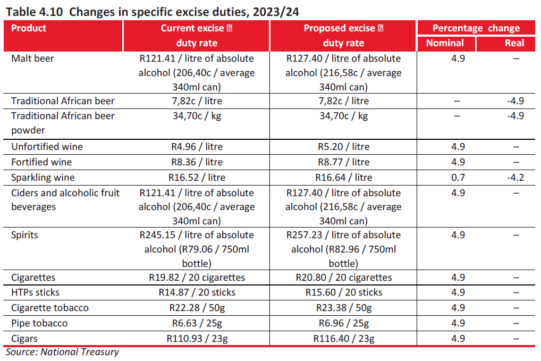

Drinkers and smokers will fork out nearly 5% more in levies to indulge in their favourite tipple or take a puff from 1 April.

The 4.9% rate increase will add the following rands-and-cents costs to booze and smokes:

- Malt beer: 10c per 340ml can

- Unfortified wine: 18c per 750ml bottle

- Fortified wine: 31c per 750ml bottle

- Sparkling wine: 9c per 750ml bottle

- Ciders and alcoholic fruit beverages: 10c per 340ml can

- Spirits: R3.90 per 750ml bottle

- Cigarettes: 98c per packet of 20

- Heated tobacco product sticks: 73c per packet of 20

- Cigarette tobacco: R1.10 per 50g

- Pipe tobacco: 33c per 25g

- Cigars: R5.47 per 23g

The excise rate for traditional African beer (and beer powder) remains unchanged, at 7.82c a litre or 34.7c per kilogram.

Health promotion levy

On the subject of beverages, National Treasury said there will be no increase in the health promotion levy (also known as the sugar tax) in 2023/24 and 2024/25.

However, Treasury said the government will soon publish a discussion paper on proposals to extend the levy to pure fruit juices and to lower the four-gram threshold. The threshold means the first four grams of sugar per 100ml do not attract any tax. Thereafter, the levy applies at a rate of 2.31c per gram.

Treasury said it has stayed an increase in the levy for the next two years to enable stakeholders in the sugar industry “to restructure”, given the challenges from greater regional competition, and the effects of recent floods and the July 2021 unrest.