Discovery Health Medical Scheme (DHMS) is the first major medical scheme to announce its 2025 contribution increases, with a weighted average hike of 9.3% across its benefit plans.

Starting 1 January, pending approval by the Council for Medical Schemes (CMS), DHMS members can expect contribution increases ranging from 7.4% to 10.9%, depending on their plan. Half of the scheme’s members will see a rise of 8.4% or less in the new year, the medical scheme states. In other words, the other 50% will see an increase of above 8.4%.

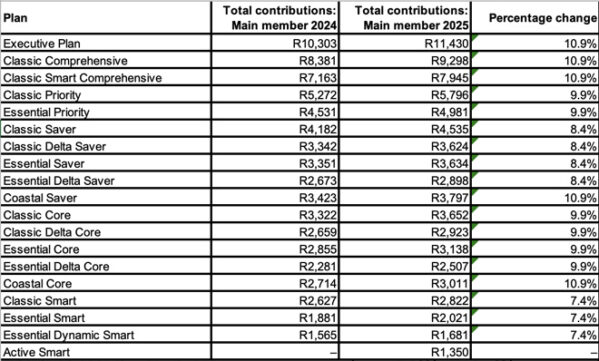

DHMS’s gross contribution increases for 2025 across its benefit plans are:

- Executive: 10.9%

- Comprehensive: 10.9%

- Priority: 9.9%

- Saver: 8.4%

- Smart: 7.4%

- Core: 9.9%

- Coastal (Core/Saver): 10.9%

This equates to:

The increases for the Keycare plans are:

- KeyCare Smart: 7.4%

- KeyCare Core: 7.4%

- KeyCare Plus: 9.9%

Overall, this compares less than favourably with DHMS’s 2024 weighted average hike of 7.5% and contribution increases that ranged from 3% to 12.9% across its plan range. In 2024, 39% of members experienced an increase of less than 4% in their gross contributions. A further 34% of members experienced an increase between 5% and 10%.

When comparing the increases for 2024 to those of 2025, it is clear that next year’s increases are more evenly distributed across all DHMS’s 1.37 million principal members, regardless of the plan to which they belong.

Factors driving medical contribution increases

In Circular 35 of 2024, issued by the CMS on 1 August, the regulator encouraged schemes to limit their tariff increases for 2025 to 4.4%, aligned with the South African Reserve Bank’s 2025 Consumer Price Index (CPI) forecast, plus “reasonable” utilisation estimates.

The circular outlines the factors the regulator will consider when evaluating schemes’ contribution increases and benefit changes for 2025. However, it did not provide a projected estimate for what would be considered “reasonable utilisation”.

Read: CMS releases guidelines on medical scheme increases for 2024

The CMS relies on CPI, along with salary inflation, to gauge the affordability of annual contribution rate increases. However, medical schemes contend that medical inflation, rather than CPI, is a more accurate measure for determining annual contribution increases.

Globally, healthcare inflation tends to outpace CPI. In South Africa, annual salary increases are typically tied to CPI, but – depending on who you ask – healthcare costs generally rise by CPI + 2% to CPI + 4% each year. According to DHMS, across the world, medical inflation is estimated to exceed CPI by 6.4% in 2024.

Experts attribute the higher rate of medical inflation compared to CPI to factors such as ageing populations and a rising number of individuals in poor health, which drive up the demand for healthcare services, in addition to the rising costs of those services.

Dr Ron Whelan, the chief executive of DHMS’s administrator, Discovery Health, said, in determining the scheme’s contribution increases for 2025, the priority was maintaining the benefits enjoyed by the scheme’s members, while ensuring contributions remain affordable in the short term and sustainable in the long term.

“To maintain the benefits available to DHMS members, contributions must increase to match medical inflation and expected claims for healthcare by members in 2025,” Whelan said.

DHMS stated that the medical inflation components for the scheme in 2025 reflect several key factors. First, there is the rise in the price of healthcare services, generally in line with CPI. The scheme noted that medical inflation is further driven by increasing demand, spurred by an ageing membership, the growing prevalence of chronic illnesses, and a higher proportion of high-cost claimants. Additionally, advances in medical procedures, the introduction of new medicines and technologies, and a heightened need for specialised care have contributed to the overall increase in healthcare service supply, pushing costs even higher.

Affordability challenge for consumers

Despite a notable dip during the Covid-19 pandemic, industry contribution increases have consistently surpassed CPI. In 2023, the average contribution increase of 6.8% was 0.7% higher than the 6.1% average CPI, marking a return to the pre-pandemic trend of contribution hikes outpacing inflation.

