The Special Investigating Unit’s (SIU) update on its investigation into the Road Accident Fund (RAF) has revealed significant “fruitless and wasteful expenditure” as the entity recorded a deficit of R1.6 billion for the 2023/24 financial year.

On 16 September, the Road Accident Fund (RAF) released its financial outcomes for the 2023/24 fiscal year, revealing a deficit of R1.6 billion. This adds to the already substantial accumulated deficit of R23.9 billion reported in the previous year, where the RAF recorded an R8.4 billion shortfall for 2022/23.

The RAF attributed its latest deficit primarily to not receiving an increase in the fuel levy over the past three years, despite inflation rising to 5.5% in the 2022/23 period. The fuel levy remains at 218 cents per litre.

According to the RAF, the deficit has also been impacted by the increase in claims liability when compared to the previous year.

“The increase in the claims liability during the 2023/24 financial year was mainly driven by a net increase of 12% in claims for which offers were made and not yet requested compared to the 2022/23 financial year.

“Our drive to reduce the backlog and settle claims within 120 days would have the resulting impact of increasing the claims offers not yet accepted and, therefore, also increasing the claims expenditure,” the RAF stated.

A review of the RAF’s financial outcomes shows a steady decline in the requested but not yet paid (RNYP) amount owed to claimants on settled claims. After peaking at R16.2 billion in the 2019/20 financial year, this figure has dropped to R8.3 billion in 2023/24.

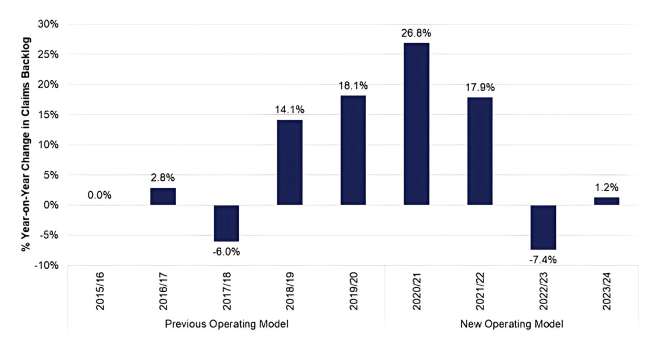

The RAF also claimed that while the claims backlog remains a challenge, the growth rate has steadily reduced.

The entity maintains that the finalisation of claims is highly dependent on the quality of claims lodged.

“Our claims report indicates that almost 80% of claims submitted for lodgement do not have sufficient information and documentation to enable the RAF to investigate the claims.”

According to the RAF, the introduction of the minimum requirement was to remedy this gap “contrary to claims that the RAF introduced onerous claims requirements”.

Some of the main reasons for non-compliant claims rejected, the RAF stated, include no certified copy of the deceased or injured ID document, no certified copy of the claimant’s ID, or RAF form 1 not being fully completed.”

‘A material uncertainty’

One day after the release of the RAF’s financial outcomes for 2023/24, the Standing Committee on Public Accounts (SCOPA) was briefed by the Auditor-General of South Africa (AGSA) on the financial performance of the RAF as well as by the Special Investigating Unit (SIU) on the investigations it has conducted at the entity.

Lwazi Kuse, senior audit manager responsible for the RAF audit, presented AGSA’s update on the RAF, focusing on the audit outcomes of 2022/23.

Nompakamo Matanzima, business unit leader at AGSA, indicated that the presentation would not include a briefing on the latest audit as the audit for 2023/24 had not yet been tabled. (It will be tabled on 30 September).

During the briefing on the 2022/23 financial year, it was noted that RAF’s total liabilities exceeded its total assets by R23.8 billion.

According to AGSA, these events or conditions “indicate that a material uncertainty exists that may cast significant doubt on the public entity’s ability to continue as a going concern”.

Further commenting on the 2022/23 financial year, AGSA reported that looking at overall performance against annual performance report targets, the target of 20% reduction of three-year-old open claims was not achieved.

“Actual achievement of 16.77% and the non-achievement is due to insufficient information to enable the fund to settle claims.”

