A decision by the Insurance Sector Education and Training Authority (Inseta) has enabled Moonstone Business School of Excellence (MBSE) to continue offering its FETC Short-term Insurance (NQF 4) and FETC Wealth Management (NQF 4) qualifications to prospective students.

Monique Brummer, operations manager of MBSE, explains that initially, all legacy (pre-2009) qualifications could only enrol their last students until 30 June 2024. However, a directive on the implementation and transitional arrangements for pre-2009 qualifications (under the South African Qualifications Authority Act) issued by the Quality Council for Trades and Occupations (QCTO) and published in the Government Gazette on 3 June called for these qualifications to extend the learner enrolment date for a year or a maximum two years.

“MBSE was prepared to begin the teach-out process. However, the directive was issued last week because a QCTO variant of the qualifications is not yet ready for enrolment,” says Brummer.

Inseta issued a stakeholder communiqué dated 19 June, clarifying the implications of the directive.

In the document, Inseta confirms that the directive replaces the pre-2009 arrangement, and it has decided to extend the registration of first-time learners for existing legacy qualifications by 12 months. Inseta states that the deadline for all learners to complete legacy qualifications remains unchanged: 31 June 2027.

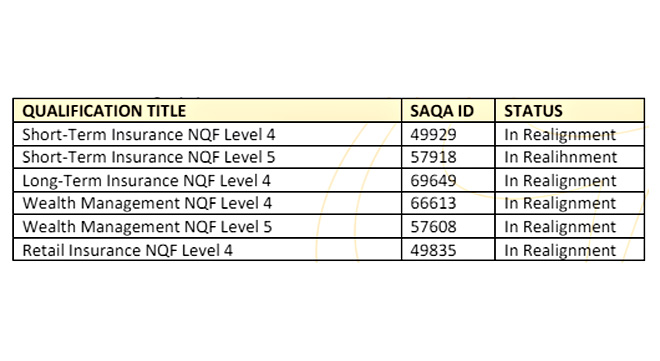

Affected Inseta legacy qualifications that have been extended include:

According to the announcement, Inseta has extended the accreditation of Skills Development Providers (SDPs) until 30 June 2027, to allow for the registration of learners. This extension applies only to SDPs with active learner enrolments. Individual letters of extension will be sent to these SDPs.

Additionally, the registration of active assessors and moderators linked to SDPs delivering legacy qualifications will also be extended until 30 June 2027. These assessors and moderators will receive individual letters of extension.

“MBSE is grateful that we can still offer the NQF 4 qualifications to prospective students, because there would be no option for them in the absence of a QCTO replacement,” says Brummer.

Pathway to further qualifications

The online learning platform has been offering its FETC (Further Education and Training Certificate) qualifications for more than 15 years. These entry-level qualifications provide a pathway to further qualifications.

There are no pre-requisites to apply for MBSE’s two FETC NQF 4 qualifications, so not having a matric certificate isn’t a barrier to obtaining a post-school qualification.

The FETC: Short-term Insurance gives students insight into the short-term insurance sector. It provides a basic understanding of the key terms, rules, concepts, and principles that will prepare you for the industry.

Once you have completed the qualification, you will be equipped to advise clients on personal or commercial lines products, while conforming to the Fit and Proper Requirements for financial services providers.

The FETC: Wealth Management provides a holistic introduction to wealth management and wealth creation, enabling intermediaries to understand the wealth management environment, the legislative requirements, and product-related information.

The qualification is aimed at students with less than four years’ experience, newcomers to the industry, or those who have lots of experience but who would like to brush up on their product knowledge.

The qualification will enable you to sell:

- Long-term Category A products (assistance policies including funeral policies), Long-term B1 and B2; and

- Risk policies and guaranteed investments/savings, recurring policies and annuities other than single-premium annuities.

Note: With either qualification, exemptions are available if maths and languages were passed in matric.

Click here for more information and to apply.

For more information, contact help@mbse.ac.za.