Generating returns ahead of inflation is crucial for a sustainable income in retirement. It is also widely accepted that returns that exceed inflation cannot be achieved without taking risk. Holding the right proportion of assets to balance risk and return is easy when markets are rising. However, it can quickly be forgotten by investors during a crisis.

US President Donald Trump’s “Liberation Day” wreaked havoc on markets, resulting in equity losses in the trillions and deepening concerns about economic stability. The JSE All-Share Index shed 8.48% in the two days following Trump’s announcement on 2 April, while the rand fell to record lows.

Although drawdowns can be severe, inflection points in the market can be equally rapid and pronounced. Uncertainty about the duration of the crisis and concerns over further market declines are likely to cause many investors to consider switching into “safer” assets. However, history has shown that investors risk permanent loss of capital by switching into cash.

This lesson was demonstrated during the global financial crisis (GFC) but was perhaps even more pronounced during the pandemic. It was not surprising that in such uncharted territory, industry views around the potential shape of the recovery varied, and concerns around another dip were rife. Despite these concerns, the market recovered most of its losses in about three months. Those on the sidelines missed out.

What about pensioners? The risk of repeating the mistakes of the past

Retirees in living annuities face an extra challenge during these times. Their requirement for income forces them to make regular withdrawals, even when the capital value of their investment has been reduced significantly. Many feel that selling into weakness to fund their monthly annuity will have a negative impact on the sustainability of their income and therefore switch into cash to preserve the value of their nest egg.

This instinct to try to avoid further capital erosion is understandable, but in practice this behaviour often has the opposite effect to what was intended. Simply preserving capital is not enough because its value is eroded by inflation over time, and this effect is magnified when an investor also draws an income.

Although the causes, magnitude, and duration of previous market crises are always different, there are consistent lessons we can glean from each.

What lessons could the Covid pandemic of 2020 and the GFC of 2008 teach pensioners in navigating the current environment?

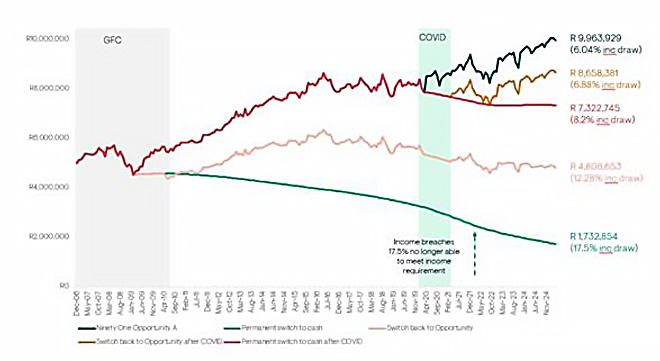

To address this question, we looked at a scenario where a client retired at the beginning of 2007, the year in which the GFC began. The client invested R5 million into a living annuity, drawing a 5% income, with the rand value of the income escalating by inflation each year. We then considered five scenarios using the Ninety One Opportunity Fund as the underlying investment:

- The client remained invested in the fund for the entire period.

- The client switched out of the fund and into cash and remained there.

- The client switched out of the fund into cash and tried to time the market by switching back into the fund a year later.

- The client held their nerve during the GFC and remained invested in the fund but during Covid switched to cash for a year before switching back into the fund.

- The client held their nerve during the GFC but switched into cash during Covid and remained there.

We matched the rand value of the income drawn in all five scenarios. The outcome of the analysis (as at 31 March 2025) can be seen in Figure 1.

Figure 1: Remaining invested delivered the best outcome

Source: Morningstar and Ninety One Investment Platform.

The figures are based on actual investment performance after fees, with all income reinvested.

An amount of R5m was invested on 1 January 2007, and the investor withdrew 5% of the investment’s value each year, increasing the amount by 5% annually on the anniversary date.

The returns shown are annualised, meaning they reflect the average return per year over the full period, ending 31 March 2025. The income withdrawn in all three scenarios was kept the same in rand terms.

- Scenario 1: The investor stayed invested in the Ninety-One Opportunity Fund the whole time.

- Scenario 2: The investor switched to cash at the market low on 1 March 2009 and stayed in cash for the rest of the period.

- Scenario 3: The investor switched to cash on 1 March 2009, then reinvested in the Fund on 1 March 2010. Another switch back to the Fund is shown on 1 April 2025.

- Scenario 4: The investor switched back into the Fund on 1 April 2021.

The same fund was used in all scenarios.

(The investment performance is shown for illustrative purposes only.)

How the scenarios played out

The difference in outcome is astounding:

- Scenario 1 (staying invested) would have resulted in a final portfolio value of nearly R10m, and the last income drawn would equate to 6.04% when expressed as a percentage of capital.

- Scenario 2 (permanent switch to cash) would have resulted in an end value of just R1.7m, and the income draw would have breached 17.5% in 2022, meaning that the income produced would no longer be sufficient to meet the investor’s income needs in the future.

- Scenario 3 (timing the market) would have meant that the annuitant gave up more than 50% of the portfolio’s capital value than if the choice had been to remain invested. This would have resulted in an end value of only R4.8m with an income draw of 12.28% of the capital value.

- Scenario 4 would have resulted in a value of R8.6m, leaving the client with 13% less capital than if they had remained invested throughout. The final income draw increases to 6.88%.

- Scenario 5 resulted in a value of R7.3m (>25% lower than remaining invested) and a dramatic increase in the income draw to 8.2%.

The strategy of remaining invested delivered by far the best outcome for retirees. Importantly, the capital value continued to appreciate. But of greater significance is that the percentage income drawn remained within acceptable parameters over the 18-year time horizon (1 January 2007 to 31 March 2025).

In the market-timing scenario, the level of income has started to reach a concerning level, and the retiree may need to consider making some lifestyle adjustments.

In the scenario in which the retiree permanently switches to cash, the percentage income drawn has escalated to a point where the pensioner would need to come up with another plan to fund retirement in their later years.

Scenario 3 demonstrates that even a temporary switch to cash can be damaging if it causes you to miss the strongest days of a market recovery – significantly increasing the risk of outliving your savings.

Periods of market volatility occur more often than we’d like, and scenarios 4 and 5 highlight the importance of maintaining discipline through different crises. Investors who stayed the course during the GFC but lost their nerve during the pandemic ultimately paid the price.

Where clients remained invested, the strong absolute and relative returns of the fund helped to deliver this outcome, but the way they have been generated has been equally important.

Dependable returns

The Ninety One Opportunity Fund focuses on producing absolute returns; therefore, downside protection and avoidance of permanent loss of capital is core to the investment philosophy. This is particularly important for investors who are drawing an income. More stable returns increase the probability that members remain invested through difficult conditions where the drawdown of a more aggressive investment strategy might tempt them to move into cash.

Finding more dependable returns regardless of market conditions should be the ultimate goal of all investors, whether saving for retirement or drawing an income from those savings. Consistently applying a disciplined investment process helps to ensure that outcomes are more predictable.

The one thing that retirees are blessed with is a long investment time horizon. Starting with the correct investment strategy means that the best course of action during periods of volatility is to sit back and do nothing. This is easier said than done, but lessons from past crises indicate that by following this discipline, retirees will be rewarded by improved outcomes over the long term.

Marc Lindley is a product specialist at Ninety One.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies. The information in this article is a general guide and should not be used as a substitute for professional financial advice.