Global stock markets are under severe pressure as investors are driven out of risky assets. Developed-market equities (MSCI World Index in US$) sunk by 2.8% over the past 10 trading days, while emerging-market equities (MSCI Emerging Market Index in US$) are down by 3.5%. Big ticket tech companies (Roundhill Magnificent Seven ETF) lost more than 7%. Since mid-July, developed and emerging markets are down by 5.9% and 6.4% respectively, and the techs down by more than 12%.

Confluence of risk-off factors

The markets are roiled by a confluence of risk-off factors. On Wednesday, 31 July, the Bank of Japan (BOJ) hiked its policy rate and at the same day the US Federal Reserve decided not to cut rates despite indications that the US is on the verge of a recession, specifically now that the Sahm Rule has been triggered (refer to my article “Why I turned mildly bearish and opted for a defensive strategy”).

The Sahm Rule “signals the start of a recession when the three-month moving average of the national unemployment rate rises by 0.5 percentage points or more relative to the minimum of the three-month averages from the previous 12 months” (Federal Reserve).

Two days later, sentiment towards tech stocks were dealt a heavy blow when Berkshire Hathaway indicated that it sold half its holdings in Apple.

Unwinding of carry trades

The confluence created a massive unwinding of yen carry trades. Yen carry trades, according to Bloomberg, is borrowing at low rates in Japan to fund purchases of higher-yielding assets elsewhere. Assets also include high-growth stocks and even loans, though. In this strategy, traders and other financial institutions typically bet that Japanese interest rates will remain extremely low, resulting in a depressed external value of the yen, particularly against the US dollar.

The BOJ’s move saw the yen appreciate by more than 5%, while the prospect of a US recession casts doubts on market valuations and company earnings going forward, resulting in many carry trades being underwater. The Black Monday-type sell-off in Japanese markets reverberated across continents.

What now?

Nobody knows exactly how it all will play out.

Is the US staring down the barrel of a recession? Some observers have cast doubt on the Sahm Rule, though. JP Morgan Private Bank is of the opinion that the “Sahm Rule may be overstating recent economic weakness, especially in the labour market”.

Conditions precedent at the start of a recession normally are: Sahm Rule (unemployment rising) is triggered, consumer sentiment tanks, and an increasing number of US commercial banks tighten their lending standards for commercial and industrial loans.

At this stage, the Sahm Rule was triggered, consumer sentiment is declining and will probably slump because of the wealth effect of lower stock prices.

The third condition is absent, though. According to statistics (Senior Loan Officer Opinion Survey) released by the Fed last week, the net percentage of banks tightening their lending standards fell to 7.9% in the third quarter from 15.6% in the second quarter. It remains to be seen how the unwinding of carry trades will impact on banks’ financials and their lending standards.

At this stage, the million-dollar question is how long the unwinding in carry trades will run and what impact it will have on the markets. Some say it is nearly complete, while others, such as JPMorgan Chase & Co, say it is “between 50% and 60% complete”. Market behaviour over the past few days indicates it is ongoing.

But as things stand, there is a high probability that the US may avert a recession altogether and a soft landing may be awaiting us.

Back to the fundamentals

Long-term earnings growth drives a company’s stock price. In the short term, a company’s earnings may have more to do with major economic cycles than the firm’s underlying fundamentals. The same is true for stock market indexes. To minimise the impact of cycles, I use the average inflation-adjusted earnings from the previous 10 years, the dominator in the calculation of Robert Shiller’s PE 10 Ratio.

The historical average inflation-adjusted 10-year earnings data, indexed to 100 at a set date, serves as a Value Line and can be calculated in local currency or a single currency, such as the US dollar.

The stock index, based to 100 on the same set date, is compared to the historical average inflation-adjusted 10-year earnings index and gives an indication whether the stock index is expensive or underpriced, but also the extent of the over- or undervaluation.

