The South African Reserve Bank (SARB) will probably wait until November before it cuts the repo rate, according to a Reuters poll of economists.

In previous surveys, economists thought rates would be cut sooner, with last month’s poll predicting a cut in the third quarter. However, the median forecast in the 6 to 13 June poll suggested the SARB will keep the repo rate unchanged at 8.25% at its July and September meetings and cut the rate in November.

Eight of the 20 economists polled forecast a quarter-point cut in November, seven predicted a 50-basis-point move, two saw a 75-basis-point cut, while three expected no change.

The results of the poll are at variance with what the signals sent by the SARB in its six-monthly Monetary Policy Review (MPR), published in April, and following May’s meeting of the Monetary Policy Committee (MPC).

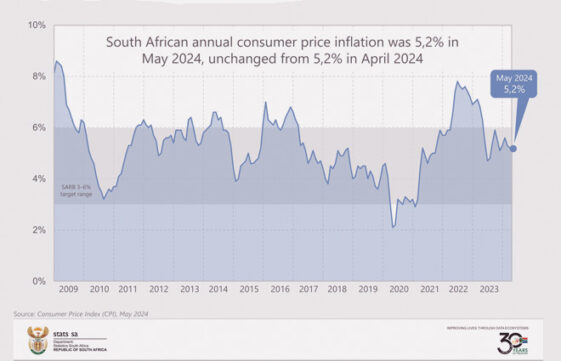

The SARB expected headline inflation to settle at the 4.5% midpoint of its target range of 3% to 6% from the fourth quarter of 2025. The MPR said the 8.25% rate “remains broadly consistent” with persistent inflation and the uncertain domestic and global outlook.

Statistics SA reported yesterday that annual consumer price inflation was 5.2% in May, unchanged from April. The monthly change in the Consumer Price Index (CPI) was 0.2%.

Casey Sprake, Anchor Capital’s fixed income investment analyst, said although May’s CPI is largely positive for the average consumer’s increasingly strained wallet, the figure is still some way off from the SARB’s target of 4.5%, with inflation proving itself particularly sticky.

“This will likely keep the SARB’s tone hawkish in any near-term remarks. The central bank has remained steadfast in communicating that it will not move the policy rate lower (and thus essentially usher in a rate-cutting cycle) until inflation is under control and sustainably hitting that target,” Sprake said.

Anchor’s view is that interest rates will likely remain on hold when the MPC convenes on 18 July. “However, we foresee potential rate cuts materialising towards the end of 2024, depending on the inflation outlook locally and abroad and global interest rate developments as we progress further into this year,” she said.

Annual inflation rates for four of the 12 product groups remained steady between April and May, including food and non-alcoholic beverages (NAB).

Transport inflation quickened to 6.3% from 5.7% in April. This is the highest rate for the category since October 2023 (7.4%). Fuel was the major culprit, with petrol and diesel prices increasing on average by 9.3% over the past 12 months and by 0.6% since April 2024.

Higher rates were also recorded for alcoholic beverages and tobacco, and recreation and culture.

Inflation was softer for miscellaneous goods and services, communication, clothing and footwear, health, and restaurants and hotels.

Sprake said the May CPI print was not a particularly important dataset. The upcoming June CPI data, set to be released in July, holds greater significance because it will include the quarterly survey of rental inflation, a substantial component in the basket.

“This category carries significant weight and is a crucial barometer for assessing demand-driven inflation pressures,” she said.

Food basket

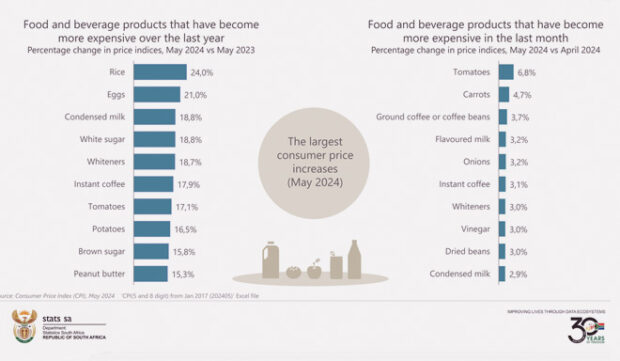

After five consecutive months of decline, food and NAB inflation remained steady at 4.7% in May, StatsSA reported.

Bread and cereals continued to trend downward, slowing to 3.9%. This is the lowest annual reading for bread and cereals since February 2022 when the rate was 3.7%.

Nine of the twenty bread and cereal products in the inflation basket are cheaper than a year ago. Rusks, hot cereals, pasta, and savoury biscuits registered the largest price decreases.

Inflation remains hot, however, for rice, pizza and pies, sweet biscuits, cakes and tarts, and bread rolls.

Milk, egg, and cheese inflation moderated for a fifth consecutive month, on the back of slower price increases for cheese, selected milk products, and eggs. The annual rate for eggs remains elevated at 21% but is softer than April’s 25.1%.

Inflation for sugar, sweets and desserts also continued a downward trajectory, dampened by lower rates for sugar, jam, chocolate, and ice cream. Although sugar inflation cooled in May, annual increases for white and brown sugar remain in double-digit territory, at 18.8% and 15.8% respectively.

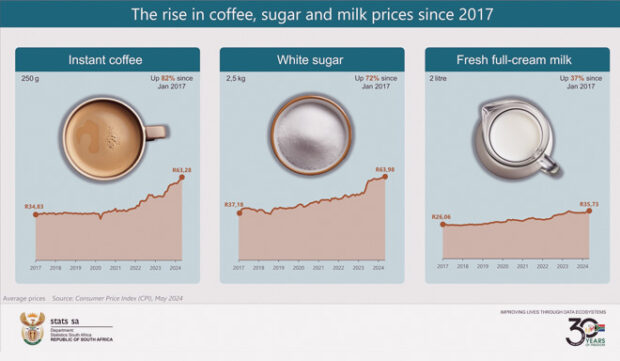

May saw an uptick in inflation for hot beverages, oils and fats, fish, fruit, vegetables, and meat. Hot beverages quickened from 11.4% in April to 14.2% in May, the highest since January 2023 (16.4%). Inflation for instant coffee, ground coffee or coffee beans, and black tea was above 10%. Instant coffee prices rose by an annual 17.9%, up from 13.8% in April.

The average price for instant coffee (250g) was 82% higher in May 2024 than in January 2017 (when StatsSA started publishing average prices).

Many coffee drinkers enjoy sugar and milk in their favourite brew, and these have also risen in price over the same period, although not as sharply as coffee.

Trends in other categories

The rate for cold and flu medication rose by 11.1%. Other health-related products that recorded relatively large increases include eyedrops (15.9%), laxatives (11.3%), cough syrup (8.1%), and vitamins (7.1%). Despite these increases, overall inflation for health products cooled from 7.7% in April to 5.8% in May.

The index for restaurants and hotels rose by an annual 6.5%. Hotel prices were up by 8% over the same period, with hotels in Gauteng, Free State, and Limpopo registering increases higher than 10%.

The miscellaneous goods and services category recorded an annual rate of 7.1%, slightly softer than 7.2% in April.

Personal care products recorded a fifth consecutive month of disinflation, slowing to 7% in May from a high of 10.3% in December 2023. Personal care products with the highest inflation rates in May were baby powder (18.4%), shampoo (16.6%), toothbrushes (16.5%), and toothpaste (16.1%).