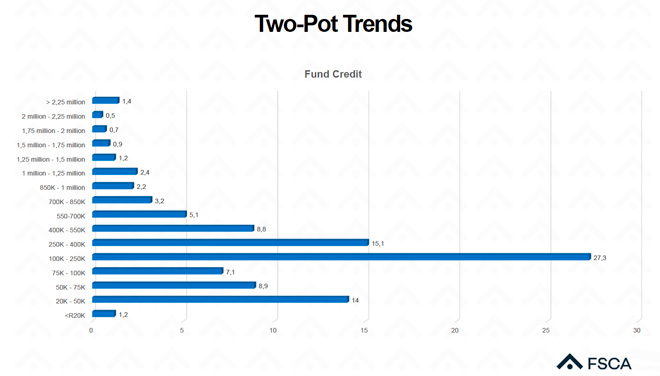

The Authority provided a graph (below) showing a breakdown by fund credit of members who have made withdrawals from their savings components since 1 September. A fund credit is the total value of a member’s accumulated benefit within the fund. The fund credits depicted comprise what members had accumulated in their vested components when the two-pot system was introduced.

According to the graph, 42% of members who have made withdrawals have a fund credit of between R100 000 and R400 000, with the highest number of withdrawals among members with a credit of R100 000 to R250 000. The third-highest number of withdrawals are by members with a credit of only R20 000 to R50 000.

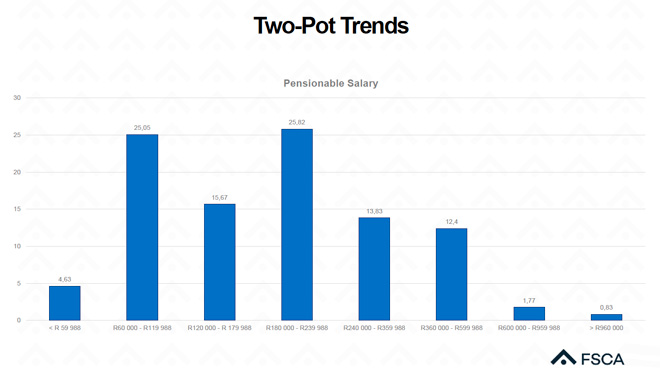

The graph below shows the percentage of savings benefit withdraws by pensionable salary (the portion of an employee’s salary that is used as the basis for calculating retirement fund contributions).

Most two-pot withdrawals are by members with a pensionable salary of between R180 000 and R239 988 and between R60 000 and R119 988 a year. Fewer withdrawals are made by higher-income earners, those with a pensionable salary above R600 000.

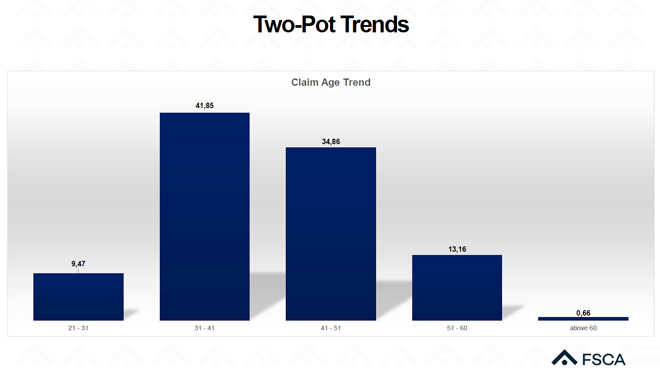

As the graph below shows, most withdrawals are made by members aged 31 and 41, followed by members between the ages of 41 and 51.

Monitoring the situation

FSCA Commissioner Unathi Kamlana said the Authority is generally pleased with the implementation of the two-pot system, which is one of the most important structural changes to the country’s retirement system.

Kamlana said although the system is providing members with much-needed financial relief, it is important that members obtain advice from qualified advisers, so they have a clear understanding of the impact of withdrawals on their retirement outcomes.

Advice conversations should emphasise the dual purpose of the system: to provide access to savings for financial emergencies and to ensure that the bulk of the member’s savings are preserved for retirement.

The FSCA is monitoring the implementation of the system by obtaining weekly reports from administrators on disbursements and analysing consumer sentiment on social media.

Funds and administrators have reported challenges with processing the high number of withdrawal claims, delays in seeding members’ savings components, and delays in making payments and with the banking systems. The need to verify members’ details has also resulted in delays, as have members providing incorrect tax numbers.

Members have expressed their frustration with poor communication from funds, administrators’ website being offline, and delays in receiving their payments, and high transaction fees.

However, the FSCA has received only three formal complaints related to the two-pot system, two of which have been resolved. The Pension Funds Adjudicator reported receiving 23 formal complaints and 1 450 enquires, which the Adjudicator referred to funds and administrators.

‘Fees should be transparent and fair’

Regarding the fees for processing two-pot withdrawals, Kamlana said the Authority is not a price regulator, but it is working to ensure that fees are transparent and accessible. To this end, the FSCA is analysing the information on fees it has gathered from funds and administrators.

In September, the FSCA issued an Information Request that required self-administered funds and fund administrators to report on how much they charge to process withdrawals from members’ savings components. The Authority also wanted to them to report on the once-off and ongoing costs associated with implementing the two-pot system. The deadline to submit the information was 30 September.

Read: FSCA wants to know how much two-pot withdrawals are costing members

Kamlana said the FSCA should be in a position, based on its analysis of the data, to issue a communication providing guidance on what it regards as a fair and transparent approach to transaction fees. Its guidance will also be based on input from other entities, such as National Treasury and the South African Revenue Service.

Corlia Buitendag, the FSCA’s head of retirement funds conduct supervision, said the average two-pot withdrawal fee is R357, and the Authority will liaise with administrators whose fees are higher than the average to find out why this is the case.

Deputy Commissioner Astrid Ludin said the fees charged are the result of what funds negotiate with their administrators. Smaller funds have less bargaining power than larger funds.

Echoing Kamlana’s comment that the Authority is not a price-setter, she said the FSCA will work with funds to understand their fee structures better. It is important that fees are fully disclosed, and consumers can compare them.

Most rule amendments registered

To pay benefits under the two-pot system, retirement funds had to amend their rules to comply with the regulatory framework introduced by the Revenue Laws Amendment Bill of 2023. The amended rules had to be submitted to the FSCA for approval and registration. To date, the FSCA has received 853 applications for rule amendments and registered 837 amendments, or 98%.

Of the 16 rule amendments yet to be registered, the FSCA was awaiting responses from funds about 11 applications and five applications were being analysed.

The Authority pointed out that not all 887 active funds had to submit rule amendments. “Legacy” retirement annuity funds and funds without contributing members (beneficiary funds, unclaimed benefit funds, funds with only pensioner members) are effectively excluded from the two-pot system.

It’s been two months I don’t receive anything

Today is 2 month s and nothing happened with my my application from my two pot

Today is my 3rd month and nothing happened to my pension claim. I retired in September 2024 my last day was 30th September 2024.Plz give progress on the status of my pension claim.

Thanks:

Zolile Cafu

0765070854

I need two pot I need R20000

I claimed my two pot withdrawal on 27 September 2024 bt shockingly no information of the progress of my claim. Desperately need my money. Help

I didn’t receive anything l resigned in August 16

I did not receive anything and is 3 months already.