The Actuarial Society of South Africa (ASSA) says most retirees will be better off buying a guaranteed life annuity or a hybrid annuity (a combination of a guaranteed life and a living annuity) instead of a living annuity.

“This is especially true in the current environment where guaranteed life annuity rates are at levels last seen more than 10 years ago. This represents an incredible opportunity if you are retiring,” says Jeanine Astrup, a consulting actuary and member of ASSA’s Retirement Matters Committee.

She believes the benefits of a living annuity only apply to the wealthy, to people with advanced financial skills, to people with expenses well below a sustainable living annuity income, or those with a short life expectancy due to illness.

“It is a very sophisticated financial instrument with an enormous burden to manage,” Astrup says.

Guaranteed life annuities are considered “old school”, mainly because it is difficult to source a complete comparison of annuity rates and examples of how much income you can buy with your investments. “You have to speak to a financial adviser for this, whereas you can get a good feel for the benefits of living annuities by doing online research,” Astrup says.

Furthermore, most consumers are put off guaranteed life annuities because the capital sum is converted to income, and this cannot be reversed. Astrup says the implication is that when the annuitant dies, no lump-sum benefit can be paid to beneficiaries. As a result, a general misconception is that when you die, your money dies with you.

There are, however, options that will ensure your money does not die with you, Astrup says. “With a guaranteed life annuity, you can leave an income legacy by adding a dependant who will continue receiving an income once you die for a guaranteed period or life. However, it is important to understand that these options come at a cost and will reduce the income you receive during your lifetime.”

She says most pensioners opt for a living annuity and sacrifice the certainty of a lifetime guaranteed income in the hope that some capital will remain for a loved one when they die.

“The outcome for some is that the capital is whittled away before they die, leaving them with no income, and family members inherit the financial burden of supporting their ageing loved ones.”

Retiring with R1 million

To illustrate her point about the benefits of guaranteed life annuities, Astrup provided an example of a single man who is 65 years old and has saved R1 million for his retirement. He decides to buy a guaranteed life annuity with a 10-year guarantee because he would like to leave something for his daughter if he dies before he turns 75. He would like his pension to keep pace with inflation and therefore opts for a guaranteed life annuity that increases with inflation every year.

Astrup’s calculations show his starting pension (before tax) is R7 117. By the time he turns 85, his monthly pre-tax income will have increased with expected inflation of 6% to R22 824 and will continue to increase annually until he dies, even if he lives to 100 and beyond.

A living annuity, on the other hand, would have wiped out a significant portion of the R1m invested over the 20 years if he had opted for a starting pre-tax income of R7 117 a month, requiring a drawdown rate of 8.54%.

Assuming the living annuity pension increases with inflation each year until it reaches the drawdown cap of 17.5%, this pensioner would be left with a monthly income of just R7 006 by the time he turns 85. The calculations assumed a very optimistic investment growth of inflation plus 6.5% and 1% upfront commission and 1% ongoing fees (inclusive of VAT).

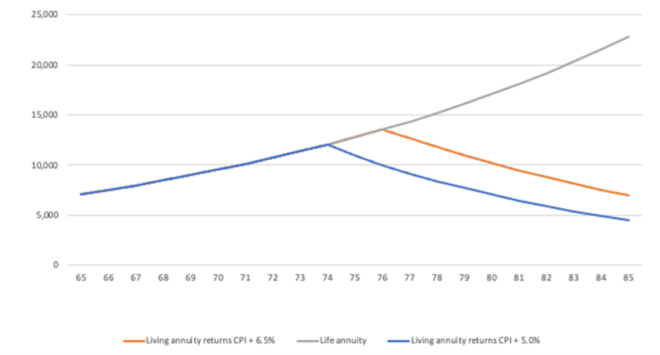

The graph below illustrates the long-term income pattern achieved by an investment of R1m in a guaranteed life annuity versus a living annuity with a return of inflation plus 6.5% and a living annuity with a return of inflation plus 5%.

Assumptions: A single male aged 65, R1m investment, living annuity fees (1% upfront commission and 1% ongoing fees). Income increases with inflation every year.

Retiring with a lump sum of R10m

Astrup also crunched the numbers to highlight the benefits of a guaranteed life annuity even if you are retiring with sizeable retirement savings of R10m, again using the example of a single man aged 65.

