Of the billions of rands Discovery Life paid out in claims for individual life policies last year, 51% was for ancillary benefits, including severe illness, disability, and income continuation.

According to Discovery Life’s 2023 claims data published recently, the company paid claims to the value of R8.4 billion across group risk and individual life policies. Under the life umbrella, the biggest portion went to ancillary benefits: the severe illness benefit (R1.5bn), the capital disability benefit (R1bn), and the income continuation benefit (R613 million).

Just under R3bn was paid in death claims and R298m was paid out for various other benefits.

Discovery Life deputy chief executive Gareth Friedlander said the fact that the total amounts the company paid through all living benefits were higher than what it paid towards mortality claims highlights the relevance of comprehensive and full-body cover.

“We know that life insurance is the umbrella term for life cover paying out when you die, but also for a whole host of living benefits: severe illness or dread disease as it’s known, income protection, disability cover,” Friedlander said.

“Our 2023 claims experience shows that one in five life cover claimants had already claimed for a life-changing illness or disability before they passed away.”

Severe illness

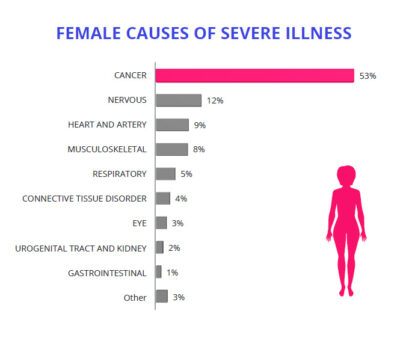

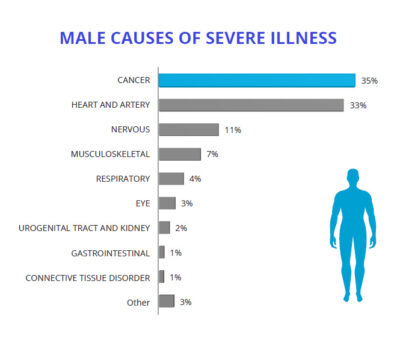

Cancer remains the primary cause of severe illness for both men (35%) and women (53%), followed by heart and artery issues for men (33%) and nervous system disorders for women (12%).

Early detection and treatment, however, significantly increase survival rates. Since 1970, median cancer survival times have soared nearly sixfold.

Dr Maritha van der Walt, the chief medical officer at Discovery Life, explained that even if cancer is caught early at the in situ stage (before spreading), it requires ongoing monitoring and potentially invasive tests. She said having coverage for early-stage cancer is crucial.

She also cautioned that cancer can often come back after remission, with certain types, such as ovarian and bladder cancer, particularly prone to recur.

“So we cover the whole spectrum from the very early cancer to high payouts for the first event, but we don’t stop there. For related and unrelated cancers, there will be further payments and also for relapses of the same cancer, which is, of course, the biggest risk if you’re looking at the long-term prognosis of cancer,” she said.

Van der Walt emphasised the importance of South Africans understanding the level of coverage needed to protect themselves adequately against cancer.

“Even with very comprehensive medical aid, there could be co-payments. And then we mustn’t forget about the hidden costs: time off work. Or when it is your spouse or kids, when it gets a bit later, that there will be time off work to support a family member that is sick. There might be traveling costs. Some people even move houses to be closer to good treatment centres.”

In 2023, 27% of Discovery Life’s severe illness benefit claims paid were for second or subsequent claims. A total of R416m was paid to these severe illness multiple claimants.

Friedlander noted that Discovery observed an increase in multiple claims based on macro trends in the data.

He said people were living longer, but they were also getting sicker. This increase in illnesses, he said, was directly affecting the rise in multiple claims. He credited advancements in medical treatment for prolonging lives.

“Thirty years ago, the first heart attack killed you. Today, we’ve had clients claim 14 times for heart and artery.”

Yet, he said that broader coverage becomes imperative with earlier detection and improved treatment of illnesses.

“What comes along with that is ensuring that you know if your coverage is relevant over the long term, pays your multiple claims, and, thankfully, we’re seeing that come through.”

Disability cover

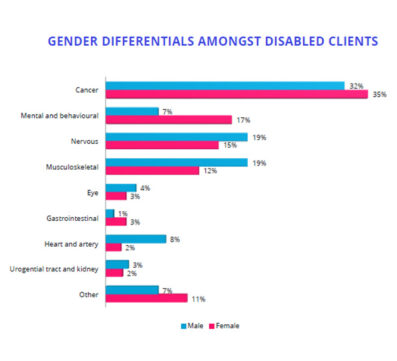

Alarmingly, within the realm of disability coverage, 40% of claims originated from clients aged 50 and under. The major causes were cancer, nervous (strokes), musculoskeletal, and mental and behavioural.

The implications of being permanently disabled, and by definition not being able to work, particularly at a young age, can be far-reaching, said Friedlander. He explained that if you’re in your 30s or 40s, it’s unlikely you’ve had enough time to develop resilience or save enough.

