The FSCA this week released its first report on the regulatory actions it has taken over the past 12 months. The inaugural report covers the period 1 April 2022 to 31 March 2023.

The Authority said the data in the report will assist the FSCA in identifying a high incidence of cases, changes in industry behaviour and consumer education needs, which, in turn, will inform the FSCA’s supervisory and regulatory activities and focus.

During the reporting period, the FSCA suspended the licences of 984 FSPs, which constituted about 8% of the 11 826 authorised FSPs at the end of March 2023.

Of the total number of suspensions, 95% (938) related to the non-submission of statutory returns and/or non-payment of levies. However, 53% (522) of the suspended licences were reinstated after FSPs rectified their non-compliance. (The number of reinstatements excludes cases where the withdrawals were set aside by the Financial Services Tribunal.)

The FSCA withdrew the licences of 420 FSPs, of which about 90% (380) related to the non-submission of statutory returns and/or non-payment of levies. (The number of withdrawals includes cases that were set aside by the tribunal.) The number of withdrawn licences constituted about 4% of the total number of licensed FSPs.

Debarments

The FSCA debarred 210 people from providing financial services, in most cases because of dishonest conduct.

A “substantial” number of representatives were debarred for submitting fictitious policies to insurers. Other common causes of debarments were misappropriating clients’ funds, acting contrary to mandates, trading and investing clients’ funds in their own names, misrepresenting investments and investment results, and not overseeing juristic and natural representatives.

FSPs debarred 1 137 representatives. In about 96% (1 100) of cases, the reason was dishonesty, while the balance was for non-compliance with the competency requirements. The number of debarred representatives constituted about 0.6% of the total number of appointed representatives.

Policy fraud is a concern

The FSCA said it was dealing with “an alarming” number of cases involving the submission of fictitious policies to insurers.

In most cases, the modus operandi is essentially the same. The representatives obtain the bank account details of members of the public and forge their signatures on policy application forms. The applications are submitted in the name of the victims and the premiums are deducted from their bank accounts. When the victims query the premium deductions, the insurer or FSP launces an investigation, and where fraud is uncovered, the representative is debarred, either by the FSP or the FSCA.

The Authority said it has “substantially increased” the debarment periods for this type of fraud, and it intends to give more attention to the issue in the coming year.

Investigations

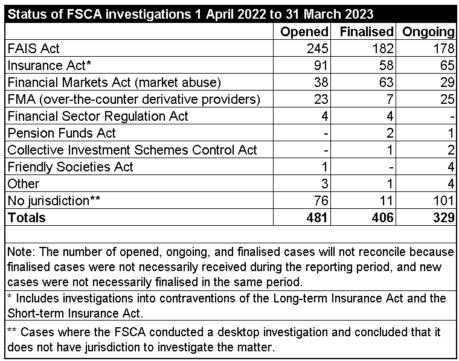

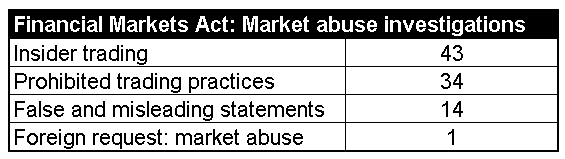

The FSCA opened 481 new investigation cases and finalised 406, while 329 cases are ongoing.

As a result of the increase in ongoing cases, the Authority said it has augmented the capacity of its Enforcement Division.

Most of the investigations related to alleged contraventions of the FAIS Act and the Insurance Act.

Most of the FAIS matters related to unauthorised business. “Given the extent of unauthorised FAIS business and the impact on customers, it remains a focus area for the FSCA,” the Authority said.

The insurance investigations related mostly to unregistered insurance business, most of which was conducted by funeral parlours. The FSCA said it has established a dedicated team to investigate these cases.

Fines

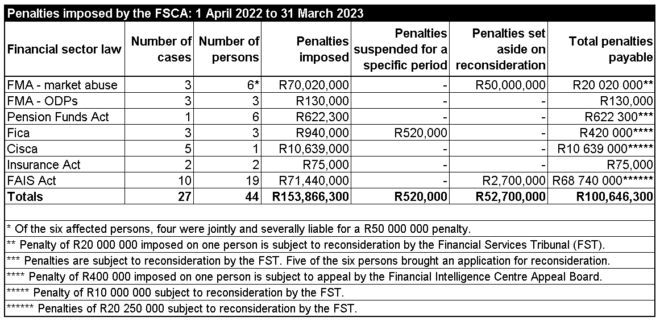

The FSCA imposed a total of R153 864 300 in administrative penalties on 44 persons. Subtracting penalties that were suspended or that were set aside on reconsideration to the Financial Services Tribunal, fines of R100 644 300 were payable.

Reconsideration applications

The FSCA took 1 688 administrative action decisions. Of that number, 59 applications for reconsiderations were lodged with the Financial Services Tribunal, of which 25 decisions were set aside. The number of set-aside decisions constitutes about 1.4% of all administrative action decisions, but it constitutes 42% of the total number of reconsideration applications.