She points out that the cost of the guaranteed life annuity is influenced by the size of the income required, which means the bigger the pension, the higher the cost. Therefore, a guaranteed life annuity of R10m with a 10-year guarantee will buy a monthly income of R64 448, which increases with expected inflation of 6% every year until the owner dies. By the time he reaches age 85, his monthly pre-tax income will be R206 693, assuming inflation of 6% each year.

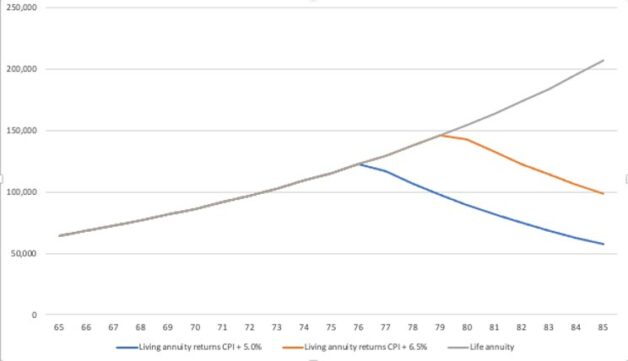

To achieve the same starting income with a living annuity, a drawdown rate of 7.73% is required. If the portfolio achieves annual investment growth of inflation plus 6.5%, his income will peak at R145 710 at age 79 and then decline. At age 85, his income would be R98 468, less than half of what the guaranteed life annuity would be paying. The chart below illustrates this.

Assumptions: A single male aged 65, R10m investment, living annuity fees (1% upfront commission and 1% ongoing fees). Income increases with inflation every year.

Consider all your options

With current annuity rates at such a high level, R1m can buy a male pensioner a non-increasing monthly pension of almost R11 000 guaranteed for life, Astrup says. Women generally qualify for a lower monthly income than men because their life expectancy is higher.

“While we don’t recommend annuities that do not increase with inflation, because you would not be protected against future cost increases, there is an opportunity to combine guaranteed life annuities and living annuities to achieve a higher starting pension without risking the complete erosion of capital.”

According to Astrup, the role of a financial adviser is invaluable when it comes to picking the right vehicle designed to turn your retirement savings into a reliable income stream during retirement.

“If you detect a bias for living annuities and are not presented with calculations that present an overview of all options, including a hybrid solution, consider getting a second opinion from another financial adviser,” Astrup says.

She also recommends that you discuss your options with your family and get their buy-in. You may find that your loved ones will forego a potential inheritance for the security that comes with your having a guaranteed income for life that keeps pace with inflation.

Also bear the following in mind

If you are gravely ill and your life expectancy is short, a living annuity is likely to be a better option for you.

A combination of a guaranteed life annuity and a living annuity (hybrid annuity) could be a good solution, even if you retire with a sizeable nest egg.

Guaranteed life annuities can be structured in several different ways to allow for spouse’s pensions and a lump-sum payout to beneficiaries if you die during a guarantee period.

If you opt for a living annuity, consider the ongoing requirement to make decisions regarding underlying investments and the draw-down rate. Initially, this may not seem like a burden, but as you get older, the process may become more challenging and the financial adviser who first helped you may no longer be around.

As you age, the risk of dementia increases, which may result in poor investment decisions. Having a base level of guaranteed income for life mitigates these risks.

Can theFund invest in my investment of my choice likeStudendAccomodation and how to remove a Trustee who use Drugs Legally?

When you want this plan can they alowe you at your work when you going on pention

Thank you for this very interesting article. Makes me think that my financial adviser steered me into the wrong direction. My pension is split into three living annuities. Surely at least one should be a life annuity.

Question: Can one move a living annuity to a live annuity with a different company?

You can transfer a living annuity to another provider. Check the T&Cs for cost implications (both for the fund you are leaving and the one you are joining); some funds charge initial admin and advice fees. A living annuity can be converted to a life annuity.

Yes- you are free to transfer at no penalty cost- and you can do this yself

Switching from living to life annuity? Yes, you may.

Mr. Muller, Please contact me, I will gladly assist you with any questions you have.

marius.swart@liblink.co.za