Inflation and rising costs are hitting both brokers and insureds hard, exacerbating underinsurance and its consequences.

Carolyn Thompson, executive of retail product, underwriting, and pricing at Old Mutual Insure (OMI), spoke on the issue of underinsurance and its growing impact on the insurance industry and customers during CN&CO’s insurance webinar, InsureTalk42, held earlier this month.

Thompson said there have been cases where, at claim stage, clients have held the intermediary accountable for not being adequately covered.

“Intermediaries have a duty to advise clients properly, including warning them about the risks of underinsurance and ensuring they obtain adequate coverage,” she said. “Proper needs analysis, record-keeping, and clear communication of policy limitations and potential underinsurance are crucial to mitigate risks for both intermediaries and clients.”

The principle of average

The principle of average, also known as the “underinsurance clause” or “pro rata condition”, is a fundamental concept in insurance that is applied when the insured property is underinsured at the time of a loss. Thompson says it is designed to ensure that policyholders are adequately covered and pay premiums proportionate to the risks against which they are insuring.

“In summary, the principle of average states that if the insured value of a property is less than its actual value at the time of a loss, the insurer will only pay out a proportionate share of the claim, based on the degree of underinsurance.”

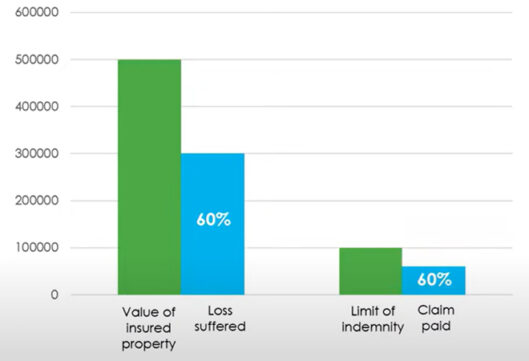

Thompson provided an example, illustrating how customers are affected when the replacement value far exceeds the insured value.

You are insured for R100 000 (limited indemnity), but your property is worth R500 000 (value of insured property). If you suffer a loss of R300 000, which is 60% of your property’s value, your claim will be adjusted on that pro rata basis. Instead of getting the full R100 000 for which are you insured, you will receive only 60% of that amount, which is R60 000.

Causes of underinsurance

According to Thompson, the causes of underinsurance are varied.

Cost considerations play a role because individuals or businesses facing financial constraints may prioritise low premiums over comprehensive coverage, opting for cheaper policies that offer less protection.

Sometimes, policyholders misunderstand what their insurance policy covers, leading them to believe they are adequately covered, whereas they are not.

In other instances, life circumstances and risks change, but people may fail to update their insurance policies accordingly, such as after buying a new home, acquiring valuable assets, or experiencing changes in their health status.

Additionally, insurance policies often come with exclusions and limitations that are not immediately apparent, leaving policyholders underinsured when certain events occur.

Inflation further complicates matters because the value of assets and living costs increase over time, rendering static insurance coverage insufficient for current replacement or repair costs.

People may also underestimate the risks they face, whether related to natural disasters, health issues, or other events, leading them to believe they need less insurance coverage than they do.

Last, Thompson said non-disclosure of relevant information, such as property modifications, can also result in underinsurance or policy cancellation if discovered later.

Impact of inflation

Of all these causes, Thompson highlighted inflation as “a big one affecting the business in multiple places” at the claim stage.

She said problematic claims arise when the replacement value significantly exceeds the market value, items such as imported plant and machinery are involved, or personal all-risks items are no longer available – for example, a particular item model (Thompson gave a Garmin Smartwatch as an example) that has been discontinued. The latter often leads to “buying up” (having to pay more than the insured amount for the latest model).

Breaking it down further, Thompson compared the growth in property values, and what these properties are consequently insured for, versus the rise in construction costs over more or less the same period. She said over time, it’s become more and more expensive to replace a home relative to what it costs to purchase.

Using data from the Statistics SA Construction Index from 2016 to 2024, Thompson demonstrated that if you purchased a house in Johannesburg in 2016 and insured it at its market value, adjusting your insurance limit each year based on market value inflation without making any renovations or improvements, you would find yourself underinsured by 33% by 2024.

“And people just don’t expect that to hit them. They don’t realise, I think, how much the cost of construction has gone up over that same period,” she said.

A metric that has seen significant fluctuations in recent years, greatly affecting the replacement cost of insured items, is the exchange rate between the United States dollar and the rand.

“Some of the agri tools that are heavily weighted to the exchange rate cause a lot of unknown threats. But there are also some household items that are coming from overseas, and you end up with massive inflation over the past few years,” she said.

Gold is another. According to stats provided by goldprice.org, the gold price in US$/oz was 1 100 in 2016. By 2024, that had gone up to just above 2 000. Thompson explained that if you had insured gold jewellery – for example, a gold ring – in 2016 and made a claim on it in 2024, you would receive only half the amount you initially believed you were insured for.

In other words, if you had insured gold jewellery in 2016 that you claim for in 2024, you would get only half the money that you thought you were insured for.

Thompson said that to reduce the risk of underinsurance, it is important to:

- understand and be aware of where high inflation exists;

- annually review values, especially where those categories have had high inflation;

- use experts (valuation certificates, surveys, calculators); and

- use the available datasets.

Ask the right questions

One of the responsibilities of insurance agents, brokers, and intermediaries is to obtain insurance coverage. Thompson said this includes understanding and evaluating the insurance needs of the client, requesting the necessary documents for the evaluation, and recommending the appropriate cover.

Failure to ensure that a client is adequately covered – for example, underinsuring a client for business interruption – may result in a breach of this duty.

This duty does not, however, require the broker to ensure that the client complies with the obligations provided by the policy, as this is the insured’s responsibility.

“So, it is our responsibility to make sure that with the information that you’re given – and make sure that you do request the right information – that the right cover is in place,” she added.

According to Thompson, there have been cases at the claim stage where clients held the intermediary accountable for their not being adequately covered.

“Obviously, if the right questions are being asked upfront and the client doesn’t give the right information, that isn’t your responsibility, but there is definitely a large part of it that does fall back on the intermediary.”

It also falls on the intermediary’s shoulders to explain the meaning of the policy to the client. This relates to the nature of the contract and all its material terms. Additionally, if the contract contains any “unusual provisions” that limit or exempt an insurer’s liability, then the broker must alert the insured of this.

Thompson emphasises the importance of two factors in fulfilling these obligations: conducting proper needs analyses and maintaining accurate records of the analysis and advice provided.

“If there wasn’t a proper needs analysis done and there wasn’t a record of the file kept, it is all going back to the intermediary to pay. They are taking the client’s word for it if we can’t prove otherwise,” Thompson said.

How to apply

Brokers should offer or outsource a valuation service to clients to ensure that their property is not underinsured. Clients think that market value is what their home needs to be insured for, but that is not the replacement value.