“Did you ever get the feeling that you wanted to stay, but also the feeling that you needed to go?”

American comedian Jimmy Durante first sang this catchy tune in 1942, and 83 years later, investors are still caught in the same push-and-pull – often to their own detriment as they jump between funds, chasing returns and eroding value.

The latest edition of Momentum Investments’ Sci-Fi Report shows that, post-Covid-19, levels of behaviour tax remain alarmingly elevated. The report notes that although engagement (switch activity) has subsided, switching continues to incur more than 3% a year in lost returns. In 2024 alone, investors on the Momentum Wealth platform “lost” about R60 million in 2024 because of behaviour tax.

Behaviour tax is the loss in returns caused by switching between funds. It is calculated as the difference in future performance between the original fund (if held) and the new fund(s) switched to. In simple terms, it measures the cost of switching decisions that reduce investment value.

Paul Nixon, the head of behavioural finance at Momentum, says investors can avoid behaviour tax by following a simple golden rule.

“If your investment goals haven’t changed, the plan to reach those goals shouldn’t change either. In other words, the best thing to do in the face of market turbulence – both up and down – is often to do the opposite of what feels like the right course of action (doing something and moving to another investment). We should be doing nothing.”

Nixon notes that market turbulence causes investors to become overly focused on the short term, rather than stepping back to see that its impact on their long-term goals is minimal.

“One of the best methods in financial psychology to avoid the behaviour tax is by building conviction in our actions. This means that the more we understand about the way the things we invest in work, the more resilient we will be when the price changes. This is likely why investors in cryptocurrencies, for example, appear hyper-sensitive to price changes (the underlying asset is complex).”

The report examines how investor behaviour impacted the Flexible Income Option (FIO) and the Retirement Income Option (RIO) from 1 September 2023 to 1 September 2024. It also includes an archetype analysis for 2024 using unsupervised machine learning.

The Flexible Income Option

The FIO includes funds designed to generate income while preserving capital and allowing flexibility in asset allocation.

A behavioural switch refers to a change in an investor’s risk preference, often based on short-term market fluctuations rather than long-term strategy.

The 2023 Sci-Fi report showed that when the stock market crossed the 80 000-point mark for the first time – a major milestone – many investors reacted by making frequent changes to their investments, increasing their costs. When the market later dropped, many pulled back from risk. In 2024, as the market performed even better overall, these costly investment changes became even more common.

The report’s key findings include:

- The number of investment switches rose by 36.71% from 2023, reaching 37 853 switches in 2024.

- Investors switched more often, with the average number of switches per investor increasing by 21%, from 1.96 to 2.32 a year.

- The 37 853 switches recorded in 2024 were double pre-pandemic levels, showing a lasting shift in investor behaviour.

- The number of investors making at least one behavioural switch increased by 15%, reaching 16 300 active investors in 2024.

- The average switch amount remained steady at about R150 000 per transaction.

Although the total behaviour tax for FIOs nearly halved, the loss per switch rose sharply.

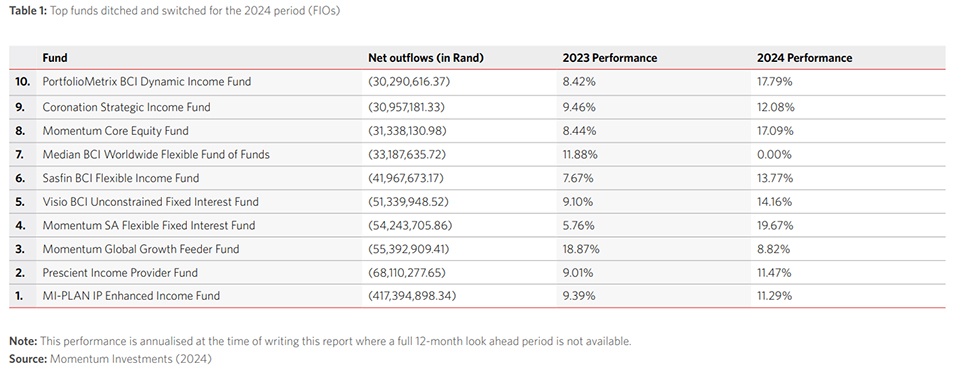

Table 1 provides a clear picture of how investor behaviour contributed to higher behaviour tax in 2024. It highlights the top 10 funds with the highest net outflows in 2023, showing a common trend: 8 out of 10 funds on this list had stronger performance in 2024 than in 2023.

One of the main reasons behind the rising behaviour tax, the report states, is that investors tend to sell funds that performed poorly in the past and move their money into funds that recently performed well. However, data shows this strategy often results in missing out on future gains.

