Budget 2023 proposed tax incentives for businesses and individuals who produce renewable energy, to bring additional energy capacity onto the grid and achieve energy security in the long term.

National Treasury has yet to publish the amendment bills that will set out the specific requirements to qualify for these incentives.

When it comes to the incentive for individuals, the only concrete information we have to date is National Treasury’s three-page FAQ document. And the Budget Review devotes an eight-line paragraph to the incentive for businesses.

I spoke to Phillip Joubert, the manager of the Centre of Tax Excellence at the South African Institute of Professional Accountants, to obtain more clarity and identify what we still need to know about both incentives.

A previous article looked at the solar incentive for individuals.

Read: A deeper look at the solar panel tax incentive for individuals

This article addresses the proposals to expand the existing incentive that applies to renewable energy assets used for the purpose of trade.

What is the section 12B incentive?

National Treasury is proposing to expand, for limited period, the tax incentive available for businesses in terms of section 12B of the Income Tax Act.

Section 12B(1)(h) provides for a deduction in respect of the cost of machinery, plant, implements, utensils, or articles used in the generation of electricity through renewable sources.

The following types of renewable energy generation projects qualify for the deduction:

- Wind power;

- Photovoltaic (PV) solar energy of more than 1 megawatt (MW);

- PV solar energy not exceeding 1MW;

- Concentrated solar energy;

- Hydropower to produce electricity of not more than 30MW; and

- Biomass generation comprising organic waste, landfill gas or plant material.

The qualifying renewable energy assets must be:

- Owned by the taxpayer or acquired by the taxpayer in terms of an instalment credit agreement, as defined in the Value-added Tax Act; and

- Brought into use for the first time as part of the taxpayer’s trade.

The deduction also applies to any improvements (other than repairs) to the abovementioned renewable energy assets and to any “foundation” or “supporting structure” that is deemed to be part of them.

The capital allowance for the cost of the renewable energy assets is spread over three years: 50% of the cost in the first year, 30% in the second, and 20% in the third. However, an exception is made for PV solar energy not exceeding 1MW, which is fully deductible in the first year of expenditure.

How will the incentive change?

The Budget proposes to expand the incentive in two key respects:

- The allowance will not be subject to any generation thresholds; and

- The full cost plus 25% – in other words, 125% – of the renewable energy assets will be deductible in the first year.

However, the adjusted incentive will be available only for renewable energy assets brought into use for the first time between 1 March 2023 and 28 February 2025.

What qualifies as a ‘business’?

The section 12B allowance is often referred to a tax incentive for businesses. One of the criteria to qualify for the allowance is that the renewable energy assets are brought into use for purpose of a taxpayer’s “trade”.

Joubert said “business” is not defined in the tax legislation, but “trade” is.

In terms of section 1 of the Income Tax Act, “trade” includes every profession, trade, business, employment, calling, occupation or venture, including the letting of any property and the use of or the grant of permission to use any patent as defined in the Patents Act, or any design as defined in the Designs Act, or any trade mark as defined in the Trade Marks Act, or any copyright as defined in the Copyright Act, or any other property of a similar nature.

Therefore, a taxpayer who engages in any of the above – whether as a legal entity, trust, partnership, or sole proprietorship – should qualify for the allowance, Joubert said.

What kind of saving can a company achieve?

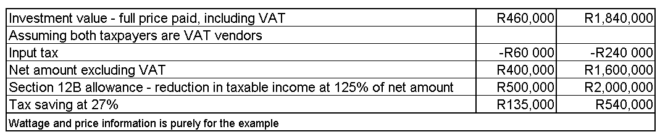

Joubert provided the following example of the savings companies can achieve if they invest in renewable energy projects that generate 1 200 Watts and 5 000W, respectively.

Based on the example, and assuming both taxpayers are registered VAT vendors, input tax can be claimed in the vendors’ next VAT return, providing immediate cash relief on the amount to be paid to the South African Revenue Service (Sars), or it may result in a refund.

The tax benefit each taxpayer will receive, including the input VAT, is about 42% of the total cost of the investment, Joubert said.

Small business corporations: section 12B vs 12E

Small businesses with an annual turnover of up to R20 million may qualify to pay income tax according to a sliding scale instead of the flat corporate income tax rate of 27%. Only legal entities – companies and close corporations – may qualify as SBCs.

Section 12E(1) of the Income Tax Act allows a taxpayer who owns an SBC to claim a tax deduction for plant or machinery acquired for the purpose of trade. The deduction is spread over three years in the 50/30/20 ratio.

If an SBC instals, say, a solar PV system, a conflict may arise between the expanded section 12B and section 12E. Under section 12E, the SBC will be allowed to claim the installation cost over three years, which will defeat the purpose of the changes to section 12B, and section 12B should get preference, Joubert said.

Hopefully, the legislation will clarify that entities that Sars regards as SBCs will not be precluded from using the section 12B allowance.

Are micro businesses excluded?

Another area that National Treasury needs to clarify concerns micro businesses, which are businesses with an annual turnover of R1m or less, Joubert said. Micro businesses pay tax on a sliding scale based on their turnover.

The Sixth Schedule to the Income Tax Act does not generally allow for any deductions, expenses, losses, or allowances to be claimed against taxable turnover. Joubert said this raises the question whether these taxpayers are automatically excluded from the section 12B allowance.

He said if an individual taxpayer operates a qualifying micro business (and is registered as such with Sars) from his or her primary residence, there seems to be an indication that the taxpayer will qualify for the individual solar incentive. However, this will depend on the circumstances of each case, Joubert said.

As with the incentive for individuals, we will have to wait for the legislation to clear up any uncertainties over the expanded 12B allowance. Taxpayers who want to take advantage of the allowance should obtain advice from a qualified tax expert, to ensure they qualify for it.

Hi

This is such a helpful thought provoking article. A great help to us smaller practices giving reassurance to our own interpretations.

Thank you!