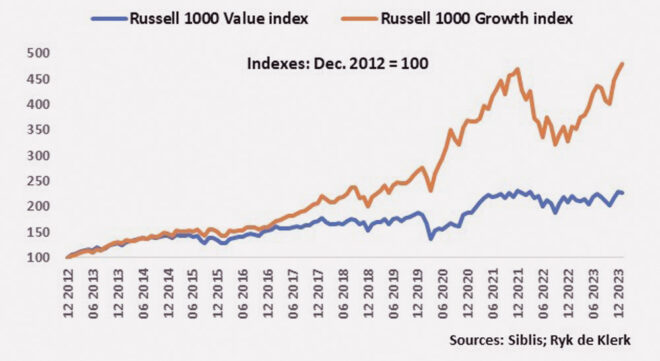

The resurgence of growth stocks continues, with the Russell 1000 Growth Index not only erasing the 31% drawdown over the nine-month period from an all-time high in December 2021 to September 2022, but also reaching new highs as the index gained more than 48% since the September 2022 lows.

The Russell 1000 Growth Index is perhaps the purest broad index to follow and analyse US growth stocks. The index includes US companies with relatively high price-to-book ratios and relatively higher historical and forecast earnings growth metrics. It is reconstituted annually. Information technology (44%), communication (11%), and consumer discretionary (16%) are the largest sector exposures.

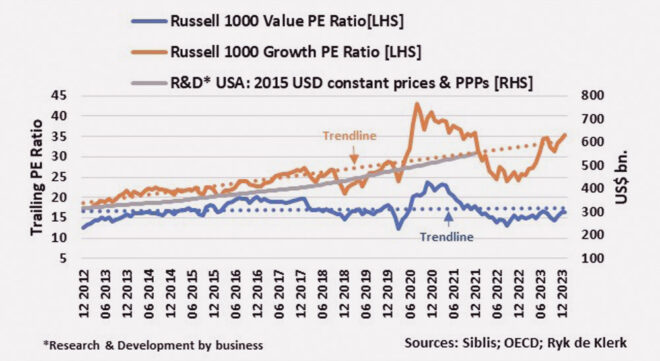

Although the Growth Index is trading at new highs, the current price-to-earnings (PE) ratio, based on 12-month trailing earnings, is about 36, which is still at a discount compared to the all-time high of 43 times earnings reached in September 2021.

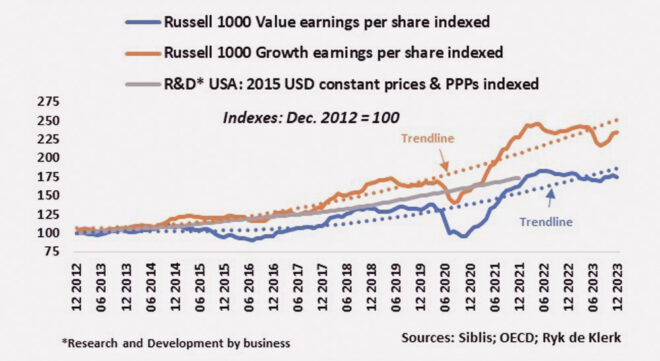

The stellar performance of growth stocks since 2012 is remarkable. The capital growth (price growth) of the Russell 1000 Growth Index was 14.5% a year, driven by growth of 8% in earnings per share and ratings (PE) growth of 6.5% a year.

The high PE multiples of growth stocks have always been highly debatable among investors, financial advisers, strategists, and fund managers. Yes, the value versus growth issue. To be honest, investing in value stocks can be boring.

The Russell 1000 Value Index includes US companies with relatively lower price-to-book ratios, and lower historical and forecast earnings growth metrics. Financials (22%), health care (15%), and industrials (14%) are the largest sector exposures.