For example, in 2023, many investors exited funds that had lower returns. In 2024, these same funds outperformed, meaning those who switched missed out on the recovery. Meanwhile, the report notes, investors moved into funds with more global exposure but often failed to see the expected returns.

The result? Investors locked in losses and missed gains.

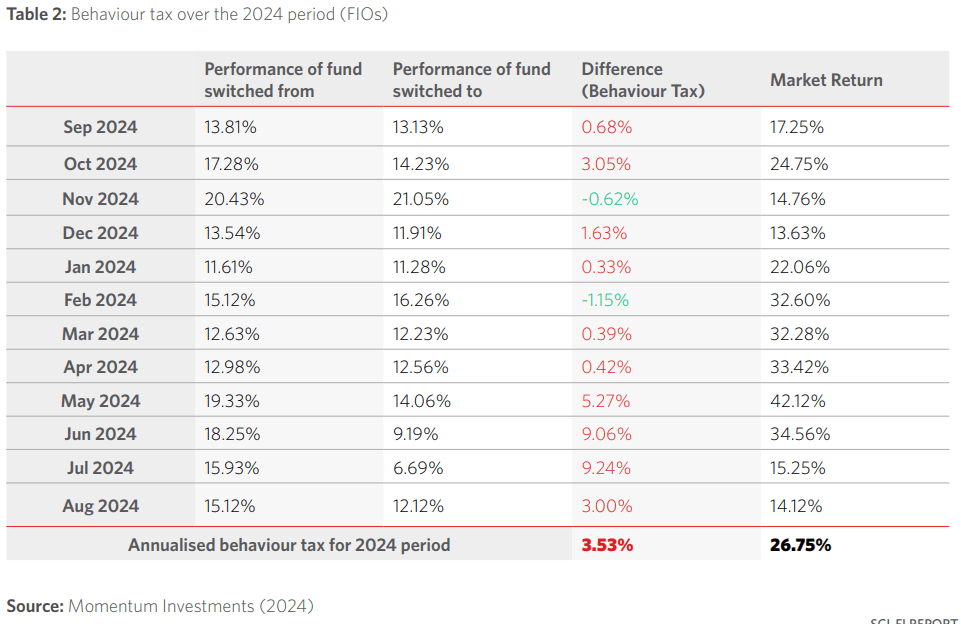

Table 2 shows that as markets surged in 2024, investor behaviour tax rose sharply.

The only two months where switching added value were November 2023 and February 2024.

Interestingly, the findings show that behaviour tax tends to drop when markets decline, as investors shift back to a more cautious approach. For the full 2023 period, behaviour tax eased slightly to 3.53% (value lost due to switching).

“This remains very high and continues the post-Covid-19 trend of high-value destruction,” the report reads.

The Retirement Income Option

The RIO includes funds that aim to provide retirees with a stable income while preserving capital as much as possible.

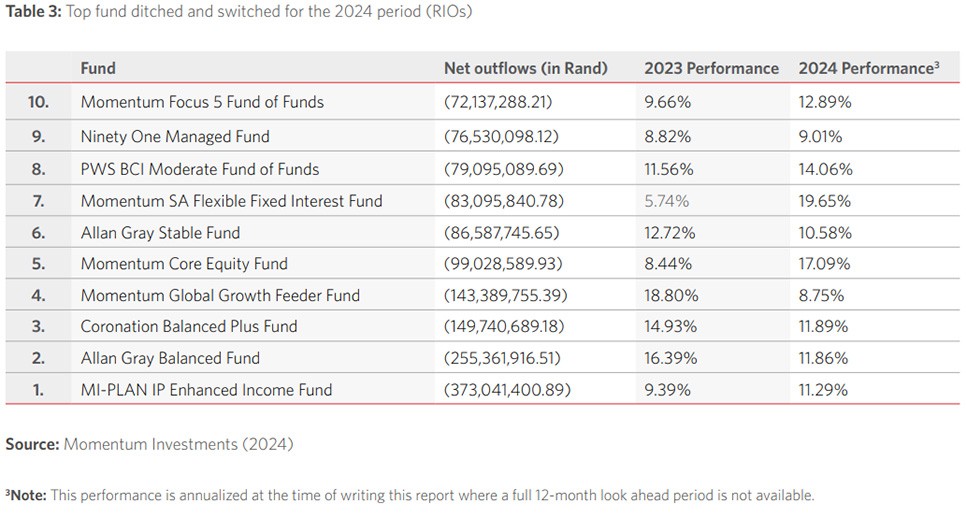

Investor behaviour in RIO funds followed a pattern similar to that seen in the FIO. Many investors switched out of funds after 2023’s performance, only to miss out on strong 2024 returns, leading to an increased behaviour tax.

The report’s key findings include:

- Investor switching activity increased sharply – the number of behavioural switches rose by 47.59% to 52 347 switches in 2024.