The CMS has previously expressed concern about this pattern, warning it has “significant ramifications for the industry’s long-term sustainability” and poses a serious affordability challenge for consumers.

The regulator cautioned that in the current economic climate, contribution increases above inflation are beyond the budget of most consumers.

High contribution rates also create barriers for new entrants to private healthcare, threatening the industry’s sustainability.

However, the Registrar of Medical Schemes, in the recent circular, acknowledged that some schemes may require increases above CPI. In such cases, trustees must submit a comprehensive actuarial business plan justifying the proposed hikes. The regulator noted that decisions on contribution increases would remain data-driven and consider each scheme’s financial and demographic risk profile. Increases above CPI, the regulator said, would be approved only if there is clear financial and actuarial justification.

Last year, the CMS advised medical schemes to limit their 2024 contribution increases to 5%, aligned with CPI, plus “reasonable” utilisation estimates, projected at 3.2% to 3.8%. This suggested an overall increase of just over 8%.

Despite this guidance, most open medical schemes set their 2024 contribution adjustments above the advised 8%. For instance, Bonitas announced a weighted average increase of 6.9%, DHMS set theirs at 7.5%, and Momentum at 9.6%. Bestmed and Medihelp reported average increases of 9.6% and 15.96%, respectively.

Given that DHMS’s average weighted increase has risen by 1.8% (from 7.5% to 9.3%) for next year and considering that DHMS’s increases are traditionally on the lower end of the scale compared to other schemes, this suggests that members of other medical schemes might anticipate similar or even higher percentage increases.

Medihelp’s 2025 product preview is scheduled for 1 October, while Bonitas’s product launch date is 2 October.

With Medihelp having submitted a CMS-approved three-year plan for gradual increases to restore its reserves to the statutory 25% level, members should most likely brace for a significant rise in contributions.

Read: Medihelp’s solvency ratio drops below threshold amid high claims and rising costs

Managing spiralling healthcare costs

Although the CMS is not blind to the challenges that face medical schemes, the regulator has noted that managing spiralling healthcare costs remains a key priority for medical schemes to ensure affordability and sustainability.

The CMS recommends prioritising selective contracting with cost-efficient healthcare providers and pharmaceutical suppliers and using formularies to curb costs without compromising quality health outcomes.

Whelan explained that Discovery Health strives to mitigate the effect of demand- and supply-side factors that increase medical inflation.

“Through our risk management and managed-care work, we expect to reduce the increase in claims in 2025, and therefore reduce the required contribution increase by nearly 1%.”

He added that engagement in the Vitality wellness programme makes participating medical scheme members healthier, reducing their health-related risks.

“The expected impact of Vitality in helping make members healthier in 2025 is projected to reduce claims by a further 1%,” he said.

Discovery Health aims to further reduce medical inflation for 2025/26 with its Personal Health Pathways initiative.

Starting January, 2.2 million adult DHMS members will access Personal Health Pathways through the Discovery Health App and WhatsApp, receiving a tailored health journey that adapts to their needs.

The initiative rewards members for completing personalised health and exercise actions.

What’s new

DHMS has expanded its Smart Series to include a new plan, Active Smart. According to the scheme, the option is “designed to meet the unique needs of young professionals at the most affordable price point for this market segment, for open schemes”. The contribution is R1 350 a month.

Also from January, people who join DHMS will receive a once-per-lifetime benefit, built into the Personal Health Fund, as a continuation of the WELLTH Fund in 2023 and 2024.

New-joining members who activate Personal Health Pathways will get up to R10 000 in additional funds in their Personal Health Fund, available immediately. This is a once-per-lifetime benefit in addition to the annual Personal Health Fund allocation received by all members.

DHMS’s 2025 contributions can be found here.

Discovery is extracting money through its “managed Care, AI and Admin” fees from members wallets, as much and for as long as it can – so the increases are not just about their no famous narrative of how their increases way above CPI of 4.5% are made up.

Worse, their copy-cat competitors are no better – they generally face bigger challenges of ageing and cost (having lower negotiation power). Momentum fights to cut the cake with “wink-wink” no PMB chronic state options, and Bestmed, Bonitas and the rest by excluding joint surgery on their saver plans.

These massive trust funds are controlled by stooge Trustees, deployed by ‘captive clients’, the CMS (read NHI proxy) and unions – elected by less than 3% of members.

Discovery members have through “investment in technology” funded Vitality international architecture, the other Discovery businesses (Life, Invest, Bank) and now get to pay ANOTHER time for the same “rings of garbage” as Personal Health Journeys in 2025.

Amyone who wants to see the folly of believing Discovery AI claims, should try their more than 2 year old trained “WhatsApp” chat bot. Do you really want such random twaddle driving your “health engagement”?