The Council for Medical Schemes (CMS) is yet to approve the 2024 contribution increases announced by Discovery Health Medical Scheme (DHMS) last week.

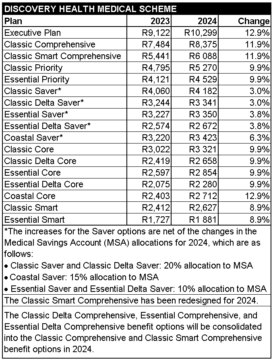

On 26 September, DHMS announced a weighted average contribution increase across its benefit plans of 7.5% for 2024. Depending on a member’s plan, the contribution increase is between 3% and 12.9%.

Read: Clash of the titans: medical scheme heavyweights announce 2024 contributions

In a circular distributed in August, the CMS advised schemes to limit their contribution increases for 2024 to 5% – in line with headline inflation as measured by the Consumer Price Index (CPI) – plus “reasonable” utilisation estimates.

The CMS projected these estimates at 3.2% to 3.8% based on its analysis of cost increase assumptions for 2023. In other words, a recommended increase of just over 8%, give or take a percentage point or two.

According to a breakdown provided by DHMS, the following benefit plans show increases higher than 8%:

- Executive: 12.9%

- Comprehensive (excluding Classic Smart Comprehensive): 11.9%

- Priority: 9.9%

- Core: 9.9%

- Coastal Core: 12.9%

- Smart: 8.9%

- KeyCare Plus: 10.9%

- KeyCare (excluding KeyCare Plus): 9.9%

Three plans come in under 8%:

- Classic Saver (Delta and non-Delta): 3%

- Essential Saver (Delta and non-Delta): 3.8%

- Coastal Saver: 6.3%

CMS approval pending

In the circular, the Council acknowledged that “industry-specific cost-push factors” could necessitate medical schemes to implement contribution increases that exceeded the CMS’s recommended increments linked to the CPI.

However, in such cases, boards of trustees must provide the Registrar of Medical Schemes with a comprehensive business plan justifying the proposed above-inflation contribution increases.

Read: CMS releases guidelines on medical scheme increases for 2024

Deon Kotze, chief product officer at Discovery Health, says DHMS submits a comprehensive actuarial valuation report to the CMS annually.

“For 2024, the valuation report has been submitted to the CMS, but to date it has not been approved by the CMS. This is not unprecedented, since most medical schemes announce their annual contribution increases after submitting their valuation report to the CMS, but prior to CMS approval,” Kotze says.

He says it should be noted that CMS has approved contribution increase above CPI for medical schemes for a number of years.

When Moonstone asked the Council whether a decision had been reached on DHMS’s valuation report, it replied: “The CMS will not be providing media comment at this time.”

Medical inflation vs CPI

While the CMS uses CPI as a guideline, Kotze says increases in line with medical inflation, not CPI, are in the interest of maintaining cover for members in the long term.

Medical inflation refers to the annual rate of increase in healthcare claims paid by medical schemes. As Kotze explains it, medical inflation is a function of tariff increases and utilisation increases. The first is linked to the increase in the unit price of healthcare (for example, the tariff for a GP consultation) and the second to the increase in the consumption of healthcare.

“For example, as members age or develop a chronic illness, they claim more than in the previous year.”

Kotze says all medical schemes must ensure that contributions increase in line with claims experience.

“Failure to do so would lead to operating losses, since contributions received are less than claims paid. Continuous operating losses would lead to the insolvency and failure of the scheme.”

Rising interest rates

Kotze says, during this period of rising interest rates, DHMS does not anticipate a significant reduction in growth or a significant increase in withdrawals from the scheme.

“What it does anticipate is a reduction in the proportion of healthy new members joining the scheme and an increase in the proportion of healthy members withdrawing from the scheme, which would lead to a greater increase in consumption of healthcare than otherwise expected.”

He adds that an analysis of DHMS data showed that utilisation increases are correlated with interest rate movements.

“For example, during periods that the cost of debt to consumers increase, the scheme experiences an additional increase in consumption of healthcare. This is due to different priorities for healthy and unhealthy members when considering the cost of their medical scheme membership during periods when the cost of their debt is increasing.”

Kotze says unhealthy members will prioritise their membership of medical schemes to retain the benefits they are using, while healthier individuals may reduce their benefits, or remain uncovered, given that they have no immediate need for the benefits.

Saver benefit plans

Concerns have been raised that members with Saver plans will experience severe cuts to the allocations to their medical savings accounts (MSAs) in 2024.

According to Discovery’s media statement last week, the increases for the Saver options (above) are net of the changes in the medical savings account (MSA) allocations for 2024.

