The FSCA has invited stakeholders to comment on its budget and estimated expenditure for the 2024/25 financial year.

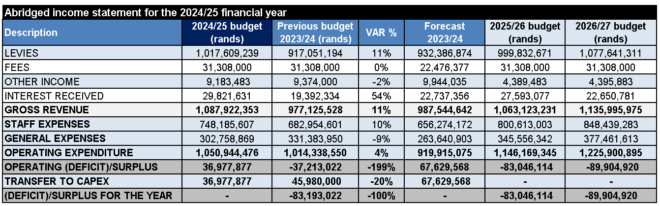

The Authority is budgeting for gross revenue of R1.087 billion (budget 2023/24: R977 million), operating expenditure of R1.051bn (R1.014bn), and to transfer R37m (R46m) from the special levy to capital expenditure, resulting in a breakeven position.

To cover the budgeted operational expenditure (which includes capex expenditure), the FSCA is proposing to increase the levy variables and fees by 6%.

Read: The FAIS Ombud has some good news for FSPs

Levies account for 93% (94%) of the budgeted gross revenue of R1.087bn. The levies include the special levy of R71m (R64m), to cover capex expenditure.

Fees and interest each account for 3% of the FSCA’s revenue, and 1% is from other income.

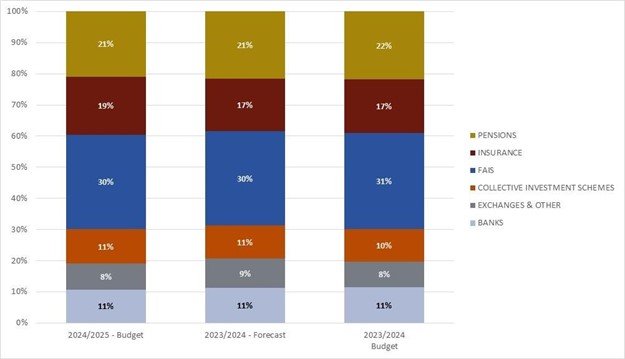

As the graph below shows, FSPs are single-biggest contributor to the Authority’s levy revenue.

The proposed 6% increase in levies translates into an overall increase of 11% in the overall levy revenue compared to the 2023/24 budget. The FSCA said this is because of new entrants and fluctuations in the data used to calculate the levies.

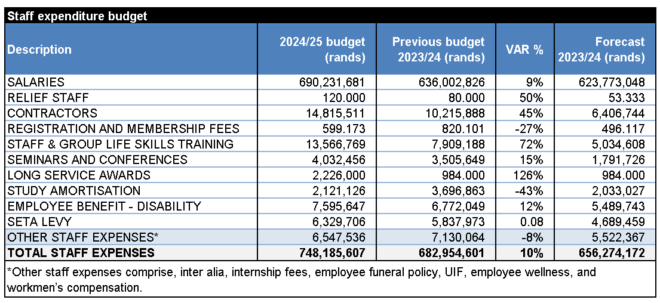

Salaries represent 92% (93%) of the FSCA’s staff expenditure budget and 66% (63%) of its total expenditure budget.

Click here to download the FSCA’s draft budget for 2024/25.

Comments on the FSCA’s proposed budget must be submitted on the comments template and emailed to FSCA.RFDStandards@fsca.co.za by 2 November 2023.