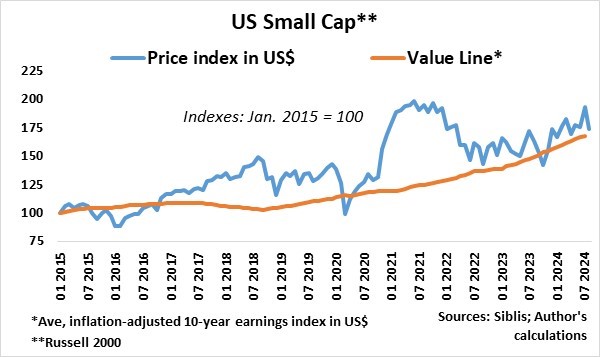

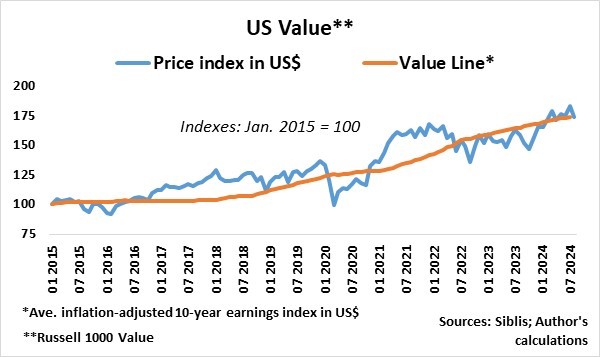

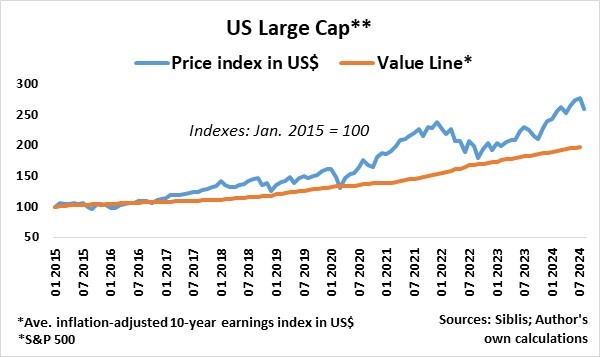

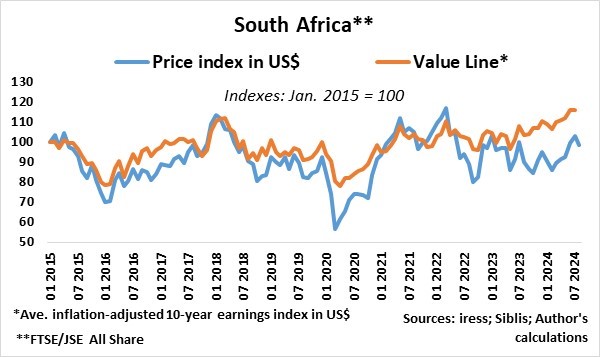

To diagnose the state of global equity markets after the recent sell-offs, I looked at the US Small Cap Index (Russell 2000), US Value Index (Russell 1000 Value), US Large Cap Index (S&P 500), and South Africa (FTSE/JSE All Share Index) as examples.

The US Small Cap Index is offering value again as it is testing the Value Line. The maximum downside from here is about 15% (as in 2016 and 2020).

The US Value Index remains in value territory, tracking the Value Line. The maximum downside from here is about 12% (as in 2023) and 25% (as in 2020).

It does seem that despite the recent sell-off, the tech-laden US Large Cap Index (S&P 500) is significantly overpriced compared to the Value Line.

However, significant growth in industries such as information and communications technology and the increased weights thereof in the index are starting to have a major impact on the average inflation-adjusted 10-year earnings of the S&P 500 index. The Value Line based to 2015 may therefore be overly pessimistic.

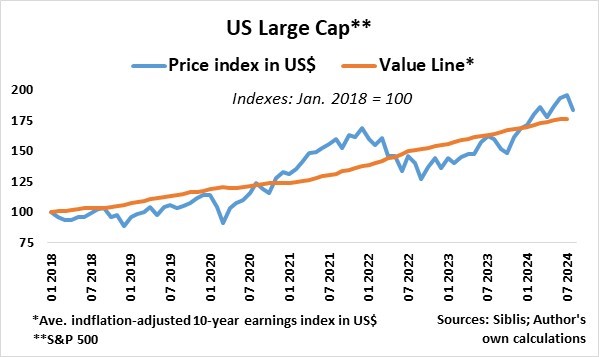

Basing the Value Line to January 2018 provides a more realistic picture of how things stand.

The US Large Cap Index is within a whisker of testing the Value Line and therefore approaching value territory again. The maximum downside from here is about 17% (as in 2022) and 25% (as in2020).

The South African stock market held up reasonably well, surviving the global stock market pullback from mid-July. The pullback because of the risk-off due to the confluence of risk factors was relatively mild, and it seems the political discount, as evidenced by the gap between the price index and Value Line, will narrow over time.

In conclusion, I think the markets are overreacting on the downside, but a major correction was long overdue. If there will be a recession in the US, it is likely to be mild, but a soft landing is more probable. Do not panic, look out for opportunities, but stick to your risk budget.

Ryk de Klerk is an independent investment analyst.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies. The information in this article does not constitute investment or financial planning advice that is appropriate for every individual’s needs and circumstances.