A recent survey found that only 8% of customers lodged complaints with their financial institutions (excluding banks and collective investment schemes) between 2021 and 2023. On the surface, this may seem like a positive sign – but does it indicate genuine customer satisfaction, or are consumers struggling to navigate the complaints process even when they have valid concerns?

These are the questions the Financial Sector Conduct Authority aims to answer as it prepares for the roll-out of the Conduct of Financial Institutions Bill (COFI).

The Complaints Management Industry Review Report 2025, released this week, sheds light on how financial institutions handle grievances and highlights gaps in the system. The FSCA is using these insights to refine its regulatory approach as it prepares for COFI, which aims to standardise complaints management across the financial sector.

South Africa’s financial sector lacks a uniform approach to handling complaints. Although regulations exist – such as the Long-term and Short-term Insurance Acts, the Conduct Standard for Banks, and the General Code of Conduct for Financial Services Providers – not all financial institutions are subject to the same requirements. Retirement funds and collective investment schemes, for example, operate without clear regulatory guidelines for managing complaints. COFI seeks to close these loopholes by introducing a sector-wide framework rooted in the Treating Customers Fairly (TCF) principles.

To understand the current state of complaint-handling, the FSCA conducted a two-phase review between 2022 and 2023.

Phase 1 focused on assessing how financial institutions handle complaints, using surveys, industry interviews, case file reviews, and policy analysis. Responses were gathered from 673 Category I FSPs, 444 retirement funds, and 61 retirement fund administrators.

Phase 2 surveyed consumers who had lodged complaints against these institutions between 2021 and 2023. The goal was to gauge their awareness of complaints processes and their experiences in dealing with financial institutions.

The FSCA also consulted with the two statutory ombuds, the Office of the Pension Funds Adjudicator (OPFA) and the FAIS Ombud, and analysed their annual reports to gain deeper insights into consumer grievances and resolution trends.

Deputy commissioner Astrid Ludin described the report as a critical step in establishing a regulatory baseline.

“The focus tends to be on banking and insurance, and as the FSCA and the FSB previously did focus on complaints-handling in those areas, but the FAIS area – particularly where we’re talking about financial advisers – that’s often the first point of contact with the financial sector for people, and no work had been done in that area before, as well as in the retirement funds area,” Ludin said.

She pointed out that complaints should be far higher, given that the FAIS Ombud and the PFA handle about 10 000 complaints annually, yet financial institutions themselves record significantly fewer.

“The feedback from some of the ombuds has been that they often have to refer complainants back to the financial institutions because complainants don’t start with the financial institution,” Ludin said.

Phase 1 – industry review key findings

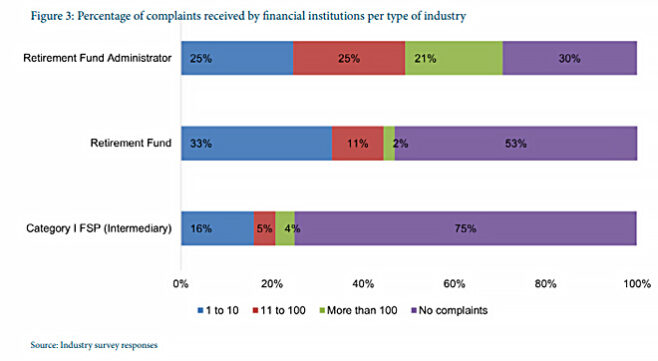

The industry review found that most FSPs and retirement funds reported few or no complaints during the assessment period. While 75% of FSPs received no complaints, 53% of retirement funds and 30% of fund administrators reported the same. However, entities with fewer clients tended to receive more complaints proportionally than larger institutions.

The review also found that financial institutions received more queries than complaints, primarily from clients seeking information about financial products.

Retirement funds recorded the highest proportion of both queries and complaints.