- More investors became active switchers – those making at least one switch increased by 29% to 24 277 active investors.

- Switching resulted in missed gains – investors left funds with 2023 returns of 8.44% and 9.66%, only to miss out on returns of 17.09% and 12.89% in 2024.

- Some funds did underperform after switches – four of the top 10 funds that saw outflows had worse returns in 2024, but the differences were mostly small.

Many investors switched into high-performing funds from 2023, only to experience much lower returns in 2024.

For example:

- The BCI Ranmore Global Value Equity Feeder Fund saw R50 million in net inflows after delivering 47.62% in 2023, but only 12.97% in 2024.

- The PSG Wealth Global Creator Feeder Fund attracted R85m in net inflows, following a 23.66% return in 2023, but dropped to 11.81% in 2024.

The report notes that this pattern of chasing past performance contributed significantly to the overall behaviour tax, which totalled R44.1m over the 12-month period.

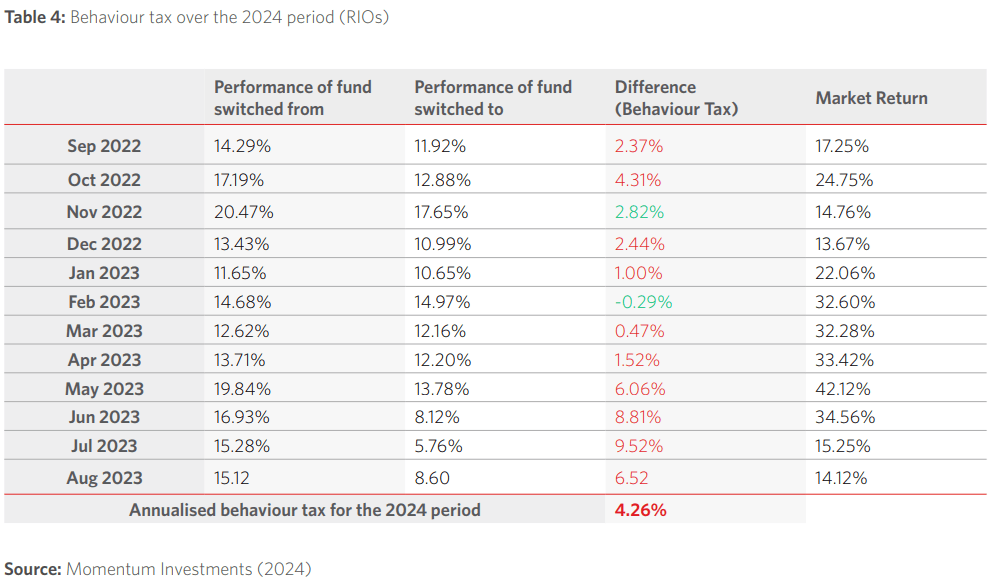

Table 4 compares the performance of switched-from versus switched-to funds, showing how this switching behaviour led to value destruction.

The table highlights that, similar to FIO investments, the 2024 market surge was accompanied by a sharp rise in behaviour tax. The average behaviour tax for 2024 reached 4.26% – “alarmingly high, particularly considering that these investors are in a retirement product and have less and less time to recover this capital”.

Archetypes: where behaviour and investing collide

Momentum Investments used clustering algorithms to identify four behavioural patterns that incur different levels of behaviour tax:

- “Market timers” chase short-term trends, frequently switching investments in an attempt to outguess the market.

- “Assertive” investors take a confident, strategic approach, adjusting portfolios with a long-term view rather than reacting emotionally.

- “Anxious” investors make impulsive decisions driven by fear, frequently switching in response to volatility.

- “Avoiders” rarely make changes, insulating themselves from the behaviour tax but sometimes missing opportunities for better outcomes.

