The FSCA has published its first integrated annual report, which describes the organisation’s activities for the 2022/23 financial year.

The Authority said the change from annual reporting to integrated reporting allows it to provide stakeholders with a balanced and holistic view of the FSCA’s performance and broader impact over the past financial year, considering risks, opportunities, and relevant socio-economic, environmental, and technological factors.

Decrease in licence approvals

The number of FSP licences approved by the FSCA in 2022/23 was the lowest in the past three years: 584 compared to 776 in 2021/22 and 662 in 2020/21. The total number of approved FSPs in 2022/23 was 11 740.

Most of the 584 licences approved were in Category I (545 FSPs). The number of approved Category II FSPs increased by 32 to 792. The number of approved Category IIA FSPs decreased by one to 118. Three Category III FSPs were approved in 2022/23, bringing the total to 33. Four Category IV FSPs were approved, bringing the total number to 105.

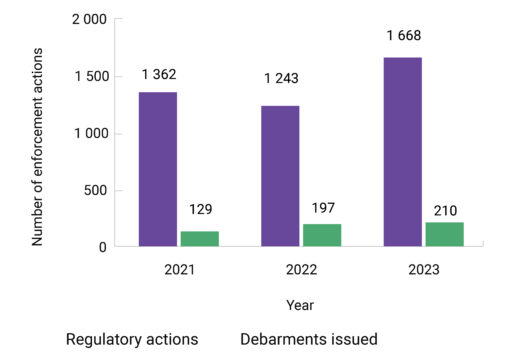

Increase in enforcement actions

The number of enforcement actions related to regulatory compliance increased by 34% to 1 668, while debarments rose by 6.5% to 210.

A total of 984 licences were suspended and were 420 withdrawn, representing annual increases of 37% and 70% respectively. The number of suspensions lifted, 522, was more than double that in 2021/22.

Most of the suspensions and withdrawals related to the non-submission of statutory returns and/or non-payment of levies, while most of the debarments involved dishonest conduct.

A total of R153 864 300 in administrative penalties was imposed on 44 investigated parties. Subtracting penalties that were suspended or that were set aside on reconsideration to the Financial Services Tribunal, a total of R100 644 300 in administrative penalties were payable. Most of the penalties imposed related to non-compliance with the FAIS Act.

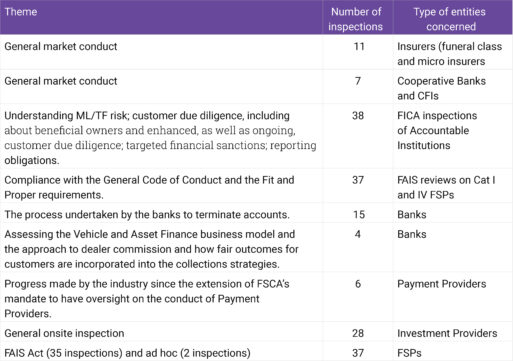

On-site inspections

The FSCA conducted 183 on-site inspections in 2023/23. The table below provides a break-down of the inspections by entity and theme – the specific compliance issue that was scrutinised.

The Authority said it adopted a risk-based approach in selecting institutions and appropriate inspection supervisory activities. For example, the inspections on banks were carried out because of complaints received and the level of media coverage of these matters.

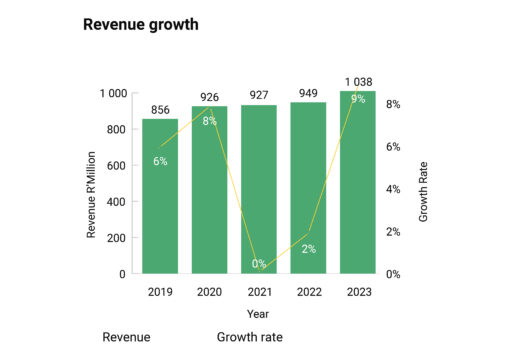

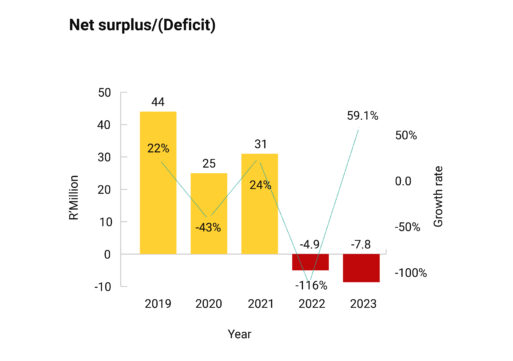

Revenue grows by 9%

The FSCA’s revenue grew by 9% to R1.038 billion in 2022/23 (2021/22: R949 million), mainly because of higher interest income from investments, penalties, and annual levy increases.

Revenue from levies, fines, and penalties increased by 8% to R955 766 603 (2021/22: R884 691 019).

Revenue from fees and service charges, and interest and dividends rose by 28% to R82 951 483 (R2021/22: R64 621 390).

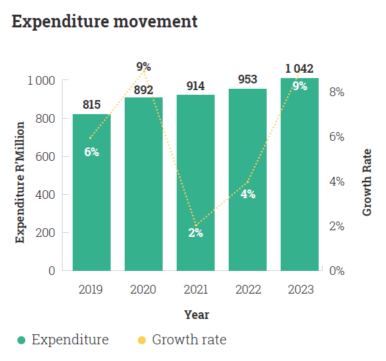

Operating expenditure increased by 9% to R1.042bn (2021/22: R953m) mainly because of expenditure on information technology, advertising and promotions initiatives for consumer education, and staff costs.

The FSCA reported a net deficit of R7.8m for the year (2021/22: R4.9m), which it said was largely made up of once-off expenses that are expected to reverse once it has fully implemented its new operating model.

The FSCA maintains two reserve accounts: the contingency reserve and the discretionary reserve, currently at R96m (2021/22: R91m) and R58m (2021/22: R45m), respectively.

The contingency reserve is maintained at a maximum of 10% of levy and fee income, which is held to protect the FSCA against the risk of unforeseen events. The discretionary reserve is a depository for fines and penalty income for funding consumer education-related expenses.

Partly because of the net deficit, net assets decreased by 1.6% to R483m for the year (2021/22: R491m). In line with section 53(3) of the Public Finance Management Act, the FSCA said it will request approval from National Treasury to retain the cash surplus for planned capital expenditure infrastructure projects.