Types and categorisation of complaints

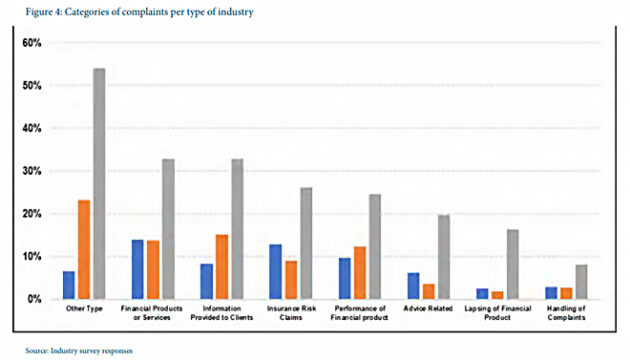

Financial institutions categorised complaints according to regulatory guidelines, including the TCF outcomes, the Policyholder Protection Rules, and the FAIS Code of Practice. The most common categories included:

- Financial products and services

- Information provided to clients

- Advice-related complaints

- Product performance

- Lapsing of financial products

- Complaint-handling

- Insurance risk claims

- Miscellaneous complaints (“Other”)

The “Other” category accounted for a significant portion of complaints in retirement funds and fund administrators. However, inconsistencies were noted in how the different sectors classified complaints.

Although FSPs maintained detailed records, including complaint sub-categories, retirement funds and administrators lacked standardised reporting systems.

Effectiveness of complaints resolution

The review assessed financial institutions’ ability to resolve complaints based on effectiveness, accessibility, and timeliness. Effectiveness was measured by:

- Organisational commitment: FSPs demonstrated stronger frameworks for managing complaints than retirement funds and administrators. Some administrators failed to keep principal officers informed about complaints trends.

- Adequate resources: Although many institutions claimed to have sufficient staff, 45% had only two to five employees to handle complaints, and 32% had just one frontline staff member. High volumes or complex cases often strained resources.

- Staff training: Training frequency varied across industries. Most institutions provided annual training (57%), while others offered quarterly (19%) or biannual (8%) sessions. However, training often lacked differentiation based on escalation levels.

- Monitoring and reporting: Institutions monitored complaints data weekly, primarily using Excel spreadsheets. Some used automated systems such as customer relationship management tools.

Accessibility of complaints processes

Most financial institutions claimed to provide accessible complaints-handling processes through brochures, websites, and in-branch assistance. However, the review noted:

- English was the primary language for complaints, with few institutions offering multilingual support.

- Awareness of internal escalation processes varied. Although 78% of institutions informed clients of escalation options, inconsistencies in documentation led to confusion, pushing consumers to ombuds or regulators instead.

- Many institutions lacked clear standard operating procedures for escalations, making it difficult for consumers to navigate the system.

Timeliness of complaints resolution

Most financial institutions had documented timelines for resolving complaints, with many cases being closed within a week or a month.

Delays were often caused by waiting for customers to submit written complaints and dependence on responses from third parties.

Despite efforts to keep complainants informed, these bottlenecks highlight areas for improvement in complaints resolution efficiency, the report noted.

Phase 2 – consumer survey key findings

Phase 2 of the review was carried out through an online consumer engagement survey, which aimed to assess consumers’ awareness of complaint-handling processes offered by licensed financial institutions and gather insights into their actual experiences.

A total of 11 602 financial consumers responded to the survey. Most respondents were black (64%), aged 25 to 54 years (79%), and female (53%), with a large portion living in Gauteng (40%).

However, many participants did not qualify to complete the survey because they were either unaware of internal or external complaint-handling processes or had not submitted a complaint to their financial institution during the review period (2021-2023).

Of those who qualified, 655 consumers had submitted a complaint to one of the three industries under review – Category I FSPs, retirement funds, or retirement fund administrators. This number excludes respondents who had submitted complaints to other sectors, such as banks and CISs, which were outside the scope of the study. The responses from these 655 consumers were included in the report.

The findings showed that only 8% of consumers filed complaints between 2021 and 2023, with most complaints directed at Category I FSPs and retirement funds (44% each). A smaller proportion (12%) complained about retirement fund administrators.

However, the FSCA’s report added that the financial literacy research published by the Human Sciences Research Council in 2021 stated that consumers generally do not complain or lodge complaints even where there is a need to (for example, being sold an unsuitable financial product or service).

“The findings from the FSCA Customer Behaviour and Sentiment Study 2023 show that customers across a broad range of demographics report experiencing challenges in lodging complaints with financial institutions, which could explain the low complaint rate. Furthermore, barriers to lodging complaints were particularly salient for married women, youth, and people who dwell in rural areas.”

The survey also highlighted a concerning lack of awareness: 66% of consumers were unaware of internal complaint-handling processes, and 55% struggled to find information on how to lodge a complaint.

“This corresponds with the findings of the aforementioned FSCA Customer Behaviour and Sentiment Study, which highlights that in instances where customers are dissatisfied or something has gone wrong, they are not always aware that they have potential recourse with their respective financial institutions.”

