The FAIS Ombud, Advocate John Simpson, published a notice this month inviting comment on the Ombud scheme’s proposed budget for 2024/25.

The proposed increase in the budgeted levy for 2024/25 is because of an increase in the number of key individuals and representatives registered with the FSCA compared to the 2023/24 budget, the Office of the FAIS Ombud said in an explanatory document.

Since its inception in 2004, the Office has been funded by levies collected on its behalf by the FSCA – previously the Financial Services Board (FSB). The levy applicable to the Office was calculated using a formula per the FSB Act, which used the number of financial services providers and representatives as the basis of the calculation. Any shortfalls in the Office’s funding requirements have been augmented by the FSCA.

This funding arrangement has been replaced by the provisions in the Financial Sector and Deposit Insurance Levies Act, which commenced on 1 April 2023. The Levies Act provides for the imposition of levies on supervised entities to fund the FAIS Ombud. Table E in Schedule 5 to the Act sets out the formula for calculating the FAIS Ombud levy.

In addition to this levy, for the first two years of implementation of the Levies Act, the Office is entitled to a special levy equivalent to 7.5% of the levy collectible in the 2023/24 and 2024/25 financial periods. These additional funds will be used for any operational and ad-hoc costs during this transitional period.

The Levies Act also means the Ombud is financially independent of the FSCA. Accordingly, any shortfall in its funding requirements will no longer be bridged by the FSCA. The Office will be required to maintain its operational and capital requirements within the constraints of the levy received from industry and/or any reserves accumulated and retained from prior period operations, the Office’s explanatory document said.

Budget anticipates 5.6% rise in revenue

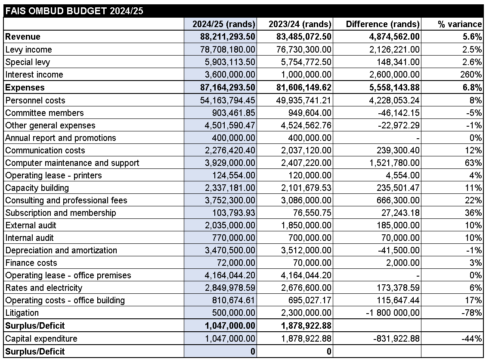

For the 2024/25 financial year, the FAIS Ombud is budgeting for gross revenue of R88.211 million (budget 2023/24: R83.485m), operating expenditure of R87.164m (R81.606m), and capital expenditure of R1.047m (R1.88m), resulting in a breakeven position.

The gross revenue comprises mainly of levy income: 89% from the normal levy and 7% from the special levy. The balance is from interest income. The Office has budgeted for a 260% increase in interest income, from R1m in 2023/24 to R3.6m in 2024/25.

The operations expenditure budget of R87.164m comprises staff expenditure of R54.163m (R49.935m) and general expenditure of R33m (R31.67m).

Staff expenses, which increased by 8% compared to 2023/24, represent 62% of the total expenditure budget.

General expenditure increased marginally by 4% compared to the previous year because of various cost-saving measures, the Office said.

A look at the Office’s budget shows it slashed its expected expenditure on litigation by 78%, from R2.3m to R500 000. The note to this line item stated: “The decrease is attributable to the Office taking a decision not to pursue matters in the High Court of South Africa; the budgeted costs relate to the finalisation of certain matters.”

It’s not unreasonable to assume that “certain matters” the Office will not be pursuing in the High Court relate to property syndication complaints.

Read: Why the FAIS Ombud is closing its files on property syndication complaints

Comments on the proposed budget must be submitted on the template available on the FAIS Ombud’s website to comments@faisombud.co.za by 31 October 2023.

Click here to download the FAIS Ombud’s draft 2024/25 budget.