A R400 000 administrative sanction imposed on a financial services provider (FSP) is a clear message to accountable institutions that non-compliance with the Financial Intelligence Centre Act (FICA) will not be tolerated.

Theuns Vosloo Financial Advisory Services CC (TVFAS) was penalised with this hefty sum following an FSCA inspection on 25 and 26 January last year when it was found that the FSP was in breach of several provisions of the Act.

The FSCA oversees FSPs to ensure they follow FICA. This law aims to fight money laundering, terrorism financing, and related crimes. All institutions designated under FICA must fully comply with its provisions.

Key provisions include:

- Accountable institutions must develop, document, maintain, and implement a Risk Management and Compliance Programme (RMCP) for anti-money laundering and counter-terrorist financing.

- When an accountable institution engages with a prospective client to enter a single transaction or to establish a business relationship, the institution must, in the course of concluding that single transaction or establishing that business relationship, establish and verify the identity of the client, in accordance with its RMCP.

- Accountable institutions are required to scrutinise client information to determine whether such clients are listed in terms of section 25 of Protection of Constitutional Democracy Against Terrorist and Related Activities Act and the Targeted Financial Sanctions Lists (TFSL) issued by the United Nations Security Council. If an accountable institution finds that a client is on the TFSL, it must, as soon as possible report this to the Financial Intelligence Centre and take steps to freeze the client’s assets.

The RMCP must outline how an institution will reduce money laundering and terrorist financing risks and comply with FICA. Simply put, it is a set of internal rules on how to identify an institution’s clients and the source of funds.

The investigation found that although TVFAS created an RMCP, it was flawed because it did not detail how it would comply with FICA. In addition, at the time of the inspection, the FSP had not implemented its RMCP, resulting in none of its clients being properly identified and verified. It also neglected to screen its clients against the TFSL.

A portion of the financial penalty, R200 000, was suspended for three years. This suspension is contingent upon the FSP adhering to a directive to address identified deficiencies and maintaining full compliance with the relevant regulations during this timeframe.

RMCP – a living document

The administration sanction comes in the wake of the FSCA imposing a fine of R870 000 on Jannie Parsons Future Financials (Pty) Ltd (JPFF) in 2022 – also for failing to meet certain provisions of the Act related to the implementation of the licensed FSP’s RMCP.

In this case, the FSCA agreed to suspend R470 000 of the penalty for three years on condition that JPFF remained fully compliant during this period, effectively reducing the penalty to R400 000.

Read: Failure to meet Fica provisions costs FSP R400 000

Both these incidents emphasise that the failure of an accountable institution to develop, document, maintain, and implement an RMCP cannot be regarded merely as a bureaucratic or technical breach of the law.

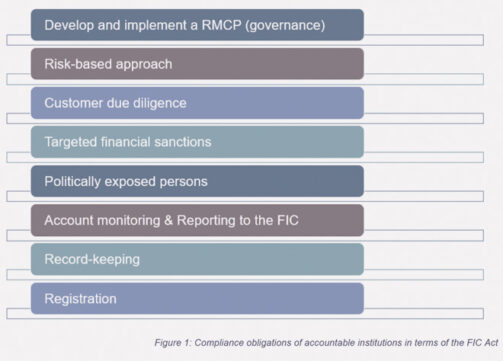

As set out in the Financial Information Centre’s Reference Guide for all Accountable Institutions, accountable institutions are subject to certain obligations in terms of FICA:

The first of these is the development and implementation of an RMCP.

Moonstone Compliance’s chief operating officer, Billy Seyffert, and legal and compliance adviser Marili Orffer provided practical insights and guidance into what a risk-based approach to compliance entails during Moonstone Compliance’s free FICA webinar in October last year.

View a recording of the “Understanding FICA Compliance” webinar by clicking here.

Touching on the role of the RMCP, Seyffert said the Act is clear – the requirement for a relevant document that is maintained and implemented is non-negotiable.

“So that means it cannot be something on the shelf; it has to be an adopted thing, a living document – an RMCP for anti-money laundering, counter-terrorism financing- and counter-proliferation financing risk management.”

Second, Seyffert said, the RMCP must be approved.

“Who does it need to be approved by? Well, the most senior structure of management in the business. If you are a Pty Limited, it must be adopted and approved by the board. Any senior management, it depends really on whatever your higher level is.”

He added that this could not reside in middle management, because responsibility for FICA compliance sits with the governing body.

“Therefore, they need to know what’s in it. They need to have approved it, and they need to have adopted it. They are responsible for implementation because they are the persons that will be held responsible.”

Seyffert emphasised that having an RMCP “in the cupboard” does not pass muster.

“In any FIC inspection, one of the first things they do is they take your staff aside, and they take you aside and they say, we see you’ve got this RMCP, tell us about it. What do you know about it? What is it trying to do? Have you been trained in it? When last was it updated, and when last were you trained?

“It’s a living document. It is the set of rules that you stand and fall by. Training about your RMCP, the availability of your RMCP is what makes you pass this test.”

Help is at hand

Moonstone Compliance offers compliance, consulting, and training options for accountable institutions of all types and sizes to help them implement anti-money laundering procedures and meet the requirements of FICA.

Moonstone Compliance will explain the complex regulations and offer practical recommendations tailored to your business.

We provide a wide range of services, from providing documentation to implementing a full compliance framework. You can select a combination of services and have them customised to suit your needs.

Click here to read more about Moonstone Compliance’s suite of FICA services or send us an online enquiry.

Standard bank had ignored my late wife’s credit life insurance policy,the credit facility agreement contract,and all the proof of debits for 13 years,nonstop, including the Aumbuds for banking complaints,apart from many money related issues from standard bank wills department,wich was promised to re inburse me,but cowardly turn their back on me……

Perhaps the FSCA should have investigated the BHI Trust and warned investors. Many of us are waiting to hear if we will ever get our money back.