A survey commissioned by US-based data analytics company Fico has cast aspersions on the honesty of South Africans when it comes to insurance claims and loan applications.

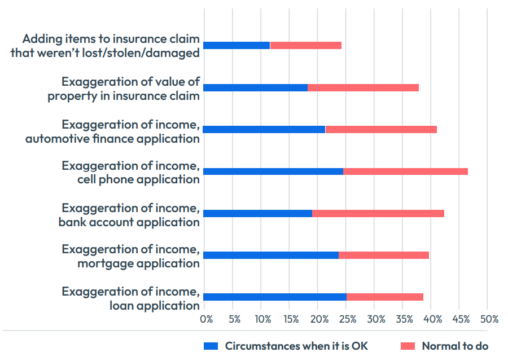

About 40% of South Africans say it is acceptable in some circumstances or normal behaviour to exaggerate income when applying for a loan or to inflate an insurance claim. This is one of the findings of an online survey of 1 000 South African adults conducted by an independent research company in August.

The project surveyed about 14 000 consumers in 14 countries about their preferences and attitudes towards fraud protection when doing business with financial institutions.

Less than 25% of South Africans surveyed said they would add items to an insurance claim that were not, in fact, lost, stolen or damaged. However, almost 40% of respondents said they saw no problem with inflating the value of a property in an insurance claim.

More than 45% found it acceptable – and in some cases normal – to exaggerate their income when applying for a cellphone.

More than 40% of respondents thought it was acceptable to exaggerate their income when applying for a bank account or vehicle finance.

“Many South Africans are experiencing a rise in the cost of living and might consider that they can ease their circumstances by falsifying information in applications for credit,” said Michelle Beetar, who heads Fico’s operations in Africa. “However, this misrepresentation is fraud.”

A cumbersome process will drive away customers

Customers must engage with fraud protection and security when they open a new account or when they use an existing account. The increased need to stop fraud and to provide more security through the rollout of initiatives such as 3D Secure 2 means that people are seeing fraud checks more frequently, and it is impacting their willingness to open and use some accounts, according to Fico.

Of those surveyed, 66% said that identity checks when they make an online purchase using their cards have increased over the past year, and 65% said identity checks have increased when they log in to their bank accounts.

Fico said South Africans surveyed expect the application process to be fast: 77% of respondents said it should take less than 30 minutes to open a personal bank account.

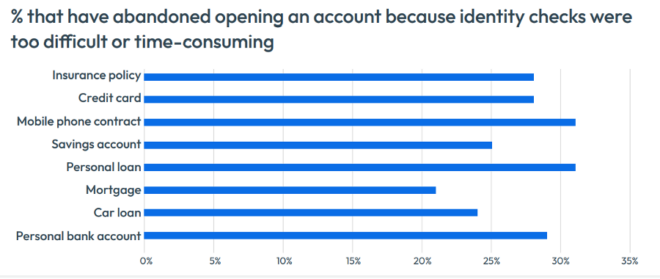

The survey found that consumers will abandon the application if the identity verification process is too difficult or time-consuming.

Once accounts are open, identity checks can still have an impact. Nearly one in four people surveyed (23%) said they have reduced or stopped use of their personal bank account because of identity checks, and 25% said the same about their credit cards.

“Each customer interaction has a different risk profile which is influenced by behavioural signals, the ability and willingness of customers to use various authentication methods, the value of the transaction and the financial institution’s own risk appetite,” said Beetar. “Financial services providers need to be able to take a flexible approach that doesn’t put too many barriers in the way of legitimate customers, but equally doesn’t lower fraud defences.”

Biometrics is a popular choice

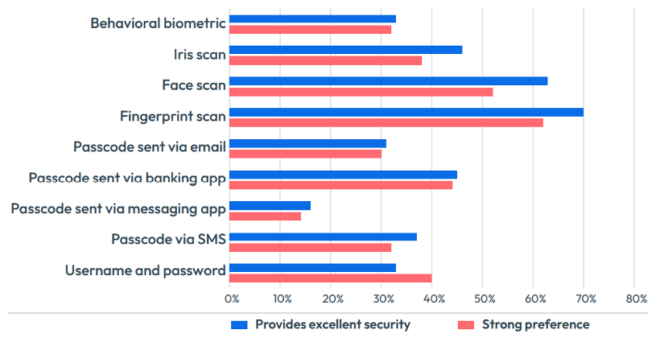

Respondents were asked about their preferences when it comes to account security methods. Biometric methods are popular security choices: 62% have a strong preference for using a fingerprint scan, 52% a face scan and 38% an iris scan.

When it comes to receiving one-time passwords (OTPs), 38% rate receiving an OTP by SMS as excellent for security, compared to 45% who believe receiving an OTP through their banking app provides excellent security and 16% who rate WhatsApp as excellent for security.

Fraud protection can be a drawcard

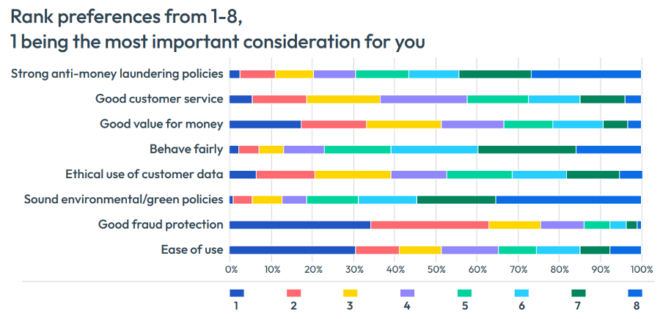

Businesses might consider anti-fraud measures to be nothing more than unavoidable overhead, but Fico said the survey suggests that anti-fraud measures are vital for attracting new customers and building trust.

Participants were asked to rank eight key considerations for selecting a new financial account provider. Good fraud protection was ranked the top consideration by 34% of South Africans, while 76% included it in their top three considerations.

“This suggests that financial institutions that can effectively communicate a focus on fraud protection will have a competitive advantage,” according to Fico.

Ease of use in accessing their banking services was selected as the top criterion for 31% of respondents. Sound environmental and green policies were a top consideration for only 1% of respondents, while 35% ranked it last.

More think they have been victims of identity theft

According to the survey, 7.2% of South African respondents said they know their stolen identity has been used by a criminal to open a financial account. This is a significant increase from 4.6% in Fico’s 2020 survey.

In percentage terms, these figures may seem low, but when they are equated to the number of victims, the scale of the problem becomes more alarming; 7.2 percent of the South African adult population is more than 2.7 million people.

An additional 6.9% said they thought it likely that their identity has been used to open an account fraudulently.

“With almost a quarter of South African respondents feeling that it’s possible or likely that they been the victims of identity theft, financial institutions have an important role to play in establishing trust,” Beetar said. “Those who can demonstrate good practices that prevent fraudsters and money-launderers from opening accounts could enhance their reputation.”