The capital growth (price growth) of the Value Index since 2012 was 7.8% a year, driven by growth of 5.2% in earnings per share and ratings (PE) growth of 2.6% a year. The long-term trend in the PE of the Value Index is basically flat, averaging about 17 times, and ranging between 24 and 16 on the upside and downside, respectively.

From the accompanying graph, it is evident that the Growth Index’s PE ratio is slap bang on the rising long-term trendline, while the Value Index’s ratio is on the flat long-term trendline. It is also noteworthy that the PE ratio of the Growth Index relative to the Value Index is two times, and the long-term earnings growth of the Growth Index is 1.5 times that of the Value Index.

The next stage of the global economic cycle, including the United States, calls for easier monetary policies and stronger economic growth, which, from a profit growth perspective, is likely to favour value, specifically cyclical stocks and may lead to the latter outperforming growth stocks pricewise.

From a longer-term perspective, the question is whether and to what extent the re-rating (growth in PE ratios) of growth stocks will continue.

R&D drives re-rating of growth stocks

In my opinion, the thrust behind the re-rating of growth stocks since 2010 was and still is new technological advancements and innovation through research and development (R&D).

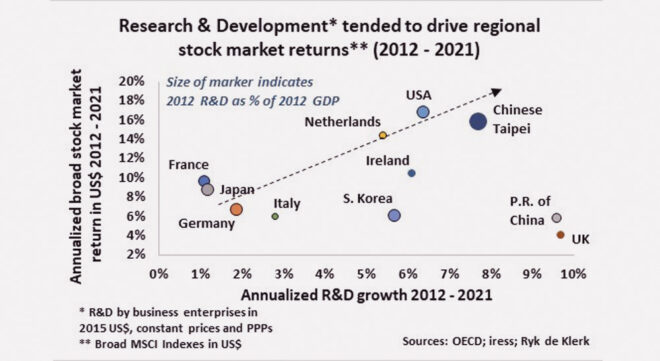

My analysis indicates that the size and growth of R&D expenditure by the business sector in a country tended to drive the respectective stock market returns from 2012 to 2021. Trade restrictions, government policies, and other factors had a major impact, though. I found it interesting to see the extent to which France, Germany, and Japan – three of the major economies – lagged the US, China, and the United Kingdom in terms of R&D growth.

I do not think it is surprising that the annualised re-rating growth rate (PE ratio growth) of the Russell 1000 Growth Index matched the annualised 6.4% growth in inflation-adjusted R&D expenditure by the US’s business sector from 2012 to 2021.

It is also evident that growth in US R&D in real terms underscores the superior growth in the earnings per share of the Growth Index relative to the Value Index.

It is just logical to assume that at some stage the growth in the Growth Index’s PE will level off. However, it seems the PE ratio of the Russell 1000 Growth Index may revisit its 2020 highs at some stage in the next two years.

According to PC Magazine, the 2010s was the decade in which artificial intelligence (AI) went mainstream. Yes, the rise of smartphones, 4G, Tesla, Apple’s numerous applications, to name a few. The 2020s started with technological breakthroughs with the Covid-19 pandemic, through to intensified AI in 2021/22, with chatbots and others. Who knows how deep the learning will be?

There will be times when the ratings of growth stocks will reach exuberant levels and others when sell-offs lead to exceptional opportunities, because drawdowns in growth stocks tend to be more vicious than those in value stocks.

Growth stocks will always be a cornerstone of my investment portfolio because R&D drives future growth.

Which stocks to hold? I take seriously the advice of Charlie Munger, the late billionaire investor and vice-president of Berkshire Hathaway – specifically when it comes to tech stocks. According to Daily Investor, Munger said, “fewer and fewer people should try to pick stocks, and instead should not do anything other than invest in index funds”.

Yes, ignore growth stocks at your peril.

Ryk de Klerk is an independent investment analyst.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies. The information in this article does not constitute investment or financial planning advice that is appropriate for every individual’s needs and circumstances.

Very topical article, and a sensible conclusion.