“Now the big question is, who’s the real winner out of the two-pot retirement system? Well, at the moment, I would say SARS.”

That’s the view of Danie van Zyl, the head of the Smooth Bonus Centre of Excellence at Sanlam Corporate Investments – and it’s hardly surprising. Last week, Commissioner Edward Kieswetter announced that SARS collected a net R1.855 trillion for the 2024/25 fiscal year, exceeding the government’s revised estimate by nearly R8.8 billion and topping last year’s total by R114bn.

Of that, R12.9bn came from tax on two-pot withdrawals – a staggering R7.9bn more than the R5bn initially projected. SARS also recovered R820 million in outstanding tax debt through these withdrawals.

To access their savings, taxpayers must be registered with SARS and have no unpaid tax obligations. Any debts are automatically deducted from the payout.

Read: SARS’s enhanced compliance efforts add R301.5bn to revenue

Van Zyl made the remark during a presentation on Sanlam Corporate’s two-pot update, which covered developments since the system went live on 1 September last year.

Sanlam, South Africa’s largest insurer, administers more than 130 stand-alone retirement funds, with more than 300 000 active members and an additional 360 000 dormant members. In 2024, the Sanlam Umbrella Fund, the third-largest umbrella fund in the country, reached assets under management of R100bn, while growing its membership to 350 000.

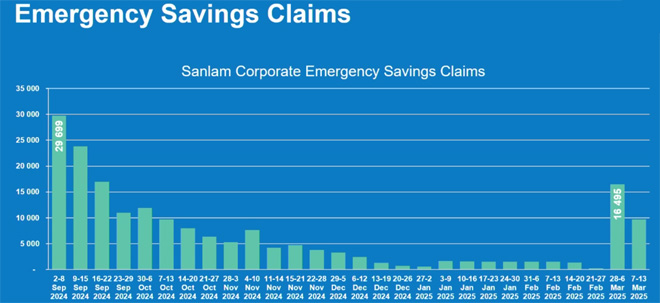

From 1 September 2024 to 28 February 2025, Sanlam Corporate received more than 162 000 two-pot claims, with a total of R2.9bn paid out, including taxes. Ninety-nine percent of claims were processed and paid, with R712m in tax paid to SARS.

To put this into context, Van Zyl explained, “We normally have between 7 000 to 8 000 claims a month, that was before two-pot. Over a six-month period, that would be about 45 000 claims. In addition to the usual 45 000, we had another 160 000 two-pot claims. That put quite a bit of strain on our admin team.”

The average claim value stood at R18 200, down from an initial R20 000.

Most claimants were individuals earning between R3 000 and R15 000 a month. Of the claimants, 56% were male and 44% were female. The largest number of claims came from those in the 35- to 44-year-old age group, followed by the 45- to 54-year-old group.

“It is not your very young members. It’s mostly between ages 35 and 44 now… We also have statistics showing that these are often members with a very low replacement ratio. The concern is that these are people with an already low replacement ratio. And if they are already 44, they don’t have that many years left until retirement. You don’t have much time to make up the shortfall again,” Van Zyl added.

Internally, Sanlam refers to the savings component as the “emergency savings pot” to remind members that it should ideally be accessed only in emergencies. Examining the claims, statistics show a sharp spike in claims during September, followed by a significant decrease in October and November, with very few claims in December. However, there was another spike in claims starting in March, marking the beginning of the new tax year.

“We have seen members who claimed previously, claiming again from the two pot [savings]. The suspicion is that there will be a large section of members who will just claim every year as soon as this savings pot is more than the R2 000 they need to withdraw.”

Van Zyl highlighted a key concern over what he referred to as the “zero claims bank”. He explained that more than 2 100 members submitted claims under the two-pot system, paid tax on those withdrawals, and then had the entire net amount withheld by SARS to settle outstanding tax debt.

These members effectively received nothing, Van Zyl said, noting that although they did owe money to SARS, it was unlikely this outcome was what they intended when submitting their claims.

Reflecting on the roll-out of the system, he said one of the major lessons Sanlam has learned is the need to place greater emphasis on explaining the potential tax implications to members upfront.

Is the two-pot system having the desired effect?

With the roll-out of the two-pot system, there was the hope that with members having to pay marginal tax on their withdrawals, it would spark significant changes in their behaviour. However, to date, Sanlam has not observed this shift.

What are members doing with their two-pot withdrawals? Van Zyl noted that before the system was introduced, surveys found members intended to use their funds to reduce debt levels and pay for education. However, the results have not aligned with these expectations.

“If you look at the results coming out, when we look at banks and all those other companies that provide credit, they haven’t really seen a reduction in the number of bad loans or outstanding loans where people are behind and paying for their limited loans,” he explained.

“I would argue, not a lot of money actually went into settling debt.”

He further pointed out that private educational institutions continue to see high levels of unpaid school fees.

“Perhaps a lot of money didn’t get into that either.”

So where did the money go? Van Zyl observed a noticeable increase in spending on groceries, fast-moving consumer goods, and electronics such as TVs, microwaves, and fridges. There was also an uptick in car purchases.

“Even though we don’t know for sure where the money went, the suspicion is that a big chunk of it went there. And the fact that such money was spent on groceries just indicates how difficult consumers are finding things out there. It speaks to the financial strain that members are under – that they would dip into their long-term savings just to put food on the table.”