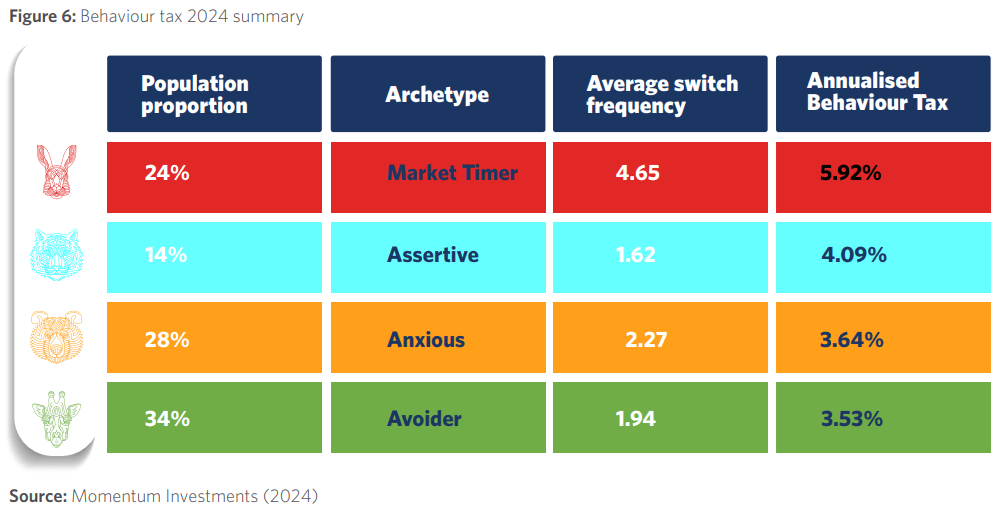

Figure 6 provides the summary of how the archetypes faired when using the k-means clustering algorithm over the 2024 period for the RIO product.

In 2024, Market Timers and Assertive investors were the most active investor types. Their frequent switching behaviour led to significant losses, reinforcing the risks of chasing past performance.

- Market Timers switched the most – 4.65 times per investor on average – and incurred the highest behaviour tax at 5.92%. Their constant movement between investments resulted in lower average amounts switched per transaction.

- Assertive investors had the second-highest behaviour tax at 4.09%. They switched less often than Market Timers but moved larger sums (about double the amount per switch), making their rand-value losses nearly the highest of all archetypes.

- Anxious investors saw a behaviour tax of 3.64%, often pulling out of underperforming funds just before a rebound. Fear of short-term losses led to higher long-term costs.

- Avoiders, the least active, still experienced an elevated behaviour tax of 3.53%, the highest in this group since the Covid-19 pandemic. Avoiders typically took a lower risk and switched to a neutral performance band.

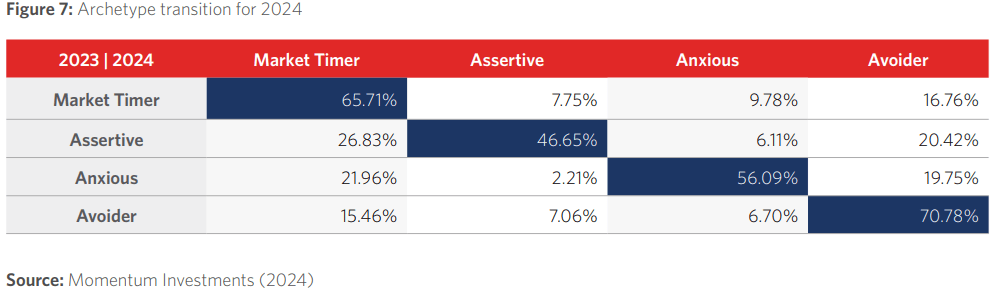

The 2024 Archetype Transition Map shows that Market Timers and Avoiders were the most consistent investor types, with 66% and 71% of investors in these groups remaining in the same category as in 2023. The report notes that this suggests that many investors have long-term risk preferences that remain stable over time.

However, according to the report, the transition map also highlights how short-term market fluctuations influence investor behaviour. The Assertive (47%) and Anxious (56%) investors were less consistent, meaning nearly half of them moved into different archetypes. The report notes that this confirms risk behaviour theory: “we tend to have certain long-term risk attitudes or preferences, but in the short-term risk will feel quite different as markets ebb and flow”.

How machine learning and AI enhance the advice process

So how do machine learning and AI fit into the advice process?

Nixon explains that machine learning can use and analyse large datasets and uncover any prominent behavioural patterns, which can enhance the advice process to provide behaviourally informed guidance.

“The ‘market timing’ pattern incurs the highest behaviour tax, so advisers should be aware if they have any clients with this pattern. Of course, if the adviser is recommending the switch, then the behavioural pattern is actually that of the adviser.”

He adds machine learning is also able to predict behaviour. Using a “random forest” algorithm, Momentum Investments was able to accurately predict client switch behaviour and highlight what the important features are to predicting the client behaviour.

“The bulk of the behaviour tax is incurred in retirement, simply because clients in market-linked solutions like a living annuity are more sensitive to market returns. These insights again give advisers insights into where attention is needed and where behavioural engagement adds the most value.”

Machine learning is also able to assist in predicting things such as longevity.

Nixon says here, an important predictor is the client’s BMI (body mass index).

“Clients who live longer need more money, and so these insights, for example, could inform the adviser’s plan and client’s choice of retirement product (like choosing a life annuity versus a living annuity).”

He explains that adding insights from personality science into the equation, such as whether the client is impulsive versus goal-oriented or whether they are composed or anxious in general, helps train AI models to help advisers provide hyper-personalised client engagement when they need it most.

“This is really where technology and psychology mesh very well to help advisers get their clients to their goals,” says Nixon.