National Treasury has welcomed the report by the Financial Action Task Force (FATF) that recognises the progress South Africa has made in addressing the compliance deficiencies that contributed to its grey-listing in February this year.

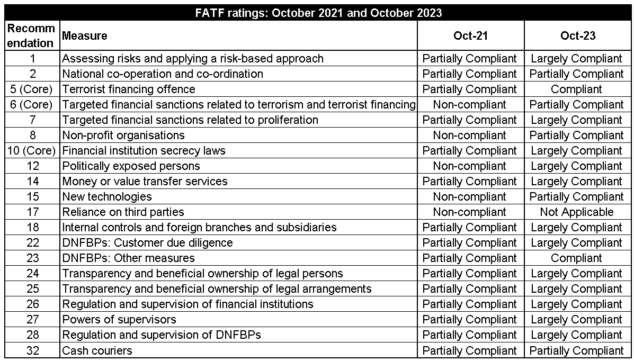

The FATF has 40 Recommendations (standards) that set out a comprehensive and consistent framework of measures that countries should implement to combat money laundering and terrorist financing, and the financing of the proliferation of weapons of mass destruction. The FATF assesses compliance with each Recommendation as “Compliant”, “Largely Compliant”, “Partially Compliant”, or “Non-compliant”.

The FATF’s 2021 Mutual Evaluation Report (MER) found South Africa deficient on 20 Recommendations.

The FATF’s Follow-up Report, published this week, shows that South Africa has made progress in addressing most of the technical compliance deficiencies identified in the MER.

On 27 October 2023, the FATF Plenary re-rated 18 of the 20 deficiencies. Of these, 15 were upgraded to be no longer deficient because 14 Recommendations were now fully or largely compliant, and one Recommendation was rated as not applying to South Africa, Treasury said in a statement yesterday.

Following these re-ratings, South Africa is now deemed to be fully or largely compliant in 35 of the 40 Recommendations, including in five of the six core Recommendations. This means that South Africa is left with five deficiencies in technical compliance, including three of the 18 that were upgraded from Non-compliant to Partially Compliant, and two that remain as Partially Compliant since 2021.

Treasury said the Follow-up Report follows an application by the South African authorities for the re-rating of the 20 technical compliance deficiencies, following the enactment at the end of 2022 of the General Laws (Anti-Money Laundering and Combating Terrorism Financing) Amendment Act and the Protection of Constitutional Democracy Against Terrorism and Related Activities Amendment Act.

The table below summarises the status of South Africa’s compliance with the 20 Recommendations:

The South African authorities will continue to address the remaining five deficiencies, with the expectation that they will be deemed to be addressed in the next FATF Follow-up Report in October/November 2024, Treasury said.

It drew attention to the following statement in the Follow-up Report: “Overall, the expectation is that countries will have addressed most, if not all, technical compliance deficiencies by the end of the third year from the adoption of their MER.” Treasury said South Africa has addressed most of the technical compliance deficiencies within two years of the publication of its MER.

No progress with two Recommendations

The two Recommendations on which no progress has been made are:

- Recommendation 2, which calls for countries to have national anti-money laundering and counter-terrorism-financing policies; and

- Recommendation 32, which aims to prevent terrorists and other criminals from financing their activities or laundering the proceeds of their crimes through the physical cross-border transportation of currency and bearer negotiable instruments (BNIs), such as bills of exchange, promissory notes, traveller’s cheques, bearer bonds, money orders, or postal orders.

Regarding Recommendation 2, the FATF said the reasons the rating has not changed from Partially Compliant since October 2021 are:

- The co-ordination of counterproliferation financing remains fragmented and does not involve all supervisors.

- There is no co-operation on data protection between supervisors and the Information Regulator.

The FATF’s reasons for retaining the Partially Compliant rating for Recommendation 32 are:

- There are gaps in the regime pertaining to BNIs.

- The enhancements to the electronic traveller declaration system, which enables the Financial Intelligence Centre to receive live electronic feed of all traveller declaration information, have not been implemented at all ports of entry.

- There is no specific procedure for retaining information when there is a suspicion of money laundering or terrorism financing.

Report does not assess effectiveness

Treasury noted that the Follow-up Report does not address the progress made by South Africa to improve the effectiveness deficiencies identified in the Action Plan agreed between the South African authorities and the FATF when the country was grey-listed in February.

Effectiveness refers to the country’s implementation of its anti-money laundering regime – the investigation and prosecution of financial crimes.

The FATF assesses effectiveness in terms of 11 Immediate Outcomes, where the ratings are “high effectiveness”, “substantial effectiveness”, “moderate effectiveness”, and “low effectiveness”.

In the October 2021 MER, South Africa essentially failed the 11 Immediate Outcomes. It did not achieve a single “high” or “substantial” rating but had eight “moderate” and three “low” ratings.

Treasury said overcoming the effectiveness deficiencies is essential for South Africa to exit the grey list.

Commentators have said South Africa will have to demonstrate a sustained increase in the investigation and prosecution of serious money laundering cases. The country will also have to enhance its identification, seizure, and confiscation of the proceeds of a range of crimes.

Treasury said addressing the remaining actions within the agreed timelines will require a significant effort from all the relevant South African authorities. In doing so, the South African authorities will also have to demonstrate that the improvements are sustainable before South Africa will be deemed by the FATF to have adequately addressed all the action items.

Treasury said the assessment of effectiveness is a distinct process from addressing technical compliance and is conducted under the FATF’s International Co-operation Review Group Joint Group process.

South Africa’s progress against its Action Plan is reviewed by the FATF Africa/Middle East (AME) Joint Group. The Joint Group meets every four months, where South Africa is expected to report on progress in addressing the 22 action items in the Action Plan.

Since the grey-listing, the Cabinet and the Justice, Crime Prevention and Security Cluster have overseen the implementation of the Action Plan, via the Interdepartmental Committee on anti-money laundering and combating of terrorism financing AML/CFT (IDC-AML/CFT), which is chaired by the director-general of National Treasury.

The IDC-AML/CFT includes many government departments and agencies, including the South African Police Services’ Directorate for Priority Crime Investigation, the National Prosecuting Authority, the Special Investigating Unit, the State Security Agency, the Financial Intelligence Centre, the South African Reserve Bank, the FSCA, the Department of Justice and Constitutional Development, the Companies and Intellectual Property Commission, and the South African Revenue Service.

Through the IDC-AML/CFT, South Africa has reported on its progress against the Action Plan at two AME Joint Group meetings in May and September 2023, and it is preparing to engage on a third report to the Joint Group, Treasury said.