“You’re missing out on 30, 40 years of income… It’s important that everyone thinks about disability insurance and does the right calculation on how much they need. I think people underestimate what their future income is worth. It’s a big number when you do a present value of future income over a number of decades. And that’s where you need financial advice and the right type of needs analysis.”

Income continuation

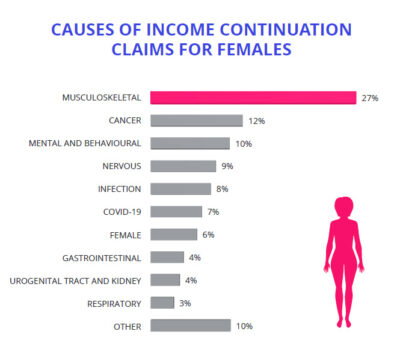

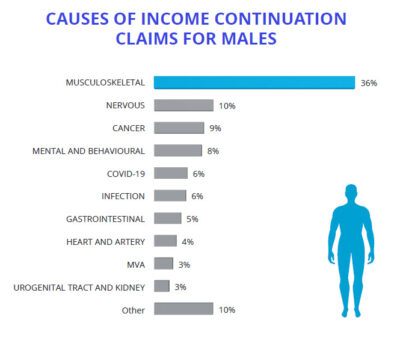

According to Discovery Life’s stats, musculoskeletal – on both the male and female side – is the most common cause of why people can’t go to work.

“Fractures, dislocations, hip replacements, those are probably the most common. Knee replacements where they get booked off for a period of time… And the next level is your cancers, mental behavioral issues,” Van der Walt said.

While 51% of the company’s claim amount paid went to ancillary benefits in 2023, in comparison the average payout for such benefits across three competitors in 2022 was 22%. This points to a much higher take-up percentage of these ancillary benefits among Discovery Life clients. Friedlander said there were a couple of reasons for this.

“I think the first is that we really try and design our shared value insurance model to incentivise clients to take up these additional benefits. In the media, you all will have seen the insurance gap studies that are done every three years and how underinsured South Africans are. So what we try and do through the model is to try and incentivise clients and advisers to utilise the discounts that they can get by linking their policy to Vitality, to buy up additional benefits. And we’ve seen a very successful uptake of those additional benefits on our book.”

Covid-19 enters endemic phase

In 2023, life payouts continued to grow, while Covid-19 claims decreased significantly.

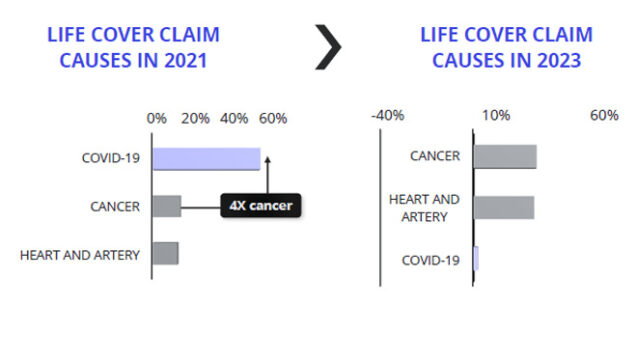

According to Friedlander, the 2023 stats for the first time showed how Covid-19 had moved from being a pandemic to a managed, endemic disease.

“In 2021, at its peak, it was four times the cancer deaths, four times the heart and artery deaths, whereas today, you’re at a very small fraction of your cancer deaths. Cancer deaths account for about 28% of our deaths and Covid deaths only 2% of our deaths in the 2023 year,” he said.

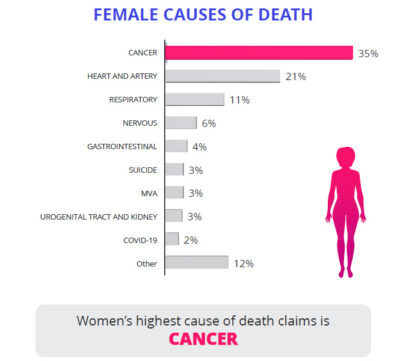

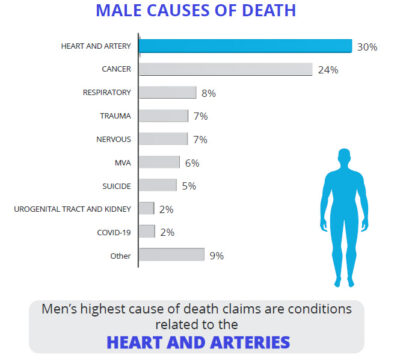

The two highest causes of death among women in 2023 were cancer (35%), followed by heart and artery (21%). Men’s highest cause of death claims were conditions related to the heart and arteries (30%), followed by cancer (24%).

According to Discovery Life’s data, one in six death claims were due to unnatural causes with instances of unnatural deaths highest in the under 30 (43%) and 31 to 40 (48%) age groups.

Thirty percent of unnatural deaths were due to vehicle accidents and 28% were due to suicide.

Discovery Life has seen an increasing trend in suicides before Covid. Friedlander said last year was the first time that it seemed to have stabilised, but it was still at an uncomfortably high level, when one considers there were almost as many suicides as motor vehicle accidents and South Africa has notoriously dangerous roads.