Electricity Minister Kgosientsho Ramokgopa recently asserted that the anticipated improvement in the electricity supply would make his role redundant by the end of the year.

He also announced that because of the reinstatement of unit 3 of the Kusile coal-fired plant, the country had begun to “turn the corner” in reducing loadshedding.

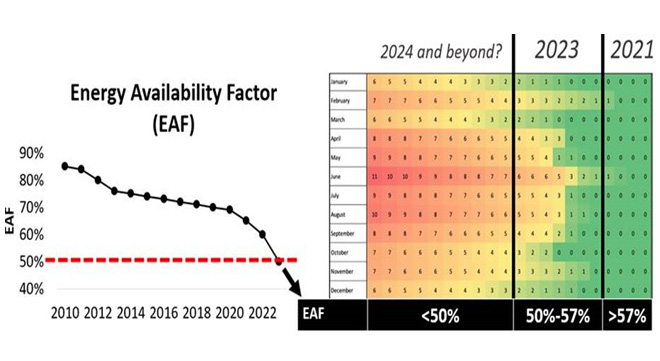

Eskom has reported a consistent, year-on-year improvement in its Energy Availability Factor (EAF), with the latest increase being from 27.4GW in May 2023 to 28.9GW in October 2023. This provides much-needed relief from the growing intensity of rolling blackouts and will go a long way in curbing their escalation. But the EAF remains low, hovering above the 50% mark, which effectively means that half of Eskom’s generation fleet remains out of service.

Furthermore, the relative gains made towards improving the EAF remain well below Eskom’s target of above 60%. These top-level figures alone show that despite Eskom’s claims that the worst is over, the numbers do not add up. With a pivotal election in May, the likelihood of political “string-pulling” to mask the harsh realities of the situation cannot be ruled out.

Facing the figures

Eskom’s Medium-Term System Adequacy Outlook (MTSAO) for 2024 to 2028 supports the view that the C&I sectors should exercise caution regarding the idea of an energy-secure future over the next five years.

Among other findings, the MTSAO stated that, according to its current modelling and projections: “In terms of unserved energy, no scenario achieves the system adequacy metric of 20GWh in all years of the MTSAO period.”

In reaching this conclusion, four assumptions were tested, namely:

- Moderate electricity demand growth of 0.64% a year

- Low EAF (averaging current levels of 50%)

- High EAF (improves to an average of 66% to 68%)

- Addition of new generation capacity including REIPPP bid windows 6 and 7, Risk Mitigation Power Producer programme (RMIPPPP), IRP’s gas-to-power capacity, and utility and private scale embedded generation (own solar)

Per the results of the MTSAO, none of the projected scenarios can close the gap between demand and supply over the next five years. If anything, these findings highlight a number of severe challenges in maintaining system reliability and adequacy, which will require further investments and major adjustments to Eskom’s energy generation strategies to meet the desired goals.

The below graphic shows the correlation between expected loadshedding stage and the EAF.

Given the EAF trajectory over the past decade, it would be prudent for South Africa’s commercial and industrial (C&I) sector to start planning for the worst when it comes to loadshedding.

The complex conundrums of an uncertain future

Similar conclusions were drawn by the state’s updated draft Integrated Resource Plan (IRP), which envisions an increase in new generation capacity of more than 29.3GW, procured through various programmes and projects up to 2030.

Considering that Eskom has an installed generation capacity of about 49 191MW, the current shortage is about 25 087MW given the current EAF of about 51% for the year to date. Turning the corner and ending loadshedding within a few months through quick fixes, as promised, is thus unrealistic. Instead, large new-build projects are required – and soon – to close this shortfall, yet these often take years to develop and construct.

The IRP places a strong emphasis on gas-to-power capacity, and South Africa imports most of its natural gas from Mozambique. However, because of several factors relating to infrastructural limitations, political tensions, and environmental pressures, gas imports from Mozambique are expected to decline. Furthermore, Sasol’s recent announcement that it will cut off its supply of the gas pipeline to industrial customers from as early as 2025 will throw yet another spanner in the works.

The most viable alternative is imported liquefied natural gas, for which there is currently no import terminal capacity at South African ports. Imported gas will also come at a much higher price than the gas sourced from Mozambique. Amid these arresting realities, the long-term financial feasibility and successful roll-out of this planned gas-to-power capacity hangs in the balance.

Eskom also plans to operate some of its coal power stations, which have been earmarked for decommissioning beyond their intended service lives. However, given the current unreliability and increased risk of breakdowns with end-of-life power stations, this is also likely to fall short of expectations.

