JSE-listed financial services group Discovery has informed the market that it delivered a strong performance for the year to the end of June, with a 17% increase in normalised operating profit to R11.604 billion. This growth, driven by “robust results” across its South African operations and its global Vitality model, enabled the group to raise its final dividend by 38% to 152 cents per share, up from 110c in 2023.

Headline earnings for the year to the end of June rose by 7% to R7.202bn, while normalised headline earnings increased by 15% to R7.329bn. Discovery attributed the discrepancy between these figures to a fair value gain from an interest rate swaption in the United Kingdom realised in the previous period, which did not impact this year’s profit.

Basic headline earnings per share (HEPS) grew by 7% to 1 089.4c, with normalised HEPS climbing 14% to 1 108.6c.

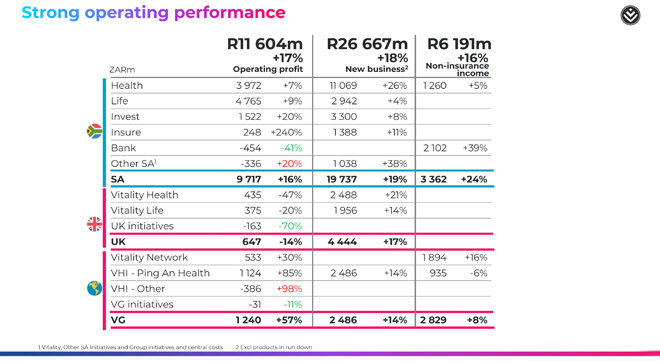

Discovery’s non-insurance business saw income rise by 16% to R6.191bn, while core new business annualised premium income (API) surged by 18% to R26.667bn, reflecting strong new business growth across the group.

Discovery’s South African operations (Discovery Bank, Discovery Health, Discovery Life, Discovery Invest, and Discovery Insure) grew normalised profit from operations by 16% to R9.717bn. Core new business API increased by 19%.

However, the UK’s Vitality division saw a 14% decline in earnings contribution to R647m, highlighting the challenges faced in that market.

“The full-year reporting period continued to be characterised by complexities in the macro-economic environment, including heightened consumer pressure due to cumulative interest rate increases, constrained economic growth, and political uncertainties on many fronts. Within this context, Discovery remained focused on delivering strong growth in earnings, value, cash generation, and capital resilience,” said group chief executive Adrian Gore.

Discovery Bank reduces operating loss

In South Africa, Discovery Bank improved its operating loss before new business acquisition costs by 89% to R52m, and the overall loss of R454m was 41% better than in the prior year.

The bank’s total client base grew by 36% to more than 950 000 by June 2024, and it achieved its ambition of one million clients after the financial year-end, well ahead of meeting this target in 2026.

Retail deposits grew by 29% to R18.5bn, advances by 27% to R6.6bn, and net interest income by 36% to R779m, as average interest-earning assets increased by 30% and the net interest margin increased by 7%.

Discovery Bank expanded its lending suite by launching a revolving credit facility in December 2023 and home loans in May 2024. The group said the initial take-up of these offerings has been “pleasing”.

Other SA businesses

The rest of the South African businesses delivered positive results, with Discovery Health increasing its operating profit by 7% to R3.972bn.

The growth of non-medical scheme products continued, with total non-scheme and other revenue now representing 15% of total revenue.

The take-on of the administration of the Sasolmed medical scheme contributed significantly to new business API, which rose by 26% to R11.069bn.

In addition to Discovery Health Medical Scheme (DHMS), Discovery Health administers 18 closed medical schemes.

The group said DHMS remained resilient despite a relatively flat open medical scheme market and a challenging macro-economic environment. DHMS maintained its market share of 57.9% in the open scheme market and its projected 2024 solvency remained at 30%, higher than the 25% regulatory requirement.

The group’s life insurance arm, Discovery Life, grew profits by 9% to R4.765bn with a better-than-expected overall claims experience and favourable trends in lapses and premium income.

New business API rose by 4% to R2.942bn, and premium income by 8% to R17.892bn.

Discovery Insure’s personal lines business delivered strong profit growth, with a “dramatic recovery” in the second half of the year, following a first half that was significantly impacted by severe weather events.

The operating profit from personal lines surged by 124% to R199m, and the business’s overall operating profit jumped by 240% to R248m.

Discovery said the dynamics for the business have improved significantly, following various initiatives in previous periods aimed at improving operating margins through reduced claims costs and operating expenses. “The exit from commercial lines will facilitate continued focus on further margin enhancement in the personal lines business,” it said.

Discovery Invest increased its operating profit by 20% to R1.522bn, with assets under management expanding by 11% to R105bn.

A higher growth in margins offshore and structured products drove higher fee income.

New business API improved by 8% to R3.3bn from higher sales of recurring-premium linked products and increased guaranteed endowments.

However, net client cash flows declined by 47% to R3.1bn following increased maturities and higher withdrawals from voluntary products and living annuities, given the increased demand for fixed annuities to capitalise on higher market interest rates.

Challenges in the UK market

In the United Kingdom, Vitality Health’s operating profit declined by 47% to R435m because of the increase in claims during the reporting period, given the lag of premium increases.

Gore said Vitality Health significantly increased its prices in response to the higher claims, in line with the market, with little impact on observed lapse rates. Post the reporting period, claim levels were in line with actuarial expectation. As such, margins are expected to recover strongly in the 2025 financial year.

He said Vitality Health is delivering strong new business growth in the context of increased demand for private medical insurance, given the backlogs experienced by the National Health Service. Membership increased by 7% to exceed 1.8 million lives, and new business API rose by 21% to R2.488bn.

Vitality Life’s normalised operating profit declined by 20% to R375m.

In light of continued lower lapses than expected for a block of whole-of-life business within the Prudential Assurance Company, Vitality Life strengthened the lapse basis, resulting in a negative impact on earnings of £12.5m for the period.

New business API grew by 14% to R1.956bn.

Vitality Global surges

The company’s Vitality Global business performed particularly well, posting a 57% increase in profit contribution to R1.24bn. This was largely driven by Ping An Health Insurance (PAHI), the Chinese health group in which Discovery has a 25% stake, which delivered an 85% surge in operating profit to R1.12 billion.

Core new business API for PAHI’s own licence increased by 14% to R2.486bn.

PAHI paid its maiden shareholder dividend during the period, with a payout ratio of 30% of the 2023 calendar year’s distributable profits. Discovery’s share, after withholding tax, was R255m.

Restructuring of international operations

Last month, Discovery announced a restructure in its international businesses, combining Vitality UK and Vitality Global into a single international business spanning Europe, Asia, and North and South America.

Discovery said it saw an opportunity to scale more effectively by operating its offshore operations as a single unit with a unified product strategy.

Gore said: “The scale of each of these underlying businesses, which have developed at different paces, given the prevailing considerations for each, underpin the creation of a powerful shared-value life and health insurance composite. Vitality Limited will leverage the opportunity for consistent IP and technology, centralise our product innovation and drive a unified product strategy to deliver value for, and grow, our global partner network.”

Gore provided an update on the group’s long-term strategy as it enters a new phase in its lifecycle.

“Over the past eight years, we have been through a cycle of significant investment, with a focus on globalising the group’s capabilities, footprint, and scale, as well as building new ventures such as Discovery Bank. This investment cycle was aimed at creating new avenues for long-term growth and we are confident that the business is positioned well to capitalise on this investment.”

He said Discovery has rigorously intensified its focus on scaling the emerging businesses and the initiatives that can meaningfully impact the group, while closing those with marginal benefits over the past two years.