Thirteen years after the global Travel Venture International (TVI) pyramid scheme’s intricate network was exposed, the High Court has placed the estate of a local businesswoman linked to the scheme under provisional sequestration.

In the application brought by the Prudential Authority (PA), Adelaide Musa Duma’s estate was sequestrated for unpaid amounts exceeding R2 million arising from her having conducted the business of a bank, namely acting as a conduit for money for the scheme.

Section 11(1) of the Banks Act prohibits any person from conducting the business of a bank unless registered as a bank. The business of a bank includes the acceptance of deposits from the public as a regular feature of the business conducted.

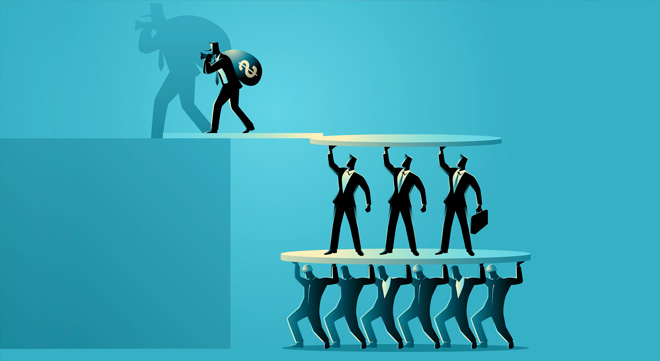

Established in January 2009, the TVI scheme marketed travel vouchers offering significant discounts on international travel and accommodation. However, these vouchers were worthless; the supposed alliance partners were not genuine; and the relationships were fraudulent. Participants made money only by recruiting new investors.

TVI was deemed unlawful by the South African Reserve Bank in 2011. An in-depth investigation followed, and legal action was taken against several local “distributors”, stripping those involved of their ill-gotten assets.

In Duma’s case, a warrant was obtained in August 2013 authorising entry of her premises and the seizure of all documents related to the TVI scheme. These included bank statements covering the entire trading period for all TVI scheme accounts.

Bank statements from Duma’s First National Bank account showed 254 inflows totalling R2 574 072.54 and 959 outflows amounting to R2 569 456.58. Additionally, statements from a separate account under the name TVI Simply the Best revealed 312 inflows totalling R2 093 819.48 and 618 outflows of the same amount.

The evidence indicated that Duma was engaged in receiving and disbursing funds from TVI investors. It was also shown that the funds received were not returned to the individuals who originally deposited them.

In February 2015, the PA issued a formal notice under sections 83(1) and 84 of the Banks Act, demanding that Duma repay all funds obtained through the TVI scheme. After failing to comply, a rule nisi was issued in November 2016 to search Duma’s premises and seize her assets.

Fifteen items were attached as a preservation measure. The solvency report found Duma’s total assets amounted to about R77 350, demonstrating her insolvency relative to her debts. The report found her true indebtedness to be R2 144 200, which has since risen to R2 978 529.83, including interest and investigation costs.

In her answering affidavit, Duma confirmed her involvement in the TVI scheme and admitted to receiving public deposits. She contended that her participation was bona fide and there was no intention to operate as a bank. According to her, the funds were “paid out immediately to further investors or in respect of vouchers for further investors”.

Patrick Bracher, a director in the financial institutions team at Norton Rose Fulbright, remarked that judgments on this issue are rare.

“It is a reminder to anyone tempted that if you use your bank as a conduit for the money of others, there are often serious consequences and a number of pieces of legislation you will probably be contravening,” Bracher said.

‘South Africa’s biggest pyramid scheme’

Before Mirror Trading International emerged on the scene, TVI was notorious as South Africa’s largest pyramid scheme, boasting more than 100 promoters and an estimated one million “investors” at its peak.

In 2012, the Mercury reported that court documents showed that millions of rands were being funnelled through TVI’s accounts, often in increments of R2 700, aligning with the scheme’s practice whereby “investors” purchased a block on a travel board for this amount. Despite the appearance, these vouchers had no real value. Investors saw returns only by recruiting new participants.

Investigations at the time uncovered that local distributors’ bank accounts received a total of R265 million, with R190m stemming from these investor deposits.

When the scandal broke, the Sunday Times identified 27-year-old Indian businessman Tarun Trikha as the mastermind behind the global scheme, which, according to the Reserve Bank and forensic auditors, had amassed more than R1 billion within two years. The scheme’s reach extended to countries such as India, the United States, the United Kingdom, China, and Australia, with estimates suggesting it was worth at least $2bn worldwide. At least 100 000 South Africans were reported to have invested in TVI.

To date, it seems that Trikha has still not been held accountable, despite India’s Central Bureau of Investigation filing a case against a Delhi-based company – tviexpress.com and its promoters Tarun Trikha, Varun Trikha and others – in 2018. The agency filed a “first information report” on the direction of the Supreme Court, which in 2014 asked it to investigate cases related to chit fund companies, the Times of India reported.

In October 2020, News18 reported the arrest of Trikha by the Economic Offences wing of the Delhi police. Subsequent court documents reveal that Trikha’s case was presented before the Rajasthan High Court in April 2022.

The court records noted that “learned counsel for the petitioners (Trikha) seeks time”, and the case was to be “listed after two weeks, as prayed”, with any interim orders to remain in effect. Since then, however, the digital trail concerning Trikha’s legal proceedings appears to go cold.