The updated IRP also relies to a large extent on embedded generation and distributed capacity (own generation, rooftop solar PV, energy efficiency, etc.), which is expected to increase by 900MW a year. If anything, this projection provides proof that the government will not be able to solve the energy in its own capacity, despite its lofty promises.

There’s no quick fix – wheeling included

The private sector is contributing significantly to potential new utility-scale generation through independent power producers (IPPs), which are entering into direct energy wheeling arrangements with companies across South Africa. Although wheeling will, in the long term, add generation capacity, wheeling inherently does not address the need for security of supply for companies in South Africa.

To this point, it is important to note the following:

- Unreliable renewable generation without energy storage for wheeling purposes will not address generation capacity constraints in the Eskom grid in the short term. In fact, it is more likely to worsen the “Duck Curve” phenomenon and introduce additional challenges to Eskom’s peaking generation requirements, which could result in elevated stages of loadshedding during specific times of the day.

- Wheeling, however, does have the potential to improve renewable penetration for companies in the long run. Furthermore, it has the potential to generate (lower than embedded generation) savings through wheeling credits/refunds and consequent savings. Below is a comparison of expected embedded generation net savings versus wheeling generation net savings for companies in South Africa:

- Embedded Generation Net Savings = Grid Power Rate minus Power Purchase Agreement (PPA) Rate

- Wheeling Generation Net Savings = Wholesale Electricity Pricing System (WEPS) minus PPA Rate (where WEPS is typically significantly lower than the Grid Power Rate, which will result in lower net savings than embedded generation on a per kWh basis).

For now, at least, transmission grid capacity constraints may significantly delay the deployment of private power generation in South Africa, and although many companies and IPPs are signing agreements, these projects are still exposed to Eskom’s administrative and transmission grid capacity constraints.

A more realistic outlook

Despite slight improvements since the last assessment, the overall outlook remains precarious, with forecasts indicating a persistent capacity shortfall between Stages 3 and 4 for most of the year. Taking into account the unplanned risk of 2000MW, higher levels of loadshedding up to Stages 5 and 6 are still highly possible.

Eskom’s MTSAO highlights the ongoing capacity constraints, emphasising the need for increased new-build capacity, improved plant performance to more than 70%, and a stabilisation of electricity demand at current levels to mitigate the risk of loadshedding in the near future.

Based on these findings, therefore, the risk of loadshedding between Stages 3 and 6 will remain high over the next 12 months.

Energy-efficiency for futureproof industries

The threat to the commercial viability, operational integrity, and business continuity of companies in the C&I sectors remains imminent. Without adequate risk mitigation strategies, these sectors face consistently undermined levels of profitability and productivity.

There is also another important factor to consider: the ongoing and worsening impact of climate change. Even given the hypothetical scenario that the energy crisis in South Africa is solved, businesses will face mounting pressure brought on by the symptoms of climate change. This includes an increase in adverse weather patterns and natural disasters, the higher demand for industrial cooling solutions, and the growing demand for climate-resilient strategies.

The all-encompassing solution to these challenges is to improve the energy efficiency of C&I companies and dramatically reduce factors such as carbon emissions. To remain competitive, companies of the future will need robust, energy-efficient solutions to aspects such as lighting, heating, ventilation, air conditioning and refrigeration systems.

Competitiveness will also hinge on diversifying energy sources to reduce reliance on Eskom generation. This could involve incorporating renewable energy sources such as solar, wind, or biomass into the energy mix. By generating their own power, businesses can become more resilient to grid disruptions and volatile energy prices.

Low-CAPEX, high-OPEX diesel generation should be carefully calibrated with alternative high-CAPEX, low-OPEX Battery Energy Storage Systems (BESS) to ensure affordable business continuity. Predictive analytics coupled with optimally sized embedded BESS, solar and thermal generation can sustain world-class operations in the South African energy context.

Now is also the time for companies to develop highly effective contingency plans that outline procedures and protocols for managing operations during loadshedding. Companies should identify critical functions, prioritise equipment and resources, and establish communication channels to ensure seamless co-ordination and response during disruptions.

With the election date looming, the energy crisis its set to take centre-stage as one of the country’s most pressing challenges and a serious threat to sustainable economic development.

For businesses in the C&I sectors, which are facing multiple infrastructural headwinds, risk management should now be a non-negotiable, top priority. In the words of Zig Ziglar, it may indeed be time to “expect the best but prepare for the worst”.

Charl du Plessis is the general manager of Energy Partners Power.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies.