The Financial Intelligence Centre (FIC) will impose harsher penalties on accountable institutions that do not pay the “smaller” fine of R10 000 imposed for failing to file their Risk and Compliance Returns (RCRs).

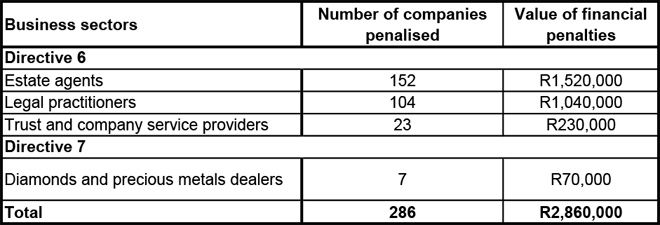

The FIC said on Friday that it has fined 286 accountable institutions a total of R2.86 million for not filing the RCRs that were supposed to have been submitted last year.

The Centre’s statement is the latest in a series of pleas – mixed with threats of administrative sanctions – for the relevant entities to comply with directives 6 and 7, which were issued on 31 March 2023.

The RCR is a questionnaire that assists businesses in identifying the risks they face of money laundering (ML) and terrorist financing (TF) abuse. The FIC uses its risk and compliance assessment analysis tool to evaluate the RCRs it receives, identifying “designated non-financial businesses and professions” (DNFBPs) at higher risk of ML and TF.

DNFBPs refer to specific sectors and professions that, although not financial institutions, are recognised as being susceptible to being exploited for ML and TF purposes.

Directive 6 requires legal practitioners, estate agents, trust service providers, company service providers, and casinos to complete and submit their RCRs online, via the FIC’s website. The due date for these submissions was 31 May 2023.

Directive 7 instructed dealers in precious stones, dealers in precious metals (including Krugerrand dealers), credit providers, and crypto asset service providers to submit RCRs by 31 July 2023.

Admission of non-compliance sanctions

Most businesses that were registered with the FIC on 31 March 2023 have submitted their RCRs. But others have remained non-compliant. As a result, the FIC has imposed admission of non-compliance sanctions on 286 institutions from November 2023 to November 2024.

“The fines are couched as admission of non-compliance sanctions, providing the institution with an opportunity to immediately correct its non-compliance and to submit an RCR and pay a small financial penalty of R10 000,” said Jan Augustyn, the manager for inspections and enforcement at the FIC.

“A total of 64 institutions submitted their RCR and paid the financial penalty. Another 77 submitted their RCR but did not pay the penalty, while 145 institutions neither remediated nor paid.

“The FIC is now determining the appropriate sanction for each institution that did not pay or remediate its non-compliance. These institutions also lose the benefit of having paid a smaller fine and immediately correct their non-compliance and now face more severe penalties,” Augustyn said.

Although the deadlines for Directive 6 and Directive 7 were 31 May 2023 and 31 July 2023 respectively, the FIC’s portals remain open for the submission of RCRs.

Accountable institutions can complete and submit the RCRs by clicking here on the FIC’s website.

Augustyn advised accountable institutions to submit the RCRs as a matter of urgency or face the consequences. “It is inevitable that the longer the non-compliance persists, the harsher the financial penalties will become.”

Why the RCR is important

The FIC said the requirement for filing RCRs is integral to ensuring that businesses are aware of how they can be used for laundering proceeds acquired through criminal activities. “Filing a RCR is thus central to ensuring that businesses survive and are robust in the fight against financial crime.”

The Financial Action Task Force (FATF), the global ML and TF watchdog, put South Africa on its grey list in February last year after finding that the country has deficiencies in its measures to combat ML and TF.

The FIC said one of the reasons for South Africa’s grey-listing was that the FATF’s 2019 mutual evaluation found that DNFBPs are unaware of the ML and TF risks they face, which make these sectors and South Africa vulnerable to exploitation by criminals. The RCR was developed to address this gap, the Centre said.

The FATF adopted a jointly agreed Action Plan containing 22 action items linked to the eight strategic deficiencies identified in the country’s anti-money laundering and combating terrorism financing regime. South Africa must address all 22 action items to exit the grey list.

In October, the FATF announced that the country has largely or fully addressed 16 of the 22 action items. South Africa must address all six outstanding items by February if it hopes to get off the grey list by the middle of next year.

Read: SA racing against February deadline if it wants to exit grey list by mid-2025

Since August last year, the FIC has pleaded with entities that have not submitted the RCRs to do so, warning that non-compliance will result in administrative sanctions, including fines (see here, here, here, and here).

The FIC’s compliance and prevention supervision team has used several platforms and opportunities to assist accountable institutions turn around non-compliant behaviour, the Centre said on Friday.

“Scores of awareness webinars and meetings have been held and several outreaches have been conveyed via different media channels. Industry associations have been brought on board to communicate to businesses under their supervision, and numerous notices and correspondences have been sent directly by the FIC to individual businesses and relevant regulators.”

Help with FICA compliance

Moonstone Compliance offers compliance, consulting, and training options for accountable institutions of all types and sizes to help them meet the requirements of FICA.

Moonstone Compliance provides a wide range of services, from providing documentation to implementing a full compliance framework. You can select a combination of services and have them customised according to your needs.

Click here to read more about Moonstone Compliance’s suite of FICA services or submit an online enquiry.