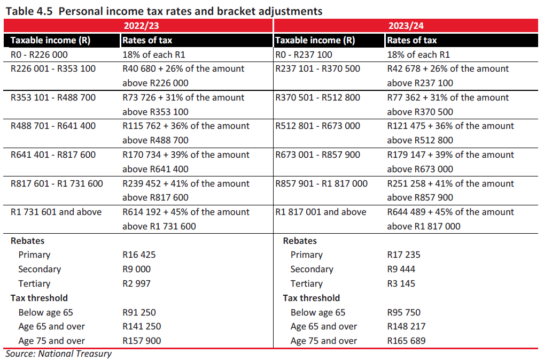

The income brackets for personal income tax will be adjusted by 4.9% in the 2023/24 tax year. National Treasury said in the Budget Review that the adjustment was line with the “expected inflation rate”.

As a result, if your salary increase did not exceed 4.9%, you should not be bumped into a higher tax bracket and pay more of your income in tax.

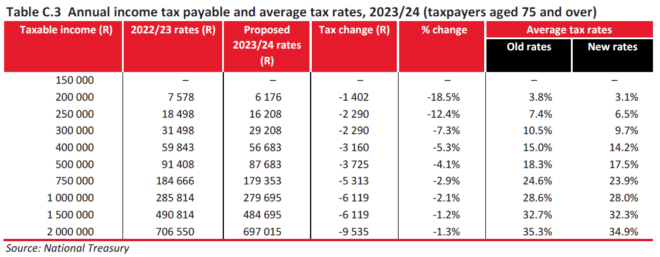

The annual tax-free threshold for a person under the age of 65 will increase from R91 250 to R95 750 (about R7 979 a month). People over 65 will be able to earn R148 217 a year (about R12 351 a month) before they will be liable for tax. If you are over 75, the tax threshold is R165 689 a year (about R13 807 a month).

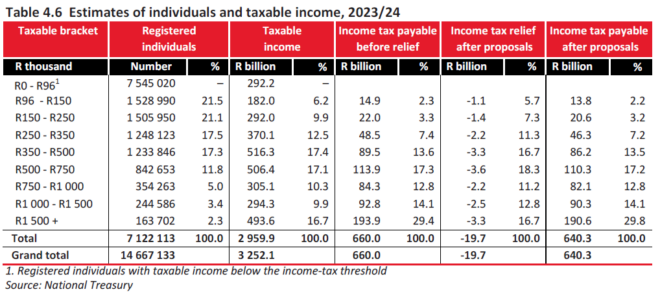

Treasury said it will forfeit revenue of about R15.7 billion because of the adjustment.

Medical tax credits for medical scheme members will increase from R347 to R364 a month for the first two members, and from R234 to R246 a month for additional members.

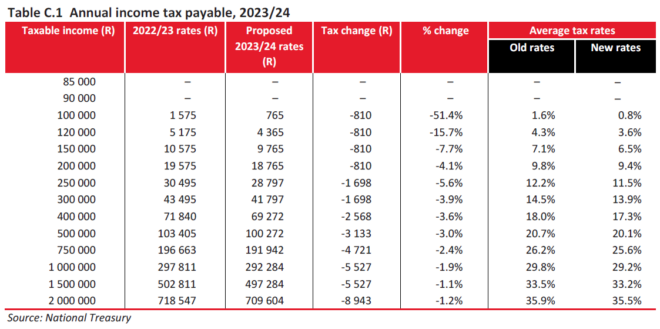

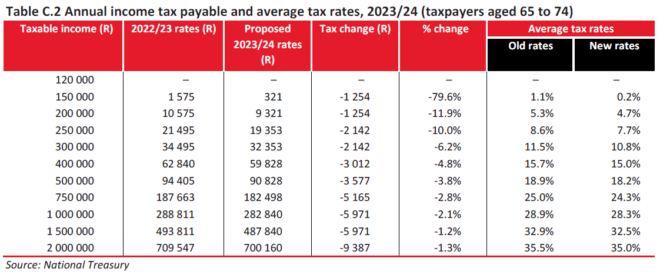

The following tables show the impact of the adjustment on the tax bill of taxpayers below age 65, those aged 65 to 74, and those aged above 75.

Taxes that stay the same

No changes were announced regarding the following:

• Estate duty remains 20% on dutiable estates up to R30 million and 25% of the value of estate above R30m. The estate duty abatement or exemption remains R3.5m.

• Donations tax remains at 20% on taxable donations up to R30m and 25% of donations over R30m. The first R100 000 of property donated is exempt from donations tax.

• The capital gains tax annual exemption remains R40 000 and the exemption in the year of death remains R300 000. The inclusion rate for individuals remains 40%, making the maximum effective rate for those on the highest marginal tax rate 18%.

• Dividends tax remains at 20%.

• The interest exemptions remain at R23 800 for individuals under the age 65 and R34 500 for those over the age of 65.

No new taxes – for now

In the Budget Review, Treasury indicated its opposition to higher tax rates to cover expected revenue shortfalls.

“Between 2015 and 2020, substantial revenue shortfalls and lower economic growth, which had not fully recovered since the global financial crisis, necessitated increases in tax rates to create a sustainable fiscal position. However, growth and revenue collections continued to disappoint. Since the 2020 Budget, government has avoided further increases in tax rates.

“Tax increases are often put forward as the natural response to cover expected revenue shortfalls, but in a highly unpredictable or low-growth economic environment, such increases carry significant risks. Research in South Africa – including two United Nations University World Institute for Development Economics Research papers – has indicated that tax increases can impede economic activity and the negative impact is more pronounced when growth is weak. For this reason, government intends to avoid tax increases while the economy is recovering from recent shocks,” Treasury said.

The above statement suggests that Treasury is not only opposed to increasing the tax rates, but also opposed to introducing new taxes, such as a wealth tax.