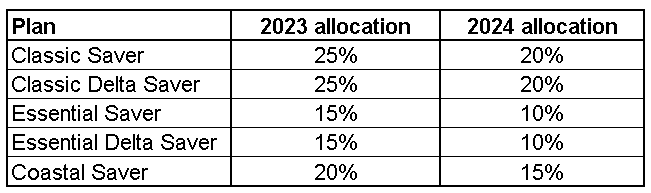

The allocations for 2023 and 2024 for the Saver series are as follows:

Kotze says the reduction (5% across the board) in the MSA on the Saver series reduces the effective gross contribution increases for 2024 for the Classic Saver, Essential Saver, and Coastal Saver members to 3%, 3.8%, and 6.5%, respectively.

The risk contributions for the Coastal Saver option increase by 12.9% in 2024, while the risk contributions for the Classic Saver and Essential Saver options increase by 9.9% in 2024.

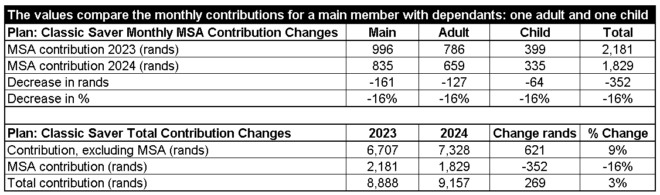

To determine the overall impact that a 5% (from 25% to 20%) reduction in the MSA allocation would have on the funds available to a member to cover medical expenses not included in the plan benefits and procedures, Moonstone compared last year’s member contributions and MSA contributions for the Classic Saver plan to this year’s.

The values show that a 5% reduction plan results in the member having 16% less available in the MSA.

When the 2024 monthly contribution (up by 9%) is added to the 2024 MSA contribution (down by 16%) and compared to the 2023 monthly contribution plus the 2023 MSA contribution, the overall increase between the total 2023 and total 2024 contribution is 3%.

The actual percentage decrease in the MSA portion of the various Saver series plans will vary greatly.

“The low increases relative to CPI maintains the affordability of the Saver series during a period where members are faced with a significant increase in the cost of household debt as a result of rising interest rates, while ensuring that the risk contributions of the Saver series remain aligned to medical inflation,” Kotze says.

New risk benefits

DHMS also introduced new risk benefits for all members of the scheme, including those on the Saver series. These risk benefits cover healthcare services that would typically have been funded from MSA, and include:

Funding for immediate virtual consultations with a doctor for urgent care, paid from risk benefits.

Funding for guided, on-line physical therapy, paid from risk benefits where part of an approved treatment plan.

Funding for virtual or in-person consultations with a doctor or psychologist following the completion of a mental health risk assessment, paid from risk benefits and the MSA where the member is at risk of depression.

Funding for on-line cognitive behavioural therapy, paid from risk benefits where prescribed by the GP or psychologist.

Typing error I think but I hope it will be true Clasic Smart R2412 to R1863 , maybe it should be R2 863? but I sure hope to pay less

Thank you for pointing out the error. It has been corrected. The correct figure is R2 627.

Good day, I’m looking to downscale my medical aid plan for 2024, from Classic Priority to Essential Priority, I need to know what my contributions will cost per month with Vitality as well.

Also the medical aid savings amount per year, and hospital % is there an above threshold on this plan?

I am 75 years old & finding monthly costs are above my means, this is the reason for downscaling, can a representative please speak to me regarding the best option for me.

I have been on Classic Priority for about 18 years & now it’s very costly for me as a pensioner.

Good day. Moonstone does not provide healthcare broker services.

How can i find out about my contributions for 2024 for Coastal saver plan for two adults.

Would like to know when I’m getting my benefits for year 2024 and Hw much Wll tht be

I am disgusted that the keycare plus medical aid assumed to put up my medical payments to R6708.00 A WHOLE R2000.00 EXTRA I WAS AT THE OFFICES TODAY TO TRY AND SORT IT OUT I SENT MY INCOME VERIFICATION TODAY AS I DID NOT RECEIVE AN EMAIL FOR PAYSLIPS. BUT I DID SEND IT LAST YEAR SO THEY HAVE ALL MY PARTICULARS. ITS ONLY MYSELF AND MY DAUGHTER ON THE MEDICAL AID. I AM REALLY GOING TO BE LOOKING FOR OTHER MEDICAL AID COVER IN THE NEW YEAR

My mom who is a pensioner experienced the same thing. No notification received via email or on her portal re the income verification they required, however she receives all her claim and pre-authorisation communication on the same email. I looked back as far as May 2023 to ensure the error was not on our part (both email and portal). They simply deducted the maximum premium.

Ofcourse we haven’t had any feedback regarding the communication they failed to send. Sad to see how they take advantage of people in these already trying times.

Discovery Medical is nonsense

Premium increases but the benefit are down grading