Financial institutions primarily used statements, policy documents, websites, and call centres to communicate their complaints procedures, but only 34% of consumers were aware of these options. In contrast, 47% knew of external bodies, such as ombuds.

The survey found widespread dissatisfaction with complaint resolution. A significant 67% of consumers expressed frustration with the effectiveness of complaint-handling, while 63% of those who lodged complaints were dissatisfied with the resolution.

Most consumers used email or online forms (50%) to lodge complaints, followed by phone calls (24%) and in-person visits (19%).

Timeliness was another issue, with 65% of complainants dissatisfied with the speed of resolution. For many, complaints took weeks or even months to resolve. More concerning, 16% of complaints with Category I FSPs and 22% with retirement funds were still unresolved at the time of the survey.

Escalation of complaints was common, with only 23% resolved at the first point of contact. More than half of complaints were escalated, but 40% of those were not resolved, and 41% of consumers were unsure of the status of their complaint.

The survey also uncovered that 67% of complainants regretted their choice of financial product or service, citing poor complaint-handling and unresolved issues. This regret was particularly common among retirement fund and Category I FSP consumers.

“Corresponding findings from the FSCA Customer Behaviour and Sentiment Study show that the most common product for which regret is reported by the older age cohort was for retirement fund products. It is important to note that this cohort did not regret belonging to a retirement fund per se but regretted having a specific retirement fund product such as an annuity that they chose and now felt locked into it,” the report noted.

Ombuds highlight gaps in complaint-handling

The review of complaints data disclosed shortcomings in financial institutions’ complaint-handling and engagement with ombud schemes. Although the FSCA’s analysis did not assess the ombuds’ handling processes, it incorporated insights from statutory ombuds’ reports and direct engagements.

“The analysis of statutory ombuds’ annual reports showed a substantial decline in complaints lodged with the OPFA between 2020 and 2021, which could suggest that members may have addressed administrative-related complaints with funds before taking them to the OPFA,” the report noted.

Despite this, persistent challenges remain, particularly concerning withdrawal and death benefits, maladministration, delays in updating contribution schedules, fund growth issues, and other administrative hurdles.

The FAIS Ombud’s data from 2019 to 2021 showed that 30% of complaints fell outside its mandate, while 39% were referred back to FSPs for resolution.

“This highlights the gap in consumer awareness of FSPs’ complaints-handling procedures,” the report added.

Insights from ombud engagements further pointed to significant gaps in effectiveness, accessibility, and timeliness.

According to this feedback, financial institutions, particularly at the branch level, show limited commitment to resolving complaints efficiently. Many cases are handled by junior staff rather than senior personnel, leading to delays and inadequate resolutions. Poor record-keeping and a lack of proper monitoring further hinder effective complaints management, making it difficult to track trends and address recurring issues.

It also noted that accessibility remains a major concern, because many consumers are unaware of internal complaints procedures. Although financial institutions provide multiple channels for lodging complaints, these processes are often unclear or difficult to navigate. Ineffective internal escalation systems also result in cases being unnecessarily referred to ombuds.

Large financial institutions are more likely to inform consumers about their right to escalate complaints to an ombud, but this practice is inconsistent among smaller institutions.

Timeliness is another challenge, with some financial institutions failing to resolve complaints within reasonable timeframes because of poor oversight. However, ombuds noted that when institutions prioritise complaint-handling, many issues can be resolved within a month, proving that delays are avoidable with the right focus and resources.

Recommendations

In the face of these findings, the report urged financial institutions to strengthen their complaint-management processes. It underscored the need for documented systems to receive, record, report, and resolve consumer complaints effectively.

“Complaints-handling processes should also align with the overall regulatory requirements and ultimately enhance customer experiences and outcomes,” the report states.

Among its recommendations, the FSCA advised financial institutions to seek customer feedback to refine their processes and ensure their complaints management frameworks are suited to their business complexity and size.

“The effort and complexity of complaints management frameworks will, understandably, not be the same across financial institutions,” the report notes.

Going forward, the insights presented in the report will assist the FSCA in determining its complaints management supervisory focus areas.

Ludin emphasised that complaint-handling should not be seen merely as a regulatory obligation but as a fundamental aspect of customer service.

“This overall system of recourse for consumers really starts with financial institutions. This shouldn’t just be a matter of dealing with complaints. This should really be about customer service.”