The exact meaning of the phrase “bona fide inadvertent error” is still open to different interpretations despite two well-publicised court cases that went from the Tax Court to the Constitutional Court.

The highest court in the country did have its say on understatement penalties, but by no means the final say. Therefore, the attitude that the South African Revenue (SARS) will take in thousands of future tax cases remains uncertain.

In the Thistle Trust judgment, the Constitutional Court admitted that the dispute over the correct interpretation raises an arguable point in law and is of obvious public importance. But it refrained from interpreting the phrase because there was no “reasoned judgment” in the preceding courts.

The court held that if SARS had a strong case in its claim for penalties (in the Thistle case), it might have been in the interest of justice to entertain the claim. However, SARS had no “sustainable case”.

Read: Constitutional Court clarifies CGT in multi-tier trust arrangements

Narrow approach

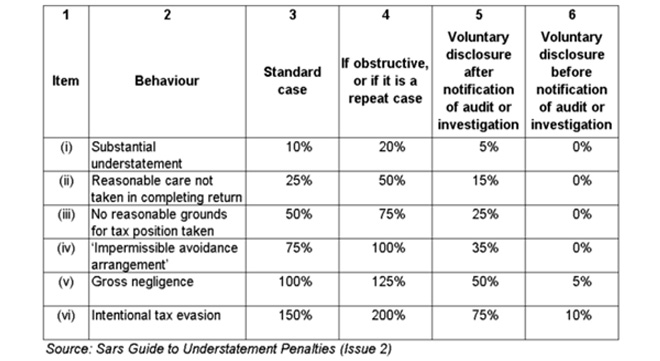

BDO associate director Esther van Schalkwyk says SARS has traditionally taken a narrow approach in interpreting the term bona fide inadvertent error. This provision in the Tax Administration Act (TAA) allows taxpayers to escape understatement penalties of between 10% and 200% of the understatement of tax.

SARS reportedly “conceded” before the Supreme Court of Appeal (SCA) in the Thistle case that the trust’s reliance on a tax opinion gave rise to a bona fide inadvertent error.

“It is questionable whether the judgment in the Thistle case handed down by the SCA created legally binding precedent on the meaning of the term bona fide inadvertent error, since SARS’s reported concession meant that the matter was not argued before the court,” Van Schalkwyk remarks.

Expert advice

She says it is perhaps understandable that even the highest courts may differ when interpreting complex legislation. However, when taxpayers, sometimes on expert advice, interpret complex legislation in a different manner to SARS, they are charged understatement penalties.

SARS spokesperson Siphithi Sibeko says tax practitioners play an important role in achieving and building a culture of tax voluntary compliance. In this regard, if a taxpayer receives legal advice with the sole intent of complying with their legal obligations, SARS will review the advice in that context.

“However, if the advice is intended to obviate and evade legal obligations, naturally an understatement penalty will be imposed based on the level of that deliberate misrepresentation.”

The judgment in the Thistle matter did not deal with a bona fide inadvertent error as contained in law and nothing has changed in that regard, Sibeko adds.

Instructive remarks

Van Schalkwyk says the Constitutional Court made some “instructive remarks” regarding the two blameworthy behaviour categories on which SARS based its understatement penalty in the Thistle case.

In relation to “no reasonable grounds for tax position taken”, the court held there were indeed reasonable grounds for the tax position taken by the trust. It was not only based on legal advice but upheld by the Tax Court in a reasoned judgment.

In relation to “reasonable care not taken in completing the return”, the Constitutional Court rejected SARS’s argument that the trust failed to take reasonable care in completing its return by not following the stated SARS position.

“In view of these remarks, a taxpayer who adopts a position contrary to SARS’s position is not automatically liable for understatement penalties. Rather, to discharge the onus resting on it, SARS must prove the facts that bring the taxpayer’s conduct within the chosen behaviour category,” Van Schalkwyk remarks.

The Constitutional Court, in the Thistle case, found: “It follows that SARS’s understatement penalties claim will fail on simple factual grounds irrespective of how this court may determine the meaning of ‘bona fide inadvertent error’.”

Full disclosure

Van Schalkwyk adds that SARS’s prior narrow view of the term bona fide inadvertent error seems to require an update. “Moreover, where taxpayers act on reasoned expert advice, SARS will not easily discharge the onus of proving the facts which bring the taxpayer’s behaviour into one of the categories required to successfully impose understatement penalties,” she says.

The value of tax opinions that comply with the requirements of the TAA should not be underestimated, she adds. If the penalty is based on a “substantial understatement”, SARS must remit the understatement penalty if the taxpayer “made full disclosure” and was, by the time the relevant return was due, in possession of an opinion by an “independent registered tax practitioner” that satisfied the requirements of the TAA.

Another requirement, says Van Schalkwyk, is that the opinion must confirm that the taxpayer’s position is more likely than not to be upheld if the matter proceeds to court.

It would also seem that the behaviour of the taxpayer would not fall into the ‘intentional tax evasion’ category, unless there was some sort of collusion between the taxpayer and the tax practitioner who issued the opinion.

In these circumstances, SARS must show that that the “arrangement” constituted an “impermissible avoidance arrangement” before it can impose an understatement penalty.

Amanda Visser is a freelance journalist who specialises in tax and has written about trade law, competition law, and regulatory issues.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies. The information in this article does not constitute financial planning, legal, or tax advice that is appropriate to every individual’s needs and circumstances.