AGSA also noted that the fund continues to incur irregular expenditure due to non-compliance with supply change management (SCM) policy prescripts and legislation.

Irregular expenditure refers to spending by a government entity or public institution that does not comply with applicable laws, regulations, or policies.

AGSA’s presentation noted that irregular expenditure of R33 million was identified during the audit process.

“The non-compliance matters still need to be investigated and confirmed by management in line with the National Treasury Instruction note.”

For the financial year 2022/23, the irregular expenditure cumulative balance amounts to R444m, of which R362m is still under investigation.

“We therefore urge RAF to conclude all outstanding investigations and ensure effective consequence management,” AGSA stated.

The presentation also touched on fruitless and wasteful expenditure which refers to spending that is deemed unnecessary and does not provide any benefit or value to a government entity or public institution.

This amounted to R4.1m for the 2022/23 fiscal year: R468 thousand for admin-related fruitless and wasteful expenditure and R3.6 m for claims-related fruitless and wasteful expenditure (interest, sheriff and writ costs).

Fruitless and wasteful expenditure

The SIU was tasked in 2021 with investigating the RAF to address serious concerns about fraud, corruption, and mismanagement.

The investigation spans five key focus areas. The first targets duplicate claim payments to attorneys, claimants, and sheriffs, as well as changes in mandates. The second scrutinises procurement and tender irregularities, especially those involving fruitless and wasteful expenditure. The third area looks at claims from service providers who rendered services to accident victims. The fourth investigates inflated invoices and potential collusion between RAF employees and service providers, along with attorney-submitted bills of costs. Finally, the fifth focus area addresses fraudulent claims, including both local and international cases, as well as home modifications and rejected claims across South Africa.

Leonard Lekgetho (pictured), SIU’s chief operations officer, highlighted procurement and tender irregularities as a major focus, explaining that the SIU is investigating seven contracts awarded through RAF’s irregular procurement process.

“Among these contracts, there are procurement irregularities which were flagged by the Auditor General of South Africa,” he noted.

Two contracts, in particular, stand out amidst RAF’s broader financial challenges and its efforts to reduce a growing claims backlog. One of these contracts, valued at R740.2 million, was intended to address the backlog but was awarded to two service providers who ended up handling new claims instead.

“It didn’t deal with backlog. It started dealing with new claims,” Lekgetho explained, adding that performance issues also arose during the contract.

Lekgetho noted that one member of the consortium awarded the contract dropped out, yet the contract continued. Despite a budget of R740.2 million, the actual amount spent was R312 million over five years.

The SIU found that in awarding this contract, RAF violated Section 217 of the Constitution and the Public Finance Management Act (PFMA).

This case is now with the SIU’s civil litigation internal unit, which is considering referring it to the Special Tribunal for possible cancellation, Lekgetho said.

Another key contract under investigation involves RAF’s panel of attorneys, which was allegedly cancelled without a proper plan in place.

According to the SIU’s findings, this panel previously represented the RAF in court for claim disputes. Lekgetho confirmed that the contract for the panel of attorneys had been terminated. He said the rationale behind this decision is currently under investigation.

Since the termination, there has been a notable increase in default judgments issued against the RAF.

“The total amount of default judgments issued against RAF for costs and fees from 2018 until the second quarter of 2023 amounts to R4.7 billion,” Lekgetho said.

He pointed to a sharp rise in default judgments between 2021 and 2022, citing a specific case where a claimant was awarded a default court order of R11.1 million. RAF’s failure to settle the payment on time resulted in an additional R500 000 in interest. This, Lekgetho noted, exacerbates the RAF’s liquidity challenges: “The more the payments are not being made, then they increase the interest which is going to affect the liquidity of RAF.”

Lekgetho noted that the SIU had interviewed RAF’s CEO and board members to understand the reasoning behind cancelling the panel of attorneys.

“We are at an advanced stage where we will be wrapping up the investigation,” he said, adding that the outcome could lead to potential recoveries, disciplinary actions, and referrals to the NPA once the remaining affidavits are finalised.