“I was kind to myself when I needed to be, and I was hard on myself when I knew I could handle it. I also had a strong ‘why’. If you know why you are doing something, you will find a way.”

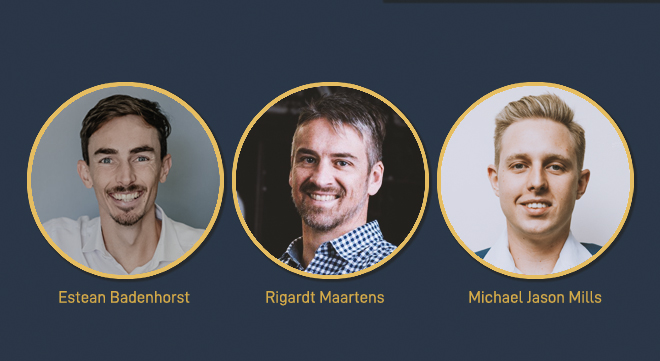

These are the words of Estean Badenhorst, a 29-year-old wealth adviser at PSG Wealth Pretoria, who embodies determination and focus.

This year, Badenhorst not only represented South Africa in Japan at the World Para Athletics and in Paris for the Paralympics but also excelled academically. He completed the Postgraduate Diploma in Financial Planning at Moonstone Business School of Excellence (MBSE), earning the title of valedictorian – all while working full-time.

“I had a jam-packed year… I realised that I had to plan and execute my plans in order for me to achieve any of the goals I set out to achieve,” he says.

His disciplined mindset mirrors that of other top achievers in the qualification.

Take Rigardt Maartens, a 49-year-old stockbroker and financial adviser at PSG Wealth Roodepoort. Maartens successfully completed his Postgraduate Diploma while balancing his responsibilities as a husband and father of two children, whose sports and extracurricular activities – often involving tours across the country – kept him on the move. An enthusiastic cyclist and swimmer, Maartens attributes his ability to manage these demands to the flexibility offered by the course’s online format.

“I was very dedicated to finish my studies successfully, so it took a lot of self-discipline and motivation from my wife to study on our trips. I had the best support network from my family, so that made it possible for me to work, study, sport, and play,” he shares.

Michael Jason Mills, a 23-year-old junior financial adviser at Dotport Capital, offers yet another perspective. Mills tackled the qualification in one year while working full-time. Despite the challenges, he persevered through long hours.

“I tried to find a balance by studying at night after work and then again early in the morning. I also studied most Saturdays and Sundays. The company I work for assisted a lot with study leave before every test and exam, which helped a lot,” he explains.

Mastering holistic financial planning

The NQF Level 8 Postgraduate Diploma is the final educational step in the journey to becoming a CERTIFIED FINANCIAL PLANNER® (CFP®) professional. Completion of this diploma enables students to meet the educational requirements to apply for the CFP® professional designation through a capstone programme with the Financial Planning Institute of Southern Africa (FPI). Admission requires an NQF Level 7 qualification. For students who don’t meet this requirement, MBSE’s Recognition of Prior Learning (RPL) pathway can help. It’s tailored for professionals with five years of relevant experience in the financial services industry and an Advanced Certificate in Financial Planning (ACPF), offering students a chance to bridge the gap and pursue this Postgraduate Diploma, which provides the underlying educational requirements to become a CFP® professional candidate.

For Badenhorst, an inherent drive to expand his understanding of financial planning was key to his decision to enrol at MBSE. Prior to completing the Postgraduate Diploma, he completed Class of Business for Pension Fund Benefits and for Structured Deposits through the online learning platform.

“I chose Moonstone over other institutions because the curriculum looked more enticing, their communication before enrolling was world-class, and the pricing was competitive,” he explains.

Maartens, who embarked on his academic journey during the Covid-19 pandemic in 2020, leveraged his time to upskill. He began with the Higher Certificate in Wealth Management (HCWM), and progressed to the ACFP.

Maartens, who was one of the top three ACFP students 2022, went on to pursue the Postgraduate Diploma.

“I then spoke to Edel Goldbach, MBSE’s academic manager, and she encouraged me to do the RPL and then the Postgraduate Diploma afterwards,” Maartens recalls.

For Mills, the decision to pursue this qualification was rooted in his passion for the financial sector, which blossomed during his studies at the University of Pretoria.

