DataEQ’s 2024 South African Banking Sentiment Index has placed Discovery Bank first overall, ranking first in both operational performance and reputational performance.

The index provides an in-depth look at how consumers perceive the country’s eight biggest banks and is based on a dataset of more than 3.3 million public social media posts between 1 September 2023 and 31 August 2024.

The assessment includes Absa, African Bank, Capitec, Discovery Bank, First National Bank, Nedbank, Standard Bank, and TymeBank.

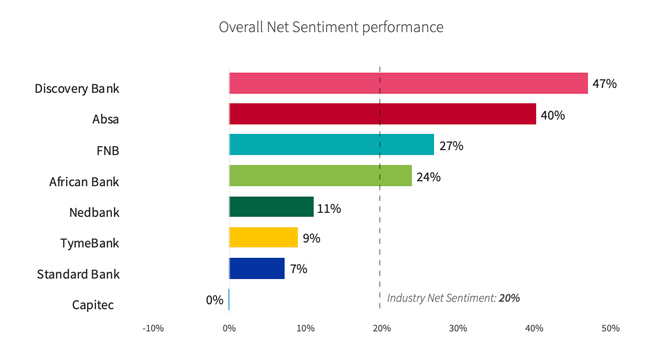

According to the report, banking is the best-perceived industry compared to the insurance, retail, and telecommunication sectors. The net sentiment (derived from the balance of positive and negative social media mentions) towards banks dropped from 24% in 2023 to 20% in 2024. However, sentiment towards the big banks is higher than it is towards retailers (9%), insurers (4%), and network providers (-19%).

Discovery Bank emerged with the most positive overall sentiment score, which increased from 40% in 2023 to 47% in 2024.

The index also showed that Discovery leads the industry in operational sentiment, moving up two places since last year. Operational net sentiment refers to conversations about a bank’s products or services, as well as customer feedback or requests for assistance.

“Discovery Bank’s praise ranged from enquiries and expressions of interest in bank accounts and credit cards to thanking staff for good service. Additionally, customers mentioned Vitality rewards benefits and commended the bank’s security. A notable amount of operational praise was driven by brand posts that encouraged customers to share positive experiences with the bank,” the report says.

Reputational sentiment is another area where Discovery Bank took the top position, moving up five places since 2023. Reputational net sentiment refers to consumer or media conversations that are not directly tied to the customer’s journey with the brand. It encompasses discussions about sponsorships, campaigns, and other content that influence the brand’s reputation.

“Discovery Bank was publicly praised both on social media and in the press for its achievements, including winning the best consumer solution award at the MTN Business App Awards, successful product launches, partnerships, and community initiatives. Discovery Bank’s innovations, such as personalised home loans with dynamic rates and Vitality Money and flight rewards, also received praise from consumers and media.”

Absa was also saw a major climb in net sentiment, from 37% to 40%, taking second place.

Capitec was the only other bank to see an improvement in its net sentiment score, from -0.1% in 2023 to a neutral 0% in 2024. The net sentiment score of all the other banks tracked in the assessment fell, although they remained positive overall.

FNB experienced the biggest drop, from first place in 2023 (42%) to third place, with 27%. Nedbank also saw a significant drop (from 24% to 11%), while Standard Bank, TymeBank, and African Bank saw smaller declines.

The biggest drivers of positive sentiment were product features linked to savings options, reward programmes, and user-friendly digital banking tools. Secure digital transactions and advanced mobile app functionalities further boosted sentiment.

The biggest detractors were fraud-related issues, with customers reporting unauthorised transactions, missing funds, and limited or slow resolution from support teams. Technical issues and account access challenges were also common. Inconsistent reward fulfilment, unexpected deductions, and perceived high fees further impacted net sentiment.

Customer service challenges remain

Customer service remains a significant pain point, with more than 60% of related conversations reflecting dissatisfaction. Common complaints included long response times, unresponsive service channels, and staff competency issues, particularly in call centres.

FNB was the only bank to achieve a positive net sentiment for customer service.

Sarah Lamb, the banking lead at DataEQ, commented: “Campaigns have been incredibly effective in generating positive sentiment, but they are not a substitute for addressing operational issues. While they create a temporary uplift, customer frustrations – particularly regarding service quality – resurface when the promotional spotlight dims.”

Governance issues also emerged as a critical area of concern, with more than a quarter of industry “priority conversations” containing a risk theme. Of this, 54% were linked to perceived downtime issues, including app outages and delayed transactions, significantly impacting customer trust.

Fraud conversations were also a major driver of industry risk, with 14% of all risk-related discussions referencing fraud complaints, including unauthorised transactions and delays in query resolution.

The lack of compliance with Treating Customers Fairly principles, particularly regarding performance and service issues, further underscored governance vulnerabilities across the industry.

“The governance challenges revealed in this year’s report present a significant risk to the market. Operational downtime and unresolved fraud issues not only undermine customer trust but also expose banks to potential regulatory repercussions. Addressing these systemic issues is essential for ensuring long-term stability and maintaining the industry’s hard-earned positive reputation,” Lamb concluded.