Mills reflects: “I saw that the best way to go about it to ensure you deliver quality service and advice to clients is to become a CFP. I then decided to study through Moonstone specifically because I did all my Class of Business training through Moonstone and I liked how their systems work, how easy it is to get assistance, and just the general professionalism of the organisation. They also provide very high-quality education and comprehensive resources.”

The Postgraduate Diploma comprises four compulsory modules: financial planning environment, personal financial planning, corporate financial planning, and a case study. Each module offers a unique contribution to professional practice, but students have their preferences.

Badenhorst found the case study module particularly impactful. “It taught me how to think holistically. Whenever you sit with a set of facts from a client, you need to know what the consequences and unintended consequences of a decision will be. As a professional financial adviser, you need to be able to paint a detailed picture and remain dynamic to assist clients with their financial circumstances.”

Similarly, Maartens highlighted the case study module, alongside personal financial planning, which he found invaluable for practical application. “You learn and do a lot of practical case studies of the industry I am working in,” he says.

For Mills, the personal financial planning module was the most helpful in his current role. However, he emphasises the interconnectedness of the curriculum. “It must, however, be stated that they are all invaluable and without the basics of the rest of the modules the entire puzzle would not come together. The financial planning environment module sets a very good base to work off of.”

Balancing discipline and flexibility: strategies for success in online learning

Online learning demands considerable self-discipline, says Goldbach. She emphasises that the extensive material can be overwhelming, and students often misjudge the weekly time commitment required for effective study.

Each student navigates these challenges differently. Badenhorst highlights the importance of adaptability in managing a demanding workload. “With my work and international participation, I took whatever time I could find to study. This meant studying late some nights or early mornings. I studied a lot on airplanes and in airports.”

He says his biggest driver was his self-discipline to not go on Instagram or Facebook when he had an hour or so of free time, and study instead.

His advice to prospective students is to focus on application rather than rote learning. “Don’t just study or memorise the work. You need to be able to take a set of facts and apply it to three or four scenarios that will have different outcomes. This will assist you to think holistically,” he says.

Maartens adopted a structured approach, building momentum with consistent daily study. He credits his earlier qualifications for laying the groundwork for his postgraduate studies.

“I made time almost every day, even if it’s just a minimum of half an hour, to keep me motivated and going. There were days with the case study exam preparation that I studied for more than 14 hours on certain weekends. I keep a record of my study times, as I am very analytical, so that also motivated me,” he says.

For those considering the Postgraduate Diploma, Maartens recommends completing the ACFP first. “The ACFP helped me a lot to gain knowledge that was necessary and made it easier to handle the enormous workload of PGDip. As I gained proper background knowledge in ACFP, it saved a lot of time when I studied for the PGDip,” he explains.

In contrast, Mills took a flexible approach, eschewing rigid schedules to avoid unnecessary stress. “There is a lot to cover. I did not have a study schedule, and I’ve never really used one, even in high school or university,” he shares.

Instead, Mills prefers to prioritise tasks and study whenever possible. “I usually just jot down what I need to study and start with the most important first. If I don’t study for a week or two, it’s fine because I don’t feel under pressure or like I’m behind; I just keep calm and continue when I get the chance.”

Despite the course’s challenges, Mills believes it is immensely rewarding. He urges prospective students to remain undeterred by its difficulty.

“The satisfaction you have after successful completion is one of the best feelings in the world. There are also a lot of advisers out there, and you need to stand out above the rest, and this is a very good way to start differentiating yourself from the rest of the pack. Just be prepared to work hard and put in the time. It is not impossible, but it is not easy,” he says.

“Also, don’t be afraid to ask for help. The staff is very helpful, and lecturers go out of their way to assist.”

2025 enrolments are open

Applications for the first semester are now open and close on Monday, 27 January 2025.

The Postgraduate Diploma in Financial Planning is one of five accredited qualifications offered by MBSE. The others are:

- Advanced Certificate in Financial Planning (NQF 6)

- Occupational Certificate: Compliance Officer (NQF 6)

- Higher Certificate in Wealth Management (NQF 5)

- Higher Certificate in Short-term Insurance (NQF 5)

Apply today at www.mbse.ac.za.

For more information, contact us at help@mbse.ac.za.